Pay service providers instantly. 0% fees. Full transparency.

World Direct, the smarter way to manage cross-border service payments, directly in WorldFirst.

Key benefits for payers

Zero transaction fees

Pay agencies, logistics partners, tax service providers and more, with no hidden costs.

Instant settlement in full

Funds arrive instantly in your provider's World Account.

One-click payments

Select a provider, confirm, and done – settled in seconds.

Stronger relationships

Instant payments build trust and credibility.

Want to make fee-free payments to your suppliers?

Benefits for your service providers

Faster cash flow

No more 3–5 day waits for funds to clear – payments are instant.

Easy reconciliation

Payments are matched to invoices automatically.

On-demand balance top-ups

Replenish your operational funds in real time. Stay agile.

Zero fee deductions

Invoice amounts are settled in full without intermediary bank charges or deductions.

Are you a service provider?

Tailored value for your service partners

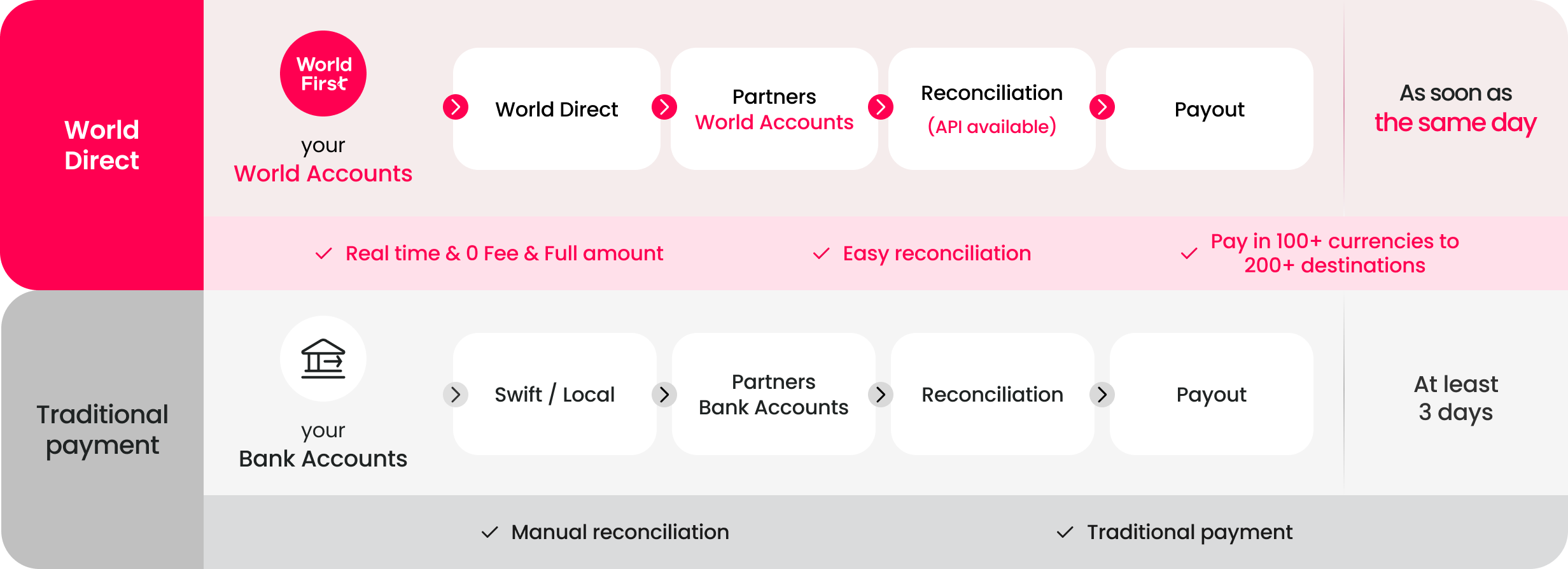

*The above illustration is for reference only to understand the capabilities of this product. The actual arrival time may vary depending on different transaction circumstances. Please refer to the final result.

Pay the partners your business relies on

Logistics partners

Pay instantly to release shipments faster and keep orders moving.

Advertising platforms

Top up campaign budgets in real time to capture opportunities.

Tax and compliance

Settle filings on time without missing deadlines.

IT & SaaS providers

Avoid service disruptions by keeping your software and systems paid.

How it works

Open

In your online portal, navigate to 'World Direct' under 'Payments'.

Select

Select your service provider (e.g., 'Global Logistics Co').

Pay

Pay your provider instantly, in full, in 10 major currencies.