Same-day

USD payments to China

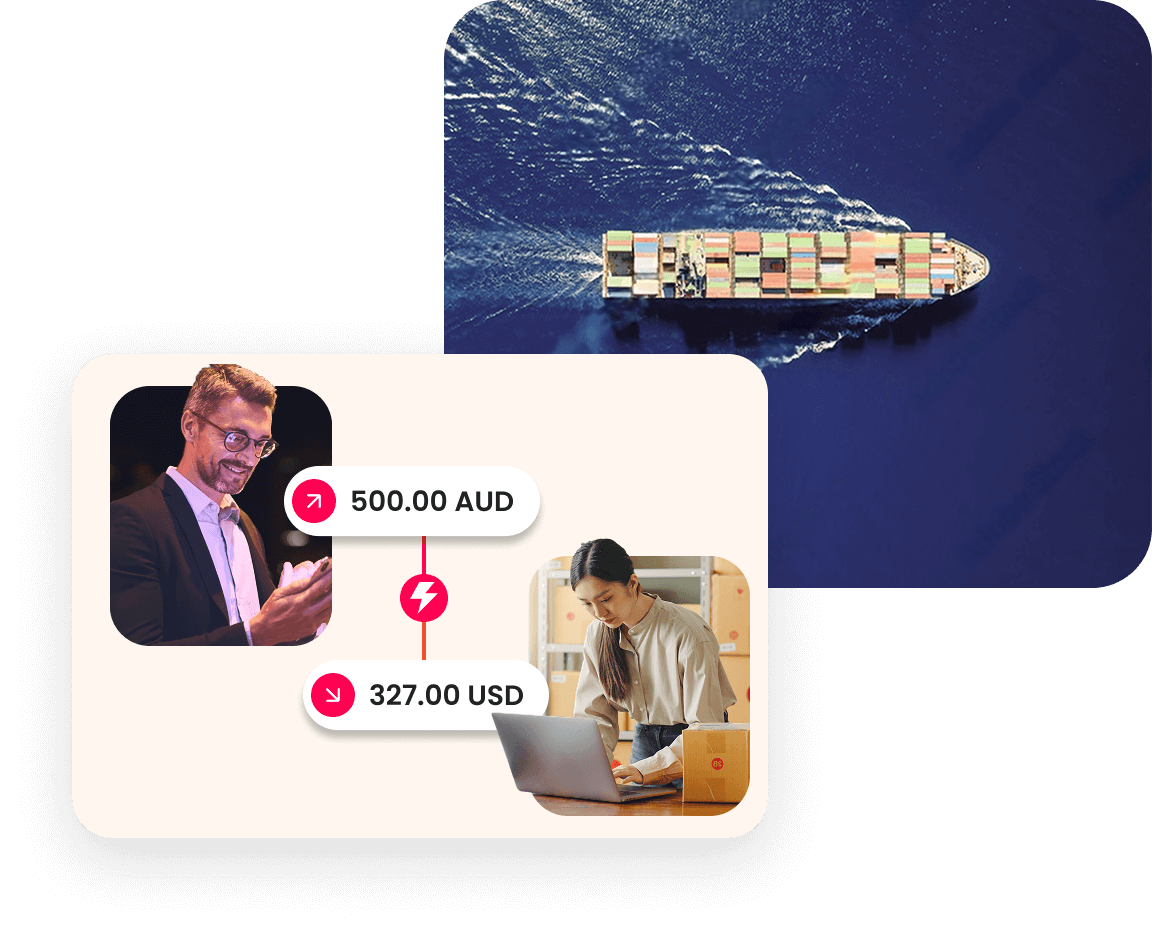

Speed up your supply chain with faster payments

Skip the 3-5 day wait with traditional payment methods – payments into China with WorldFirst can arrive in just hours, or even within seconds if your supplier has a WorldFirst account too.

Faster payments mean that suppliers can ship sooner, helping you secure stock ahead of your competitors.

Send money to major Chinese banks

Through our banking partnerships in China, we can send USD payments to accounts at major Chinese banks, including China Merchants Bank, Bank of Communications, Zhejiang Chouzhou Commercial Bank and China CITIC Bank.

Whoever your supplier banks with, they'll receive funds quickly and securely.

Why choose WorldFirst for supplier payments to China?

It’s fast

- Make fast USD payments through domestic networks.

- Transfer to other WorldFirst accounts instantly – 150,000+ Chinese suppliers already use us.

It’s safe

- We partner with global banks to safeguard your money.

- We're licensed and regulated in over 60 locations.

It’s simple

- Open a multi-currency account in minutes, for free.

- Pay suppliers in just three steps.

- Send payments to multiple suppliers at once.

Unlock exclusive FX rate to send USD payments to China

- October 1 - December 30, 2025

Save up to 16% on FX costs

when you make USD payments to China or Hong Kong*

- Sign up by clicking on the button below to enrol in the promotion

- FX savings voucher will be automatically applied when you make USD payments to China

- Voucher valid for 60-days from the date of registration, within promotion period

- No cap on number of payments made using the FX voucher

3 easy steps to pay suppliers in China

Select payee

Enter the payment amount

Confirm payment

About WorldFirst

We are licensed and partner with leading banks to make sure your money is safeguarded.

The only platform you need for global payments

Send and receive payments worldwide, from one account. And manage your FX too.

Fast global reach

Send payments to suppliers and vendors in 100+ currencies, in 200+ countries and regions. Most funds arrive within hours.

Multi-currency account

Receive, hold and spend in major currencies without forced conversions or extra fees.

Real-time FX conversions

Convert your currencies online, 24/7, with advanced tools to set rate alerts and manage currency risk.