What is a BSB number?

Last updated: 20 Aug 2025

Learn how BSB numbers work and why they’re essential for secure, accurate payments in Australia.

Key takeaways

- A BSB number is a 6-digit code used to identify Australian bank branches

- You need a BSB and account number to send or receive money within Australia

- BSBs aren’t used internationally—use SWIFT codes instead

- You can find your BSB in online banking, account statements, or by asking your bank

If you’ve ever needed to send or receive money within Australia, chances are you’ve come across the term BSB number. It is a key part of making sure your payment goes to the right account.”

In this guide, we’ll explain what a BSB number is, where to find it, and how it compares to international payment systems like SWIFT.

Whether you’re a business owner or just managing your own banking, you’ll find everything you need to know below.

Table of Contents

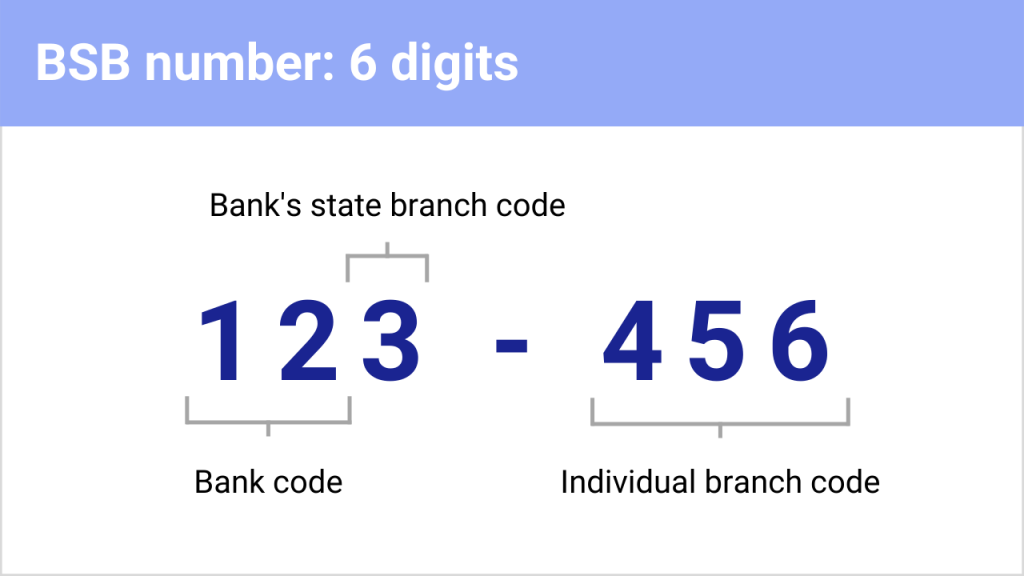

BSB number format and structure

A BSB number (Bank State Branch number) is a six-digit code used in Australia to identify individual bank branches. It’s used when transferring money between bank accounts within Australia.

Here’s what it does:

- Tells the system which bank the account is with

- Points to the specific branch where the account was opened

- Works alongside the account number to make sure the funds land in the right place

So if you’re wondering, “What is my BSB number?” You’ll usually find it in your online banking account details, on a bank statement, or by asking your bank directly.

Every bank in Australia assigns BSB numbers this way, and no two branches share the same one.

How do I find a BSB number?

If a supplier is requesting payment to their Australian bank account, the BSB number will be stated before the account number on the invoice.

If you’re looking for your own banking BSB number, here’s where you can find it:

- Internet banking: Log in and head to your account details

- Bank statement: Usually listed right next to your account number

- Mobile app: Most banks show the BSB on the main account screen

- Cheque book: Printed on each cheque if your bank issued one

- Ask your bank directly: In a branch, over the phone, or through online support

Every Australian account is linked to a unique BSB. If you switch banks or open a new business account with another provider, your BSB number will change too.

Do I need a BSB for international transfers?

If you are transferring money from an overseas account to an Australian account, you’ll probably need to have both the BSB number and the bank account number. Australia doesn’t use IBANs (International Bank Account Numbers).

But keep in mind that some overseas banks do not require the BSB to form part of the account number. They just need the SWIFT code and account number.

but some international banks require one to process cross-border payments. In this case, you can combine the BSB and account number, without spaces or hyphens, to create the IBAN.

Likewise, if you’re invoicing an overseas client for payment into an Australian bank account, you’ll need to provide your BSB number.

If you are transferring money to an overseas bank account, you won’t need a BSB number as BSBs are unique to Australia’s banking system. Other countries have their own systems for identifying the bank and the branch of accounts.

Is it safe to share your BSB and account number?

Generally, providing your BSB and account details to suppliers is safe, as the details are used to deposit, rather than withdraw funds. However, there’s a possibility that your details may be used to set up direct debits if the debiting business doesn’t verify ownership of the account with a signature or ID. As long as you regularly check your statements and activity, these are relatively quick to pick up.

To be safe, only share your bank details with people you trust, or with businesses and suppliers who genuinely need to know this information.

- Open 15+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Take control of spending with the World Card, a business expense card that saves you more with 1% cashback. Learn more

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

BSB number: Australia vs New Zealand

Australia uses BSB numbers to identify banks and branches for domestic payments. A BSB number is six digits long and formatted as XXX-XXX. The first two digits identify the bank, and the next four identify the branch.

New Zealand doesn’t use BSB numbers. Instead, it uses a different format for bank account numbers. A New Zealand bank account number follows this structure: BB-bbbb-AAAAAAA-SSS [3]

- BB: bank code

- bbbb: branch number

- AAAAAAA: account base number

- SSS: suffix for account type

So if you’re sending money between Australia and New Zealand, you won’t be using a BSB number for the New Zealand side. You’ll need the full New Zealand bank account number and may also need a SWIFT/BIC code depending on the transfer method.

How can you transfer money with a BSB number?

To send money within Australia, you’ll need two key details:

- The recipient’s BSB number

- Their account number

Here’s how it works:

- Log in to your online banking or use a mobile app

- Choose the option to make a domestic payment

- Enter the BSB and account number of the recipient

- Add the payment amount and reference if needed

- Review and confirm the transfer

The BSB number tells the bank where the money should go. It works like a postcode for the branch. BSB-based transfers usually land on the same day or the next business day, depending on the bank’s processing time.

Is a BSB code the same as a SWIFT code?

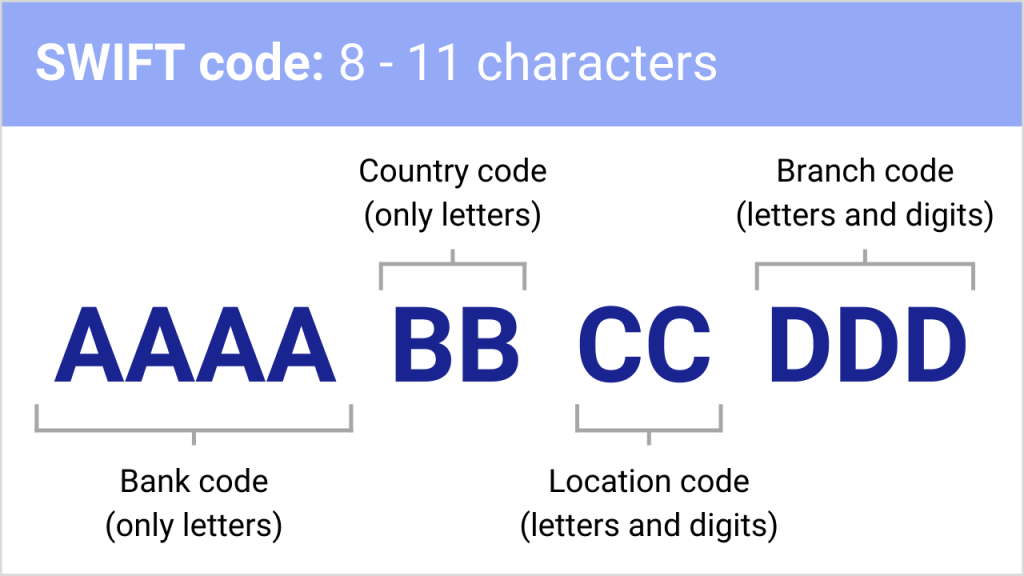

While BSB numbers and SWIFT/BIC codes are both used to identify the receiving bank when making a money transfer, the SWIFT/BIC code is used for international payments. SWIFT is a messaging network with a standardised system of codes used by financial institutions globally to allow them to securely transfer funds cross-border. The acronym stands for Society for Worldwide Interbank Financial Telecommunication.

BSB numbers are for domestic transfers within Australia and SWIFT codes are essential for international transactions.

Here’s what a SWIFT/BIC code does:

- Identifies the bank involved in the transfer

- Makes sure the funds reach the correct country, bank, and branch

- Required for both sending and receiving payments internationally

You can find your bank’s SWIFT code:

- On their official website

- In the international transfers section of your online banking

- On your bank statement

Below is a breakdown of how SWIFT codes are formatted.

Fast and secure international payments for your business

Open a World Account to save on international transactions with competitive exchange rates and quick transfers. WorldFirst aims to simplify international payments and collections for online sellers, SMEs and global businesses.

Disclaimer: The information contained is general only and largely our views. Before acting on the information you should consider whether it is appropriate for you, in light of your objectives, financial situation or needs. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions, estimates, mentioned products/services and referenced material constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. WorldFirst shall not be responsible for any losses or damages arising from your reliance of such information.

Top no-fee bank accounts for businesses in Australia

Explore top no-fee business accounts in Australia for everyday banking, global payments and better control over cash flow.

Nov / 2025

The best business transaction accounts in Australia

Compare top business bank accounts in Australia and explore smarter global solutions to manage local and international payments.

Nov / 2025

Foreign transaction fee: Meaning and when it applies to you

Learn what foreign transaction fees are, when they apply and how to minimize them with effective strategies for your business.

Nov / 2025Choose a category below for more business, finance and foreign exchange support from WorldFirst.

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions