Make international payments to overseas suppliers

We’ll help you pay suppliers and staff around the world as easily as if they were around the corner. Better exchange rates means you are saving money on your overseas supplier and staff payments.

Reach out to more suppliers

Pay in 100+ currencies, so you can buy more competitively, from more countries.

International invoices and payroll, all taken care of

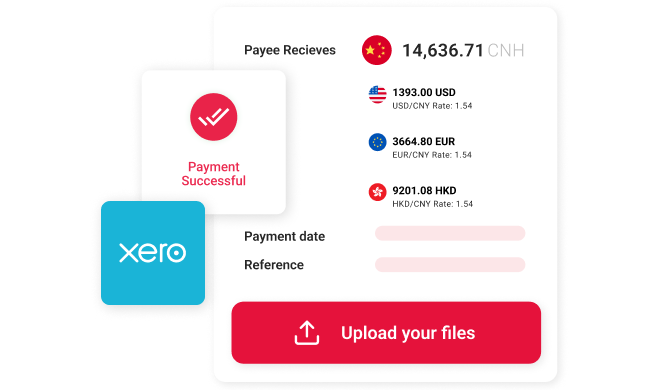

- Pay into China, the US, New Zealand, Europe and more – we can move 100+ currencies for you

- Automate your accounting with seamless Xero integration

- Make bulk payments with our quick file upload system

- Utilise forward contracts to help protect your business from currency fluctuations

Eggzi Australia eyes market domination through using WorldFirst

Learn about the role WorldFirst plays in Eggzi’s ambitions to dominate the hospitality and retail sectors in Australia and expand overseas.

Businesses Trust WorldFirst

- Almost 1,500,000 business have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions

Hear from Our Customers

It gives us that flexibility to use one card across multiple currencies. We pay for all our subscription costs, our Amazonad vertising, as well as general office bills.

Georgie Kerr

Founder

Elk & Friends

WorldFirst is easy for us. It was fast, we had a dedicated account manager. We had transparency and we had favourable exchange rates.

Annette Katinis

Co-founder

Scoot Boot

Your money is always safe with WorldFirst. So you can hold your funds and pay your suppliers directly, without moving money from your bank account.

Rocky Yan

Founder

Party Bestbuy

With WorldFirst, having an option to pay directly to 1688 is very convenient. All we do is transfer directly or to the factory, and we know it will get there fast.

Mark & Jenny Brookfield

Owners

Sunrise Accessories

It gives us that flexibility to use one card across multiple currencies. We pay for all our subscription costs, our Amazonad vertising, as well as general office bills.

Georgie Kerr

Founder

Elk & Friends

WorldFirst is easy for us. It was fast, we had a dedicated account manager. We had transparency and we had favourable exchange rates.

Annette Katinis

Co-founder

Scoot Boot

Your money is always safe with WorldFirst. So you can hold your funds and pay your suppliers directly, without moving money from your bank account.

Rocky Yan

Founder

Party Bestbuy

With WorldFirst, having an option to pay directly to 1688 is very convenient. All we do is transfer directly or to the factory, and we know it will get there fast.

Mark & Jenny Brookfield

Owners

Sunrise Accessories

Simply the best

I would choose them again without hesitation. The issue was resolved very quickly, and the customer service is extremely helpful!

Mr Vitalij Gurkov, February 05

I have used Worldfirst for many years…

I have found the service to be very good. Transactions have always gone without a problem.

peter carmichael, January 17

Wow! What rapid and helpful support

Silly me used wrong login and hit problems but got quick responses and help very soon.