Make same-day payments to your Chinese suppliers now

Refer & Earn US$475 each

E-commerce Seller

Corporate Payment

Freelancer

Coming Soon

Developer

Coming Soon

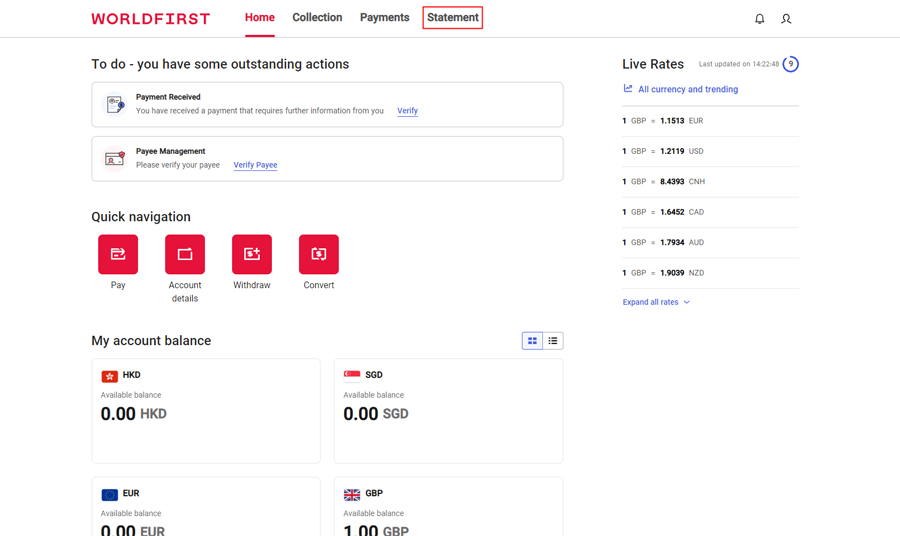

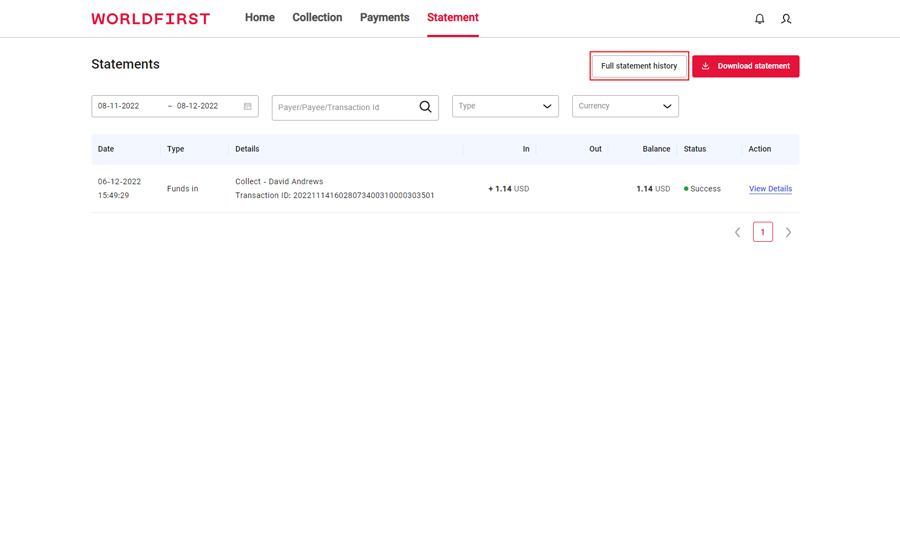

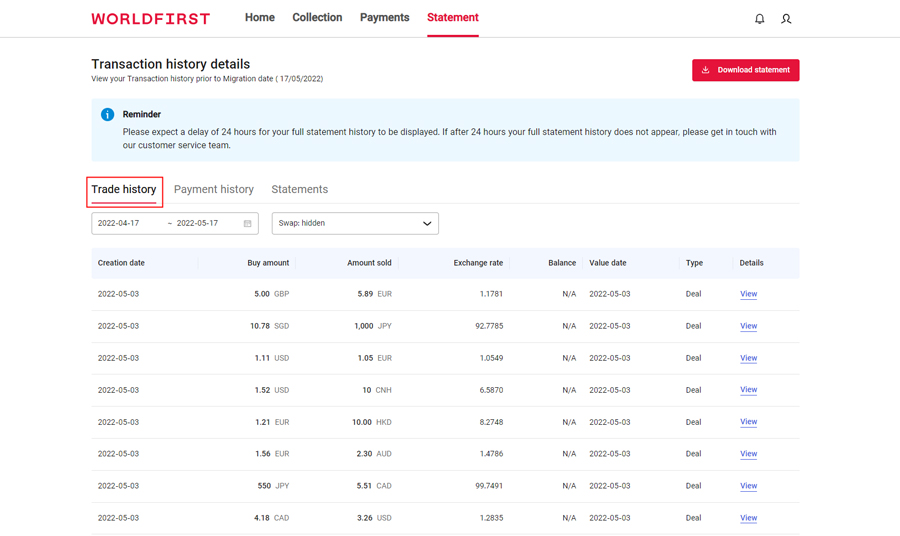

World Account

An all-in-one multi-currency account that helps businesses grow globally.

About WorldFirst

More brands of Ant International

Europe

United Kingdom

English

Nederland

Nederlands

Türkiye

Türkiye

Deutschland

Deutsch

English

France

Français

Europe

English

Asia

Singapore

English

대한민국

한국어

English

Thailand

ภาษาไทย

English

South Asia

中国

简体中文

繁体中文

English

Việt Nam

Tiếng Việt

English

Indonesia

English

English

日本

日本語

English

Malaysia

English

Philippines

English

English

Oceania

Australia

English

New Zealand

English

Americas

México

Español

United States

This country is supported by WorldFirst affiliates, Zyla

América Latina

Africa

Africa