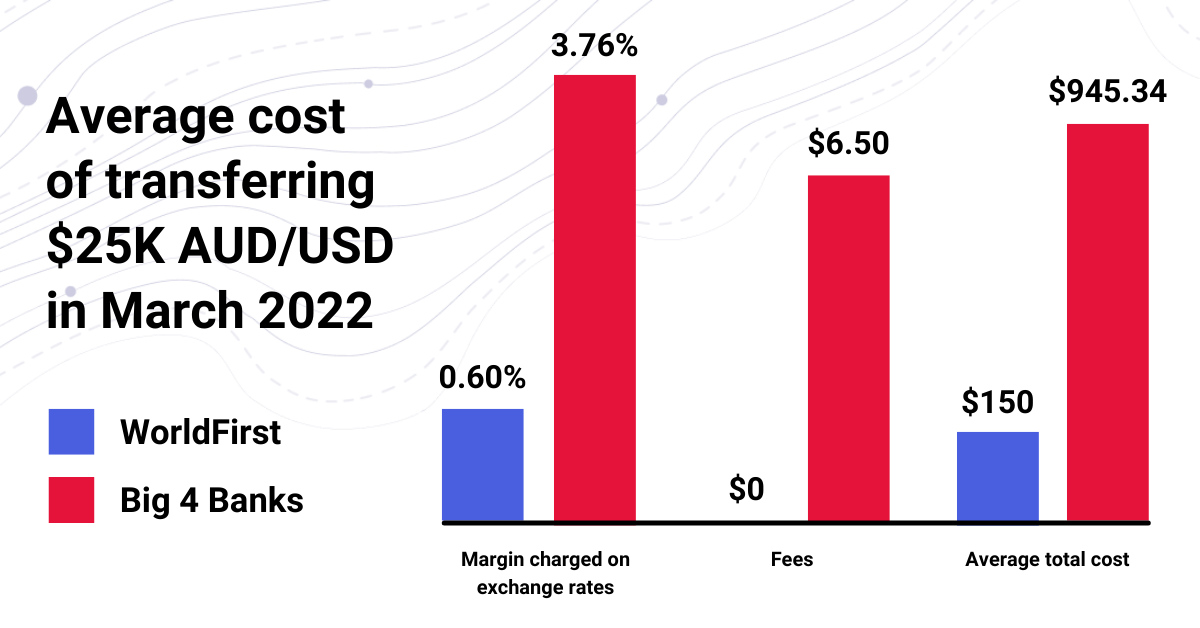

Could your business be spending up to six times more than it should be on international payments? SMEs using their bank to make international payments or to collect overseas funds could be losing out on thousands of dollars a year through hidden currency conversion costs. Many people don't realise that the cost of a foreign exchange transaction is not only the set fee charged. It's also the margin taken by your FX provider on the exchange rate.

The margin is the difference between the foreign exchange rate your provider buys your currency for, and what your end customer exchange rate is. Since it’s not always obvious what margin your bank is charging, many businesses may not even know they’re losing money when transferring funds. Your goal should be to achieve an exchange rate as close as possible to what you see in a search engine when you query the foreign exchange rate (the interbank rate). Businesses should also be looking to avoid any set transaction fees on foreign currency payments.

What are you really being charged?

In the graph above, banks are charging an average margin of 3.8%, compared to WorldFirst’s maximum margin of 0.60%.

It’s quite common for banks to take a margin of three to five percent on top of a fixed transfer fee. International money transfers are a low priority for many banks and they capitalise on a lack of awareness of costs and other non-bank options. Other hidden costs include the fees an intermediary bank may charge for a foreign currency transfer. Many small businesses are also focussed on day-to-day operations and don’t consider other options when transferring money overseas, seeing the fees and costs as a necessary evil.

The high cost of using banks for international payments has led to FX specialists emerging to provide a cheaper and more effective option for businesses and individuals. WorldFirst has helped over 250K clients send money overseas since 2004, making over a million transfers per year.

Your 60-second guide to saving money on international payments

Here are 5 things small and medium-sized businesses should consider when making international payments:

- Cost: How much is it going to cost to simply do business overseas? If you’re importing, look to save on international supplier payments and as an exporter, bring home more overseas revenue with a competitive exchange rate and low to zero set fees.

- Speed: Will the money arrive at its destination quickly, or will it disappear into a ‘banking black hole’ for a few days? If you’re importing, making payments on time will ensure goods are released and/or relationships are maintained. Exporters need to receive money as quickly as possible to help cash flow.

- Security: Is the transaction secure? Will it definitely get to where it’s supposed to?

- Volatility: How much money will you lose – or pay – if there’s volatility in your currency pair? Importers should look to protect business profit when local currency weakens while for exporters, this is when their local currency strengthens.

- Ease: Save time managing foreign exchange transfers – focus on running your business! Look for a great online platform backed with local account support.

In our 16-page guide, we cover why currency markets fluctuate, examples of how WorldFirst has helped businesses expand globally, a checklist of questions to ask your foreign exchange provider and more. Download the guide below.

The world of international payments made easy

With an account from WorldFirst, you can pay overseas suppliers and staff as easily as if they were around the corner. Pay in over 50 currencies at speed, with real-time fraud monitoring, blocking and alerts.

You might also like

Insights from WorldFirst cover the latest FX news, top accounting tips, strategies to mitigate risk and key industry trends. Choose a category below to find out more.

Businesses trust WorldFirst

Since 2004, more than 250K businesses have utilised WorldFirst to send more than $160B around the world.