Home > blog > Global Business Tips > How to avoid international wire transfer fees in 2026: best methods

International trade keeps UK businesses moving, but it also exposes them to a constant financial pressure point: the cost of moving money across borders.

In 2024, exports and imports represented around 62% of UK GDP. If you run a UK SME, chances are your partners expect euros or US dollars. The EU accounts for 41% of UK goods exports and the United States is the largest single market, so foreign currency payments have become a routine part of cash flow management.

The cost becomes evident when the payment goes out. SWIFT wires collect fees at every stage, reducing the amount that actually reaches your supplier or your own account. Understanding how to avoid international wire transfer fees is now a practical skill for any UK business trading abroad.

This guide clarifies what contributes to the cost of international payments and presents practical methods to reduce those expenses – for example, via a digital payment platform like WorldFirst – helping your business retain more of its global revenue.

Key takeaways:

- International wire fees add up quickly for UK SMEs: Most UK businesses trading in euros or US dollars face multiple charges on every SWIFT payment. These include upfront bank fees, intermediary deductions, receiving-bank costs and FX markups that can add 2–5% to each transfer

- FX markups often cost more than visible fees: Banks frequently blend the exchange-rate markup into the total transfer price, making it hard to see what you are actually paying. Checking the mid-market rate, avoiding automatic conversions and choosing transparent providers can significantly reduce overall costs

- Local payment rails offer major savings compared to SWIFT: Routes like SEPA for EUR or ACH for USD avoid long correspondent chains. This leads to faster settlement, fewer hidden deductions and lower fees for businesses that pay suppliers abroad

- Multi-currency accounts help avoid forced conversions: Receiving and holding funds in their original currency prevents unnecessary FX charges. Paying suppliers in their local currency and converting only when conditions align with your business can protect margins and improve cash flow predictability

Open a World Account and avoid hidden intermediary fees through optimised routing and local payment methods.

What are international wire transfer fees?

International wire transfers move money between countries through the SWIFT network. The system is reliable and widely used, yet it often involves several banks before the payment reaches its destination.

Each bank in that chain can apply its own charge. By the time the payment arrives, your recipient may receive noticeably less than you sent. UK regulators have highlighted this gap between the amount a business intends to pay and what actually arrives.

The Financial Conduct Authority reports that many banks still add hidden markups to FX rates, thereby increasing the actual cost of an overseas payment relative to the mid-market rate. The Bank of England has also noted growing variability in cross-border payment costs as more transactions pass through long correspondent banking routes.

Many SMEs feel these fees long before they reconcile their accounts. The charges trim the margin on each shipment, complicate supplier conversations and make international trade more expensive than it should be.

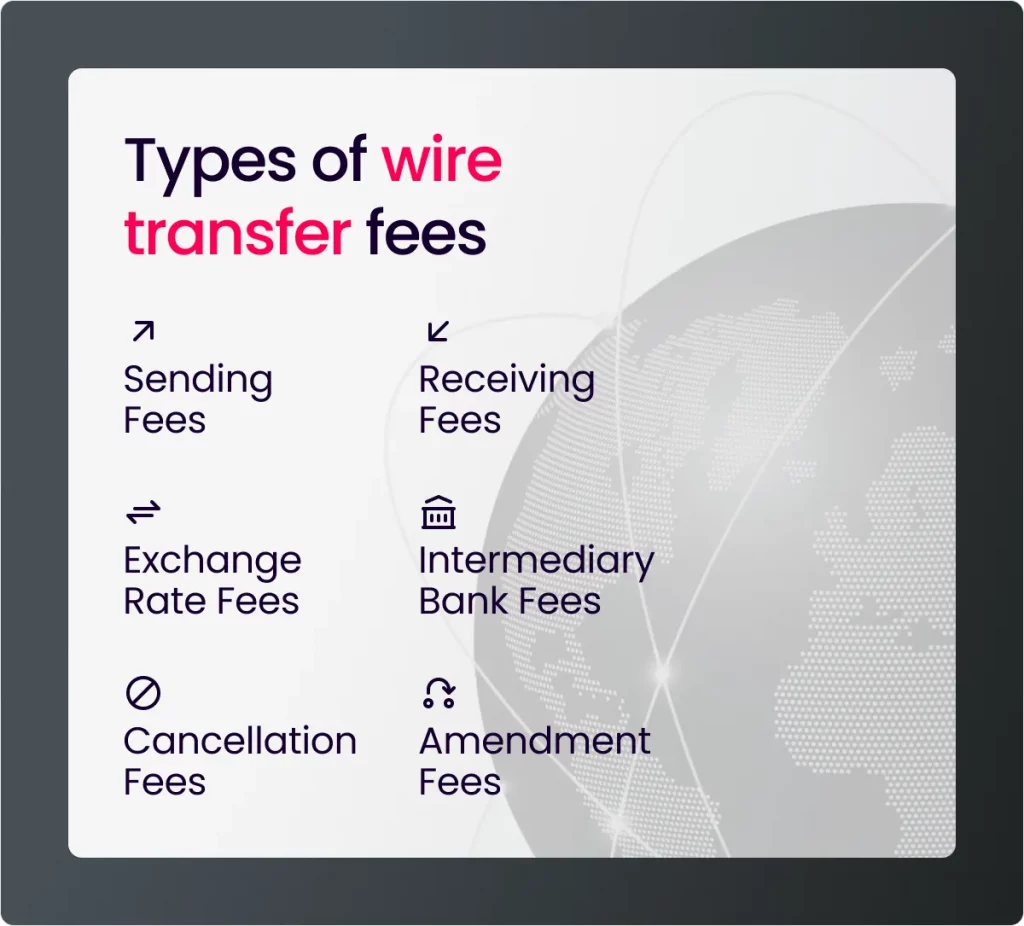

The most common international wire transfer fees UK businesses face in 2026

Understanding these fees is crucial for any UK SME that pays suppliers abroad or collects overseas revenue. Each charge affects what leaves your account, what your partner receives and how confidently you can plan cash flow.

These are the fees business owners most often encounter:

1. Upfront bank fees

Most banks apply a fixed charge every time you send an international wire. Firms that pay multiple suppliers each month feel this quickly, since each transaction incurs the exact cost regardless of size.

2. Intermediary or correspondent bank fees

When a payment travels through several banks before reaching its destination, each intermediary can deduct its own fee. Banks rarely show these deductions upfront and the final amount that arrives often differs from what you intended to send. SMEs usually discover this only when a supplier reports a short payment.

3. Receiving-bank fees

Some overseas banks charge to accept an international transfer. The sender usually has no visibility into this, so the recipient absorbs the fee and must reconcile the shortfall on their end.

For businesses managing tight margins or time-sensitive shipments, this can delay fulfilment or spark avoidable payment disputes.

4. FX markups: the highest hidden cost

Fixed fees are manageable. The real impact often comes from FX markups. Many banks widen the spread between the mid-market rate and the rate offered to customers by 2–5%. A 3% spread on a £50,000 supplier payment adds £1,500 to your costs before any wire fees even enter the picture.

The Financial Conduct Authority’s recent review showed that these FX markups remain one of the biggest contributors to total transfer cost, especially when conversions happen automatically with limited visibility or control.

Why fees vary so widely

International payment costs can shift significantly from one transfer to the next. The main factors include:

- The currencies involved: Some corridors are more costly to service and less common currency pairs often carry higher FX spreads

- The number of correspondent banks along the path: Each intermediary can charge a fee, increasing both the total cost and the unpredictability of the final amount received

- The receiving bank’s own charges: Many overseas banks charge fees for incoming payments that the sender may not see in advance

- The payment rail used: SWIFT transfers usually involve higher charges, while local payment rails, when available, can reduce costs and settle faster

How FX is priced and executed: As already mentioned, markups on the exchange rate often account for the largest share of the cost. Conversions that occur automatically, without visibility or control, tend to increase the final price compared with transparent FX pricing

1. Reduce forced conversions with a non-bank, multi-currency setup

A large share of international payment costs comes from conversions that happen simply because the business has no choice. The moment your revenue arrives or you pay a supplier, the bank converts the currency at a rate that may not reflect market conditions.

A multi-currency account gives you the freedom to:

- Receive funds in the currency your customer uses

- Hold balances without triggering immediate FX

- Pay suppliers in their own currency without incurring fresh conversion costs

- Convert only when pricing aligns with your cash-flow needs

For many SMEs, this is the first step toward controlling international payment expenses. When FX stops happening automatically, you remove one of the highest avoidable costs in global trade.

How the World Account helps:

The World Account from WorldFirst provides local receiving details in major currencies, letting you collect payments directly in USD, EUR, AUD, JPY, CAD and others. You keep funds in those currencies without forced conversion, settle suppliers in the same currency and choose your own conversion timing. This gives UK businesses greater control over FX decisions.

2. Use local rails instead of SWIFT when the corridor allows

SWIFT is reliable, but it is not cheap. Its cost reflects the number of parties involved, the distance a payment must travel and the differences between banking systems. Local payment rails, on the other hand, keep the payment inside a single domestic clearing network.

When the corridor allows it, routing payments through local rails offers clear advantages:

- Fewer intermediaries

- Faster settlement times

- Reduced or eliminated correspondent fees

- More predictable outcomes for the recipient

Many businesses paying European suppliers now prefer SEPA because it avoids SWIFT entirely. Similar opportunities exist in markets where ACH or other domestic systems are available through specialist providers.

3. Check the real exchange rate before committing to a transfer

The FX spread is often the biggest contributor to international payment cost, yet many businesses pay it without noticing. Banks frequently combine the fee and FX markup into a single rate, making it difficult to see which portion reflects market pricing and which is an internal charge.

The FCA’s recent findings reinforce that many SMEs pay materially above the mid-market rate simply because the actual comparison is not visible at the point of conversion.

Businesses that reduce FX costs typically follow three habits:

- Checking the mid-market rate before sending a transfer

- Choosing providers that show pricing clearly

- Avoiding conversions that happen automatically without approval

Adopting these practices can save SMEs hundreds or even thousands each month when dealing with regular overseas activity.

4. Consolidate supplier payments to reduce transaction volume

International transfers carry fixed fees regardless of size. Sending 10 separate wires to the same market costs significantly more than sending a single, carefully structured batch payment.

For many SMEs, especially in e-commerce and import manufacturing, this is one of the most overlooked cost-saving tactics.

Batching works best for businesses that:

- Pay multiple fulfilment partners in the same market

- Manage several suppliers within a single region

- Operate predictable monthly or quarterly payment cycles

How the World Account helps:

As an online payment solution, World Account supports batch payments to up to 200 suppliers at once, giving finance teams a practical way to reduce transaction volume and cut per-payment costs. Grouping payouts into a single workflow keeps approvals organised, improves cash-flow visibility and helps businesses avoid unnecessary wire fees.

5. Receive foreign revenue in its original currency

Many online marketplaces and payment gateways automatically convert foreign earnings into GBP before depositing them. While convenient, this hands total control of timing and pricing to the marketplace, which often leads to higher FX costs.

Businesses that keep more of their revenue typically:

- Receive payouts in the original currency

- Match inflows and outflows (for example, use EUR revenue to pay EUR suppliers)

- Choose the conversion moment based on market conditions, not platform defaults

For companies selling on Amazon or Etsy, this can result in a measurable improvement in margins.

6. Shorten the payment route to avoid unnecessary intermediaries

One of the hidden issues with SWIFT transfers is the number of banks that handle the payment before it reaches its destination. Each link in the chain creates potential deductions.

Businesses reduce these costs by selecting providers that:

- Use optimised routing instead of long correspondent paths

- Rely on established partnerships for direct clearing

- Offer local payouts in key markets

Shorter routes mean fewer deductions, clearer settlement times and stronger trust between you and your suppliers.

7. Treat FX management as part of procurement planning

FX does not operate independently from the rest of the business. Conversions tied to procurement cycles, seasonal demand and recurring invoices produce far better results than ad-hoc, last-minute transfers.

Practical tactics include:

- Setting alerts that notify you when desired rates appear

- Converting part of your expected currency need during favourable periods

- Planning conversions in line with supplier payment schedules

When FX planning aligns with operational planning, businesses gain far greater control over their total international payment spend.

8. Double-check supplier details to prevent avoidable returns

A rejected international payment often creates costs on both sides of the transfer. Errors in account numbers, routing codes or currency selection can lead to returns that not only delay delivery but also incur additional fees.

Before initiating a transfer, confirm:

- The supplier’s bank details match the format required by their country

- The beneficiary name aligns with the account

- The SWIFT or local routing information is valid

- The receiving bank supports the chosen currency

A few minutes of verification can prevent days of delays and unnecessary charges.

How the World Account supports UK businesses trading across borders

While international payments today move faster than ever, UK businesses trading overseas still face avoidable fees, forced conversions and unpredictable deductions that complicate cash flow planning and reduce margins. Learning how to avoid international wire transfer fees has become a practical skill for any SME working across borders, not a technical detail for finance teams alone.

The businesses that succeed in 2026 are the ones that build modern financial infrastructure around the way they already trade. They look for clearer FX visibility, payment routes that avoid unnecessary intermediaries and tools that give them more control than conventional banking channels allow.

International business payments are becoming cheaper and easier – and businesses that stay ahead with the right tools will see those savings.

As an alternative to a traditional business bank account, World Account from WorldFirst gives UK businesses the structure, flexibility and speed needed to manage international payments without absorbing the traditional costs of cross-border banking.

The World Account enables your business to:

- Operate in 20+ currencies from one account: Receive, hold, manage and pay in major global currencies without triggering automatic conversions. This lets SMEs match currency inflows and outflows and avoid FX charges that would otherwise erode margin

- Collect like a local in major markets: Local receiving accounts in USD, EUR, AUD, CAD, JPY and more help UK businesses collect funds quickly and with fewer deductions, sidestepping many of the receiving-bank fees that accompany international wires

- Convert with clarity and confidence: Transparent FX pricing and control over conversion timing enable businesses to plan around procurement cycles and protect margins, rather than reacting to unfavourable rates

- Send faster, more predictable payouts: Optimised routing and local rails minimise correspondent involvement and improve payment speeds to suppliers in China, Europe, the USA and other key markets

- Manage high-volume operations efficiently: Batch payments to up to 200 suppliers at once, reduce transaction volume and streamline approvals, giving finance teams far greater control over outgoing funds

- Receive guidance from cross-border specialists: WorldFirst provides dedicated support for UK SMEs, helping businesses navigate currency planning, local payment requirements and practical steps to reduce total international payment costs

Are your international payments costing more than they should?

Open a World Account for free today and manage international payments with lower fees, clearer FX and the control your business needs to trade confidently.

Shawn Ma leads business development at WorldFirst UK, with a deep expertise in fintech, risk management and cross-border commerce.

Shawn Ma

Author

Sources:

- https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/uktrade/august2024

- https://data.oecd.org/trade/trade-in-goods-and-services.htm

- https://www.bankofengland.co.uk/statistics/smp/2024

- https://www.fca.org.uk/publications/multi-firm-reviews/consumer-duty-fx-disclosure-2025

- https://www.ukfinance.org.uk/policy-and-guidance/reports-publications/uk-payment-markets-summary-2024

- https://www.finextra.com/blogposting/23245/uk-sme-fx-fees

- https://www.which.co.uk/news/article/revealed-hidden-currency-exchange-fees-in-your-international-money-transfers

- https://www.currencytransfer.com/blog/expert-analysis/uk-bank-fx-fees-2024

- https://www.statista.com/statistics/1287655/fx-margin-bank-vs-fintech/

- https://www.swift.com/our-solutions/swift-gpi

- https://www.bankofengland.co.uk/report/2024/enhancing-cross-border-payments-g20-roadmap

- https://www.ecb.europa.eu/paym/intro/paymentsystem/html/tips.en.html

- https://www.bis.org/about/bisih/topics/payments/nexus.htm

- https://www.worldfirst.com/uk/insight/

- https://www.worldfirst.com/uk/business/world-account/

- https://www.worldfirst.com/uk/blog/news/worldfirst-announces-netsuite-integration/

- https://www.worldfirst.com/uk/support/

Continue reading

Subscribe

The Weekly Dispatch

Get the latest news and event invites. Signup for our weekly update from the worlds of fashion, design, and tech.

You might also like

Choose a product or service to find out more

E-commerce guides

Doing business with China

Exploring new markets

Business Tips

International transactions

E-commerce expansion guides

Doing business with China