Dropshipping is a relatively new concept in eCommerce and has changed the logistical chain between manufacturer, seller and buyer. It minimises overheads such as warehouses, staffing and inventory management, making it more difficult to pinpoint exactly what type of business dropshipping is.

As a dropshipper, you’re not a traditional bricks-and-mortar store but neither are you a traditional eCommerce store managing and fulfilling orders with pre-purchased stock. It can therefore be confusing to determine whether you need an ABN and are required to pay GST as a dropshipper.

In this article, we’ll look at what dropshipping is, what an ABN is, who requires one and whether, as a dropshipper in Australia, you should have one.

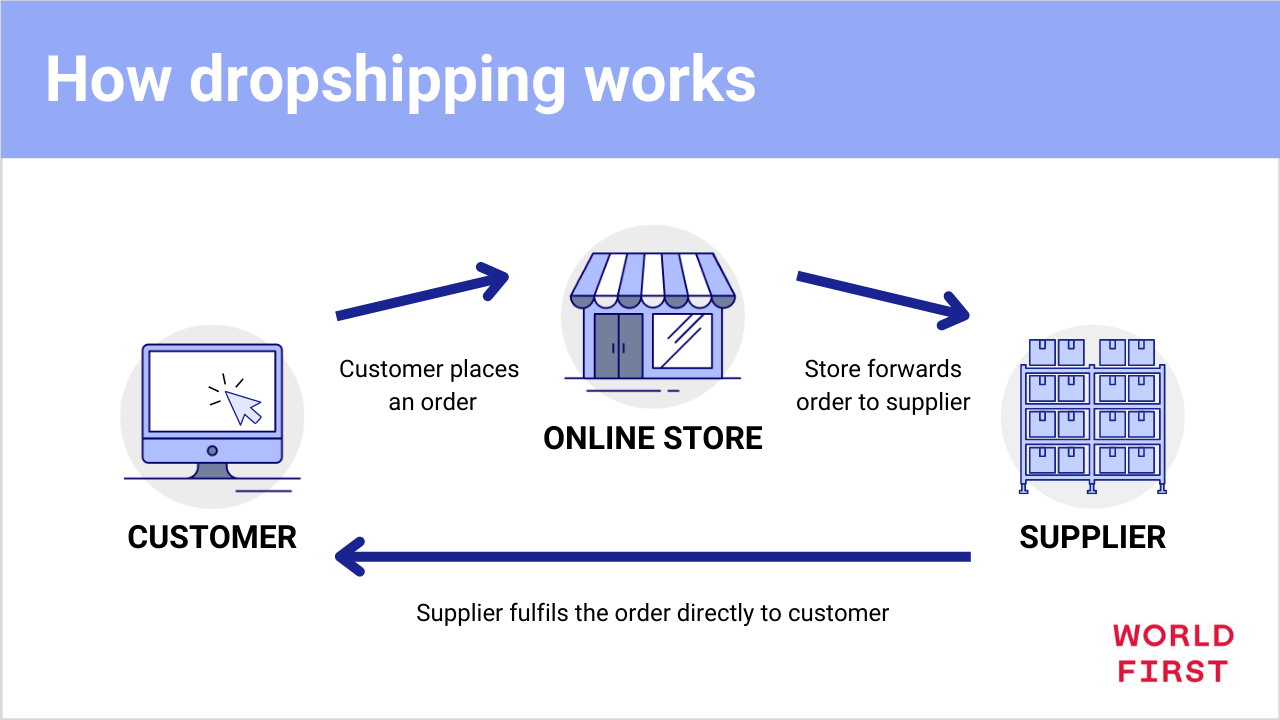

What is dropshipping?

Dropshipping has greatly lowered the cost of entry into eCommerce. You’ll no longer have to deal with minimum order quantities, inventory costs or shipping logistics. When a customer places an order with your store, whether this is an online marketplace, Shopify site or your own website, you simply pass the order onto your dropshipping supplier, who prepares, packs and ships the order directly to your customer.

What is an ABN?

An Australian Business Number (ABN) is an 11-digit number provided by the Australian Business Register. It’s unique to your business and helps identify it with the Australian Taxation Office (ATO), other businesses and the general public.

Who needs an ABN to sell online?

Not everyone who sells online requires an ABN. If, for example, you sell items online as a hobby or don’t intend to make a profit from selling, then you may not require an ABN.

However, if you intend to set up your dropshipping activity for profit, with a registered domain name and/or paid advertising and marketing, then you should consider it a business and you will likely need an ABN, if not now then in the future. The ATO has a handy guide to determine whether you’re carrying on or intend to start a business.

The benefits of having an ABN

Aside from identifying you with the government, having an ABN has several advantages.

You can get an Australian domain name

With an ABN, you can register your business name and purchase a .au domain name. This will allow customers and suppliers to identify you and increase your trustworthiness.

Open more opportunities

There are suppliers who will only work with registered businesses as the risk is otherwise too high. If you want to open a business account with financial institutions, you may also be required to have an ABN.

Tax deductions and tax credits

Without an ABN, you can’t apply for tax deductions related to running a business. You also aren’t able to charge GST.

How to register for an ABN

You can register for an ABN with the government’s Business Registration Service.

Grow your business without barriers

- Open up to 10 local currency accounts without a local banking relationship

- Sell on platforms including Amazon, eBay and more

- Reduce accounting admin with Xero integration

Disclaimer: These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.

You might also like

Insights from WorldFirst cover the latest FX news, top accounting tips, strategies to mitigate risk and key industry trends. Choose a category below to find out more.

Businesses trust WorldFirst

Since 2004, more than 250K businesses have utilised WorldFirst to send more than $160B around the world.