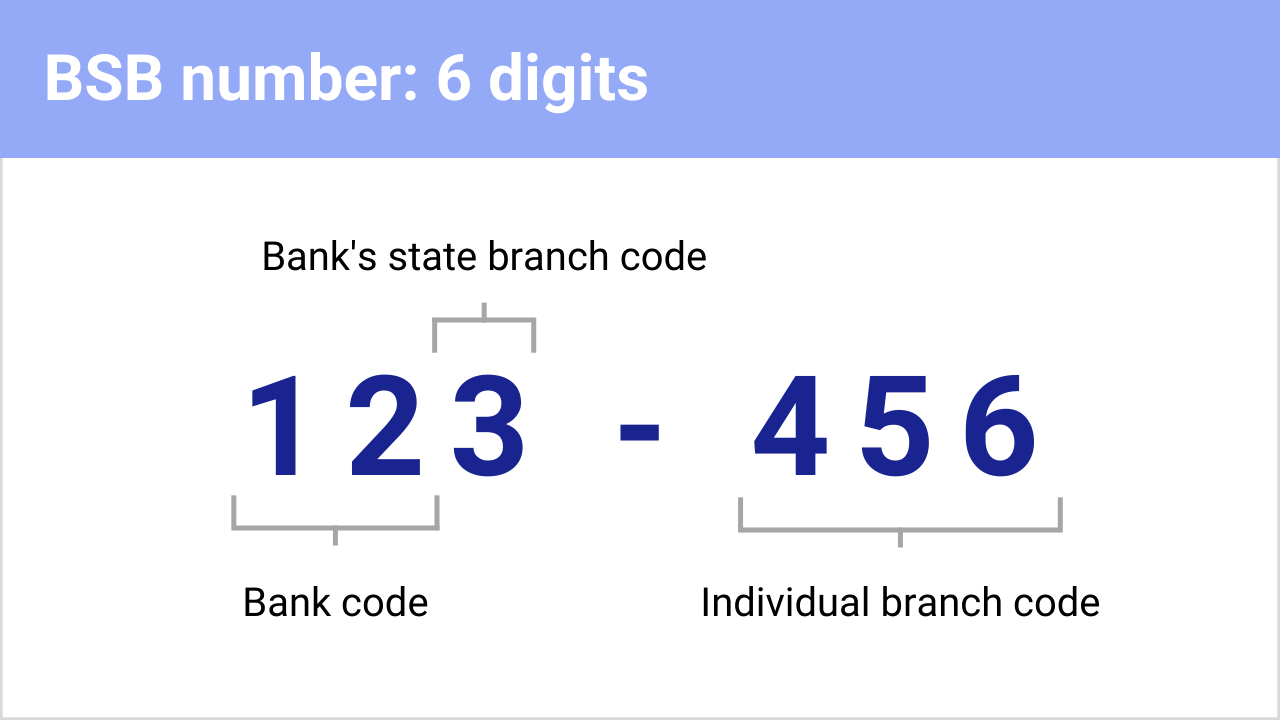

A BSB, or Bank State Branch number, is a six-digit code used to identify the specific branch of an Australian bank or financial institution. Some banks have the same BSB number for all branches across the country, while other banks have a different code for each branch. Below is a breakdown of how BSB numbers are formatted.

In this article, we’ll cover the most commonly asked questions regarding BSB codes:

- How do I find a BSB number?

- Do I need a BSB for international transfers?

- Is it safe to share your BSB and bank account number?

- Is a BSB code the same as a SWIFT code?

How do I find a BSB number?

If a supplier is requesting payment to their Australian bank account, the BSB number will be stated before the account number on the invoice. If you’re looking for your own banking BSB number, look at recent bank statements or log into your bank’s online portal for your account details. You can also contact your bank’s customer service to confirm.

Do I need a BSB for international transfers?

If you are transferring money from an overseas account to an Australian account, you’ll need to have both the BSB number and bank account number. Australia doesn’t use IBANs (International Bank Account Numbers) but some international banks require one to process cross-border payments. In this case, you can combine the BSB and account number, without spaces or hyphens, to create the IBAN.

Likewise, if you’re invoicing an overseas client for payment into an Australian bank account, you’ll need to provide your BSB number.

If you are transferring money to an overseas bank account, you won’t need a BSB number as BSBs are unique to Australia’s banking system. Other countries have their own systems for identifying the bank and branch of accounts.

Is it safe to share your BSB and account number?

Generally, providing your BSB and account details to suppliers is safe, as the details are used to deposit, rather than withdraw, funds. However, there’s a possibility that your details may be used to set up direct debits if the debiting business doesn’t verify ownership of the account with a signature or ID. As long as you regularly check your statements and activity, these are relatively quick to pick up.

To be safe, only share your bank details with people you trust or businesses and suppliers who need to know this information.

Is a BSB code the same as a SWIFT code?

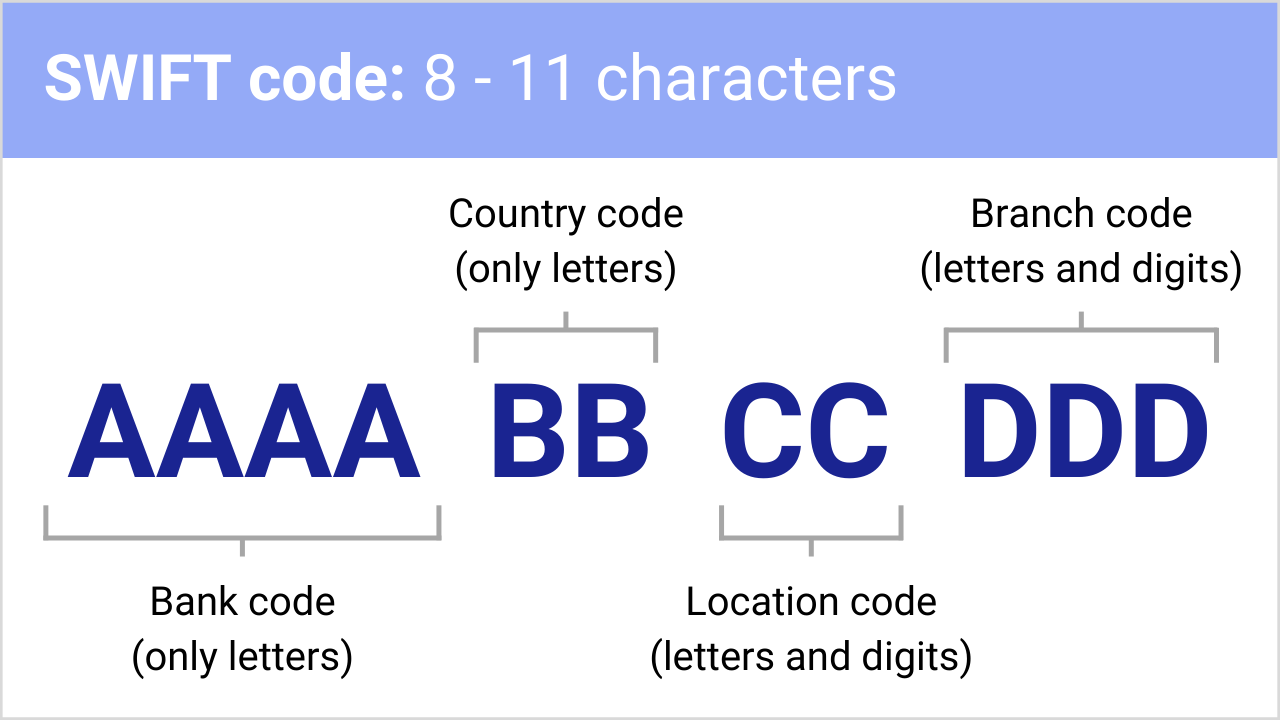

While BSB numbers and SWIFT/BIC codes are both used to identify the receiving bank when making a money transfer, the SWIFT/BIC code is used for international payments. SWIFT is a messaging network with a standardised system of codes used by financial institutions globally to allow them to securely transfer funds cross-border. The acronym stands for Society for Worldwide Interbank Financial Telecommunication.

Below is a breakdown of how SWIFT codes are formatted.

Reach global suppliers and pay at speed

Strengthen your supplier relationships with secure payments made at speed. Plus, protect against adverse currency fluctuations with forward contracts.

You might also like

Insights from WorldFirst cover the latest FX news, top accounting tips, strategies to mitigate risk and key industry trends. Choose a category below to find out more.

Businesses trust WorldFirst

Since 2004, more than 240K businesses have utilised WorldFirst to send more than £87bn around the world.