Cross-border payment fees in Singapore: What you need to know

Last updated: 17 Dec 2025

Singapore’s entrepreneurs, exporters and e-commerce sellers are global by design. They source products from China, pay suppliers in Malaysia and collect payouts from Amazon or Shopee in US dollars, pounds or yen. Yet even in a city built for global trade, moving money across borders can still feel like navigating a maze of hidden charges.

Each cross-border payment passes through several intermediaries and each stop adds a fee. The World Bank estimates that sending money internationally costs around 6.5% of the transfer value. In Singapore, businesses often pay SG$10–40 per transfer, plus 1–3% in hidden FX markups, which can add up to significant lost revenue over time.

This guide explains how cross-border payment fees in Singapore really work, what drives those extra costs and how businesses can reduce them with the right tools.

Key takeaways:

- Cross-border payment fees can quietly reduce profits: International transfers often involve multiple hidden costs, including handling fees and FX markups. These can gradually erode margins for exporters, e-commerce sellers and other globally active Singapore businesses

- Most costs come from FX markups and intermediary deductions: Beyond the visible transfer charge, intermediary banks and conversion spreads account for a large share of the total cost

- Local and digital payment networks are changing the landscape: Regional connections such as PayNow–DuitNow and PayNow–UPI are making payments faster and cheaper by reducing reliance on older SWIFT routes

- Regulators are improving transparency, but control rests with businesses: MAS and global initiatives are pushing for greater fee clarity and faster settlements. Even so, the biggest gains come from how each business manages its payment methods, currencies and providers

- WorldFirst helps simplify and reduce cross-border costs: The World Account lets Singapore businesses receive, hold and send multiple currencies with transparent FX pricing and no hidden transfer fees

Open a WorldFirst World Account for free today and manage all your international payments and conversions with full visibility on fees.

What are cross-border payment fees?

Cross-border payment fees are the combined costs of sending or receiving money between countries and currencies. For Singapore businesses, each international transfer can include several layers of charges that vary by bank, network and currency route.

The real hidden cost often lies in the FX margin. Even a small percentage markup compounds quickly on large supplier payments or frequent marketplace payouts.

While initiatives like SWIFT gpi have improved global transfer speed and tracking, full cost transparency remains a key focus for regulators and the wider payments industry.

Typical cross-border payment fees in Singapore

When a Singapore business sends or receives money internationally, several costs apply:

1. Bank transfer charges

Banks generally apply a flat or tiered handling fee to process overseas transfers. These charges cover administrative and network costs but rarely show the whole picture. These figures exclude intermediary or receiving-bank deductions, so the final landed amount may be lower than expected.

2. Intermediary and receiving bank deductions

If the sending and receiving banks don’t have a direct relationship, the transfer passes through one or more correspondent banks. Each intermediary may deduct a fee before the payment reaches its destination.

Cross-border transfers from Singapore often pass through several intermediary banks, each of which deducts a handling fee before the funds arrive. These deductions typically range from US$10–30 per intermediary, reducing the final amount received by US$50–100.

Choosing the “OUR fees” option ensures the recipient receives the full amount, though it increases the sender’s total cost.

Recent SWIFT data confirms that transfer speeds have improved, yet intermediary chains still account for a primary share of total deductions.

3. FX margin and conversion spread

Currency conversion often creates the largest hidden cost. When a business sends SGD but the supplier wants USD, CNY or EUR, the conversion usually happens at a marked-up rate above the mid-market rate.

Typical FX margins vary by provider, but is a percentage of the transfer amount, with smaller transfers often facing even higher spreads. A 1% markup on a US$10,000 invoice adds an extra US$100 to the total cost.

4. Corridor risk and compliance fees

Payments to certain countries may require additional checks for anti–money laundering (AML), sanctions or documentation. These reviews can extend processing times and add to handling costs.

Both Singapore regulators and global policy bodies continue working toward faster, cheaper and more transparent cross-border payments. However, the Financial Stability Board has noted that global cost-reduction targets for 2027 are unlikely to be fully met, making proactive cost management essential for businesses.

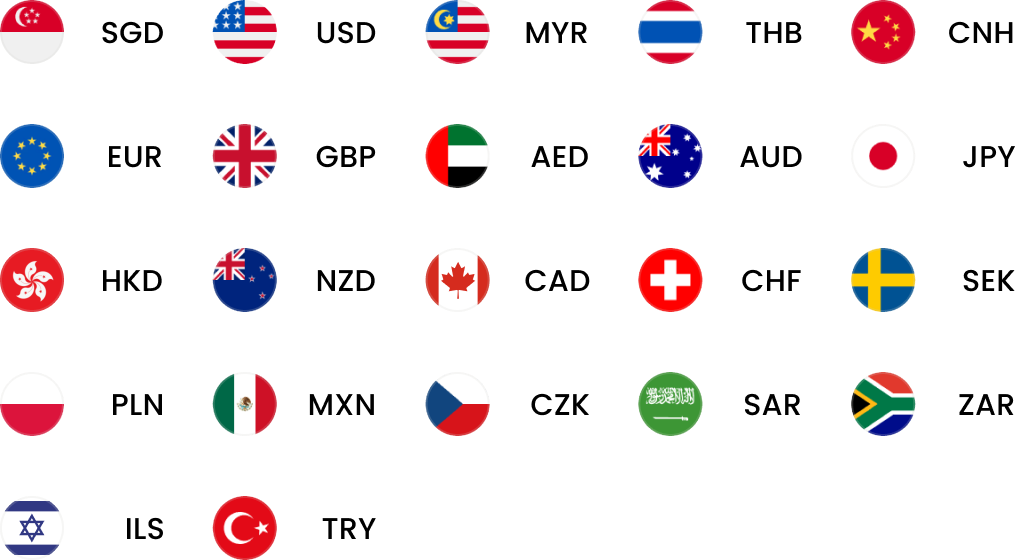

- Open 20+ local currency accounts and get paid like a local

- Pay suppliers, partners and staff worldwide in 100+ currencies

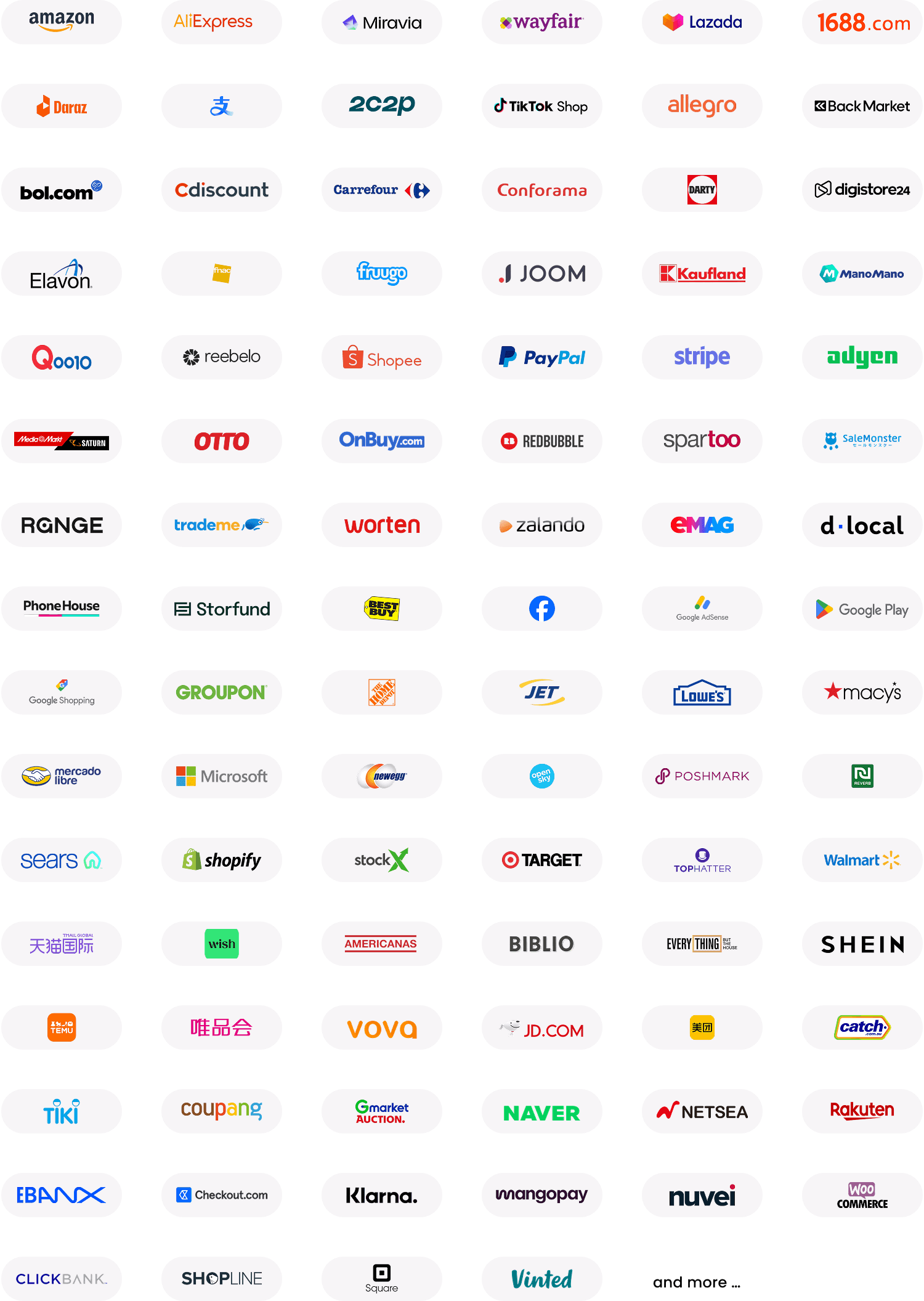

- Collect payments for free from 130+ marketplaces and payment gateways, including Amazon, Etsy, PayPal and Shopify

- Save with competitive exchange rates on currency conversions and transfers

- Lock in exchange rates for up to 24 months for cash flow certainty

Impact on Singapore businesses

High cross-border fees directly affect Singapore’s exporters, e-commerce sellers and SMEs. For companies trading on thin margins, every percentage point lost to FX markups or wire fees cuts into profit. Delays also create knock-on effects.

Transparency has become a key competitive factor. A 2025 survey found that 98% of Singapore’s online shoppers ranked transparent fees as one of the most important factors when buying internationally. Businesses that keep cross-border costs visible and consistent are more likely to win global customers.

Singapore continues to lead the region in international commerce. RBR data shows that Asia Pacific cards make up nearly half of global cross-border volume, with Singapore having the region’s highest share of international spending.

The Monetary Authority of Singapore (MAS) is linking local payment systems such as PayNow with Malaysia’s DuitNow and India’s UPI to support near-instant, low-fee transfers. These initiatives are already shifting some retail flows, such as Singapore–India, away from costly card networks toward real-time payment rails.

However, for B2B transactions, traditional wire and FX costs still dominate. Singapore businesses still process large-value payments through the SWIFT network under MAS MEPS+ oversight, although fee levels remain unregulated.

Singapore’s banks and payment providers are also aligning with G20 commitments to improve cost transparency. The SWIFT 2025 Retail Payments Initiative, supported by MAS, requires participating institutions to disclose all transfer fees upfront and remove hidden intermediary deductions. As these standards take hold, businesses can expect fewer surprise charges and greater predictability in international payments.

Strategies to reduce cross-border payment fees

Singapore’s global businesses know that managing international payments effectively is about more than just comparing headline fees. It requires control over currency flows, timing and the methods used to move money.

There are several practical strategies to reduce costs:

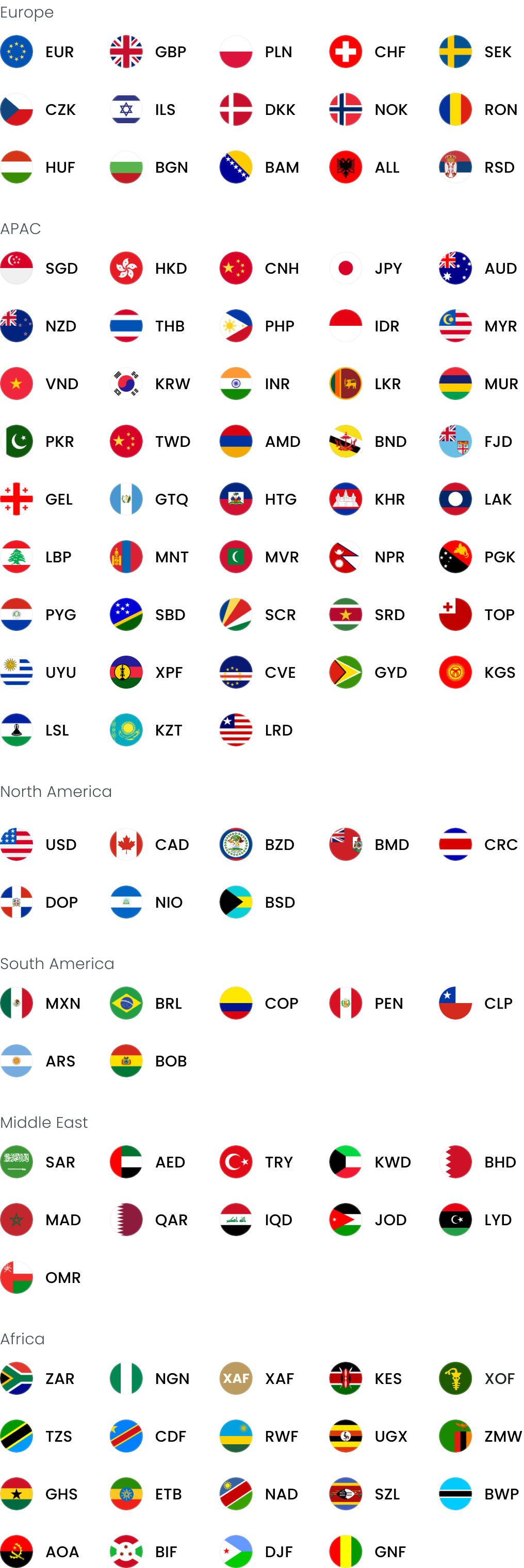

1. Use multi-currency accounts to avoid unnecessary conversions

One of the most practical ways to reduce cross-border fees is to receive and hold funds in their original currency. Multi-currency accounts allow businesses to open local receiving accounts in major currencies such as USD, GBP, EUR, AUD and JPY. This setup helps you avoid forced conversions and repeated exchange markups.

For example, a Singapore e-commerce seller that receives USD from overseas marketplaces can keep those funds in USD until the exchange rate becomes favourable, rather than converting automatically at the time of receipt. Likewise, businesses that export goods and pay international suppliers can use the same account to receive payments from customers and send payments in the supplier’s local currency, eliminating intermediary deductions and unnecessary foreign exchange.

Multi-currency accounts also simplify reconciliation and make international cash flow more predictable – a major advantage for SMEs managing multiple markets or marketplaces.

With a World Account, Singapore businesses can receive, hold and send over 20 currencies from a single platform, with no collection or ongoing account fees.

2. Leverage local payment rails when available

Using local clearing systems instead of traditional international wires helps reduce transfer costs and improve delivery speed. Sending payments in the destination country’s currency through domestic networks, such as USD in the United States or GBP in the United Kingdom, can eliminate intermediary deductions.

This approach shortens transfer chains, reduces uncertainty about final landed amounts and ensures suppliers receive full payments more quickly. Singapore’s expanding network of instant payment links also shows how regional collaboration can cut reliance on SWIFT and lower transaction fees.

3. Consolidate smaller payments

Each international transfer typically includes a fixed handling fee. Multiple small transfers can therefore cost much more than a single larger transaction. By batching or consolidating payments, businesses can reduce the number of transfers while keeping the same overall payment volume.

For example, one SG$10,000 payment often incurs the same fixed fee as ten separate SG$1,000 transfers. This approach works particularly well for exporters or manufacturers paying several suppliers in the same currency or region.

4. Negotiate timing and manage FX proactively

Timing matters when converting currencies. Monitoring FX movements and converting when rates are most favourable helps businesses protect margins and plan cash flow more effectively. Companies with predictable payment cycles often benefit from scheduling conversions in advance or setting rate alerts.

By treating FX management as part of overall financial planning, Singapore businesses can limit exposure to currency volatility and avoid unnecessary markups from urgent or automatic conversions.

5. Optimise everyday spending and receivables

Many SMEs still rely on card networks and e-commerce platforms that charge additional fees for cross-border or currency-conversion transactions. Accepting customer payments in their local currency – and paying suppliers in theirs – can significantly reduce these charges.

Meanwhile, choosing a business payments provider that offers transparent FX rates and low foreign transaction fees helps control small but frequent international costs. When both receivables and payables flow through the same currency channels, reconciliation becomes easier and fees stay predictable.

Checklist to reduce cross-border costs

- Compare providers: shop around between banks and fintechs for the lowest FX markups and fees

- Use local rails: send local currency via local rails or PayNow links, where possible (often with no fee)

- Receive in foreign currency: invoice in USD/EUR and hold that currency; convert only when needed

- Use a multi-currency account: consolidate multiple currencies into a single account with low conversion costs

- Batch and plan payments: combine invoices into one transfer; schedule currency conversions strategically

- Negotiate fees: if you do high volumes, ask your bank for fee waivers or reduced FX rates

- Stay compliant: provide required docs upfront on large transfers to avoid holds that could incur penalty fees

How WorldFirst helps reduce cross-border payment fees

Many Singapore SMEs need a reliable and cost-effective way to manage multiple currencies. The World Account from WorldFirst provides a single platform to hold, receive and send 20+ currencies at a lower cost than traditional banks.

Unlike typical cross-border transfers that pass through several intermediaries, WorldFirst uses local payment networks where possible, so businesses pay minimal transfer charges when sending money to suppliers overseas. The account is free to open and offers competitive FX rates with no hidden fees, providing users with complete transparency into every transaction.

Singapore companies have reported substantial savings using the World Account:

- Tantex, a textile exporter, reduced transaction costs by around 70%, saving thousands of dollars each year

- OSG, a Singapore company that converts shipping containers into offices and event spaces, saved over SG$30,000 annually and saw a direct improvement in its bottom line

Key features that help reduce costs:

- Zero remittance fees: Send major currencies such as USD, EUR, HKD and GBP to key markets without cable or intermediary bank charges. Many corridors, including Singapore–China, Singapore–US and Singapore–Europe, offer same-day payments

- Competitive FX rates: Convert funds within the platform at transparent rates. Businesses can also lock in rates to manage FX exposure and protect profit margins

- Multi-currency balances: Hold funds in foreign currencies and convert only when needed. Receive international earnings, such as USD from Amazon or EUR from European buyers, directly into local currency accounts without forced conversions

- Cashback on spending: The linked World Card offers up to 1.2% cashback on overseas business expenses and zero FX fees, helping reduce the total cost of global payments and travel

WorldFirst simplifies global payments by removing intermediary bank charges and replacing complex cost layers with a single, transparent, pricing structure.

Reduce your cross-border payment fees in Singapore. Open a World Account for free today and manage all your international payments and conversions in one place.

Sources:

2.https://www.worldfirst.com/sg/blog/case-study/osg

3.https://www.worldfirst.com/sg/blog/case-study/tantex

4.https://www.volopay.com/sg/blog/international-bank-transfer-charges

5.https://www.mas.gov.sg/development/e-payments/cross-border-payment-linkages

6.https://www.swift.com/news-events/news/cross-border-payments-programme-retail-payments

7.https://remittanceprices.worldbank.org/en

8.https://www.fsb.org/work-of-the-fsb/financial-innovation/cross-border-payments

9.https://fintechnews.sg/77882/fintech/singapore-cross-border-payments-2024

10.https://www.rbrlondon.com/reports/global-payment-cards-statistics-2023

Businesses trust WorldFirst

- Almost 1,500,000 businesses have sent US$500B+ around the world with WorldFirst and its partner brands since 2004

- Your money is safeguarded with leading financial institutions