Brief Summary:

- The RBA keep rates on hold at 2.50% and will deliver its quarterly Monetary Policy Statement on Friday.

- The U.S. delivers a fairly strong jobs number in April, however, the Fed’s new qualitative employment objectives mean USD strength was contained.

- Janet Yellen reiterated that a high level of accommodation remains needed for the U.S. economy.

- The European Central Bank and Bank of England will hold their monthly monetary policy decisions tomorrow night. No change to their respective policies is expected.

Australian data snapshot

Yesterday, the Reserve Bank of Australia decided to leave the cash rate on hold at 2.50%. They made few substantial changes to the statement and continued with the line, “The most prudent course is likely to be a period of stability in interest rates.” They expanded their comments on inflation, stating that lower wage growth has helped to contain inflation. “Growth in wages has declined noticeably and this has been reflected more clearly in the latest price data, which show a moderation in growth in prices for non-traded goods and services”

Australia’s trade balance declined to a surplus of $730 million, however remained strong. Retail sales, released this morning, missed expectations of 0.5%, however wasn’t a disaster after seven months of solid numbers.

Australian employment numbers for April will be released tomorrow at 11:30 AEST. Expectations are for 7,500 new jobs and for the unemployment rate to tick up to 5.9%. A better than expected figure tomorrow will top off three months of strong results and may push the AUD higher.

Probably the most important event this week will be the RBA’s quarterly Monetary Policy Statement. Released at 11:30 AEST on Friday, the statement details important growth and inflation forecasts. Recent lower than expected inflation data may prompt the RBA to revise its forecasts. Similarly, stronger than expected trade and sector growth numbers thus far may prompt an upward revision to growth forecasts.

USD

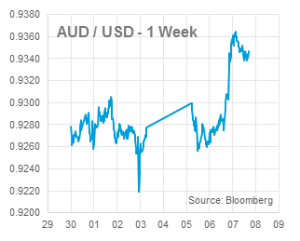

After ten days trading within a half a cent, price action has returned to AUDUSD. On Monday night, the U.S. ISM Non-Manufacturing PMI was released that showed business conditions improving. The index, which indicated economic growth when above 50.0 was 55.2 in April. Respondents said that sales were picking up as winter weather subsides.

After ten days trading within a half a cent, price action has returned to AUDUSD. On Monday night, the U.S. ISM Non-Manufacturing PMI was released that showed business conditions improving. The index, which indicated economic growth when above 50.0 was 55.2 in April. Respondents said that sales were picking up as winter weather subsides.

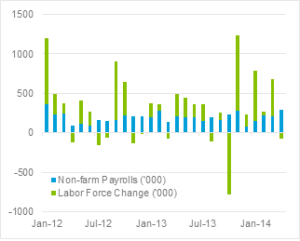

Last Friday, the U.S. delivered its strongest employment data since before the harsh winter that kept job seekers indoors. The headline Non-Farm Payrolls figure, which measures the number of jobs created in the month, was 288,000 after 215,000 was expected. The unemployment rate declined to 6.3%, but the decline was caused by a large number of people leaving the labour force; causing a decline in the participation rate.

The slightly mixed messages delivered by the report caused a volatile end to the trading week. AUDUSD spiked down sharply on the headline and then recovered all lost ground by the close. The unemployment rate fell, but the U.S. Fed have shifted their rhetoric to focus away from this figure and towards broader measures.

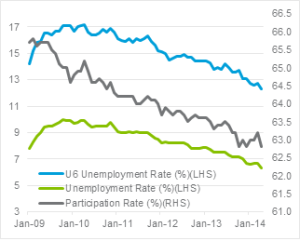

The blue series in the chart below shows U6 unemployment. U6 measures ‘underemployment’ by counting those who are working part-time for economic reasons and discouraged workers that have stopped looking. The Fed have not defined a number that they are seeking, but at 12.3%, it remains high.

NZD

The NZD pushed higher this week as New Zealand delivered better than expected employment growth. The economy added 0.9% of quarterly jobs growth after 0.6% was expected. NZDUSD touched 0.8777, the highest level since July 2011. The NZD fell back from its highs, probably based on previous comments that the Reserve Bank of New Zealand could intervene if the NZD stayed strong.

The NZD pushed higher this week as New Zealand delivered better than expected employment growth. The economy added 0.9% of quarterly jobs growth after 0.6% was expected. NZDUSD touched 0.8777, the highest level since July 2011. The NZD fell back from its highs, probably based on previous comments that the Reserve Bank of New Zealand could intervene if the NZD stayed strong.

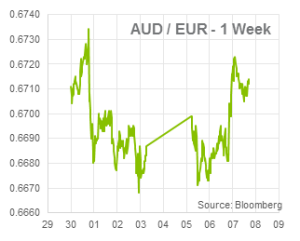

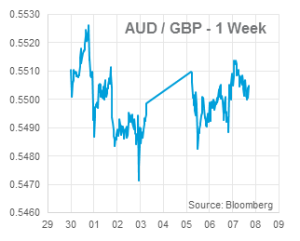

EUR & GBP

By Chris Chandler