![]() With inflation at five percent in Australia, the RBA increasing the cash rate for the first time since 2010 and several more rate hikes predicted, the question many small businesses are asking is, how will it affect me?

With inflation at five percent in Australia, the RBA increasing the cash rate for the first time since 2010 and several more rate hikes predicted, the question many small businesses are asking is, how will it affect me?

Some economists and banks have been predicting an interest rate rise in Australia since 2021, when the effects of the global pandemic and supply chain issues pushed inflation higher. And with the Russia-Ukraine war compounding global trade issues, to which Australia is not immune, inflation has skyrocketed in the first months of this year. At 5.1 percent, it’s the most rapid rise in 20 years. As a result, the Reserve Bank of Australia has just announced the first interest rate hike in ten years. But what exactly is the relationship between interest rates and inflation and what does it mean for small-to-medium businesses?

What is inflation?

In simple terms, inflation refers to the increase in the cost of goods and services over a period of time. It’s generally measured as an overall increase in prices or the cost of living. For example, we’ve seen the cost of petrol rising due to geopolitical tensions and concurrently, weekly grocery costs are going up, along with rental and housing prices. What pushes prices up are a combination of factors, mostly related to the cost of production, such as raw materials and wages, and demand outstripping supply. We’ve seen supply bottlenecks, with shipping times blowing out. Many industries are reporting difficulty recruiting staff, forcing them to offer higher wages. And with the lack of availability of certain products, consumers and businesses are paying more to source them.

How do interest rates affect inflation?

Inflation can be an issue for businesses because it decreases a buyer’s purchasing power; you might only get eight units of an item, when previously you could buy ten with the same amount of money. While some level of inflation is normal and even beneficial, it becomes a concern for governments when it outpaces the ability for consumers to pay for day-to-day goods.

This is why central banks try to hold inflation in check, usually at around two percent. And this is where interest rates come in. Higher interest rates diminishes the amount consumers – and businesses – can borrow, which, the theory goes, then lowers the amount they spend. Less demand for products means less money in the economy and reduces the inflationary pressure on goods. Improved interest rates on savings accounts should also increase the willingness to leave money in your bank account rather than spending it.

How does inflation affect foreign exchange rates?

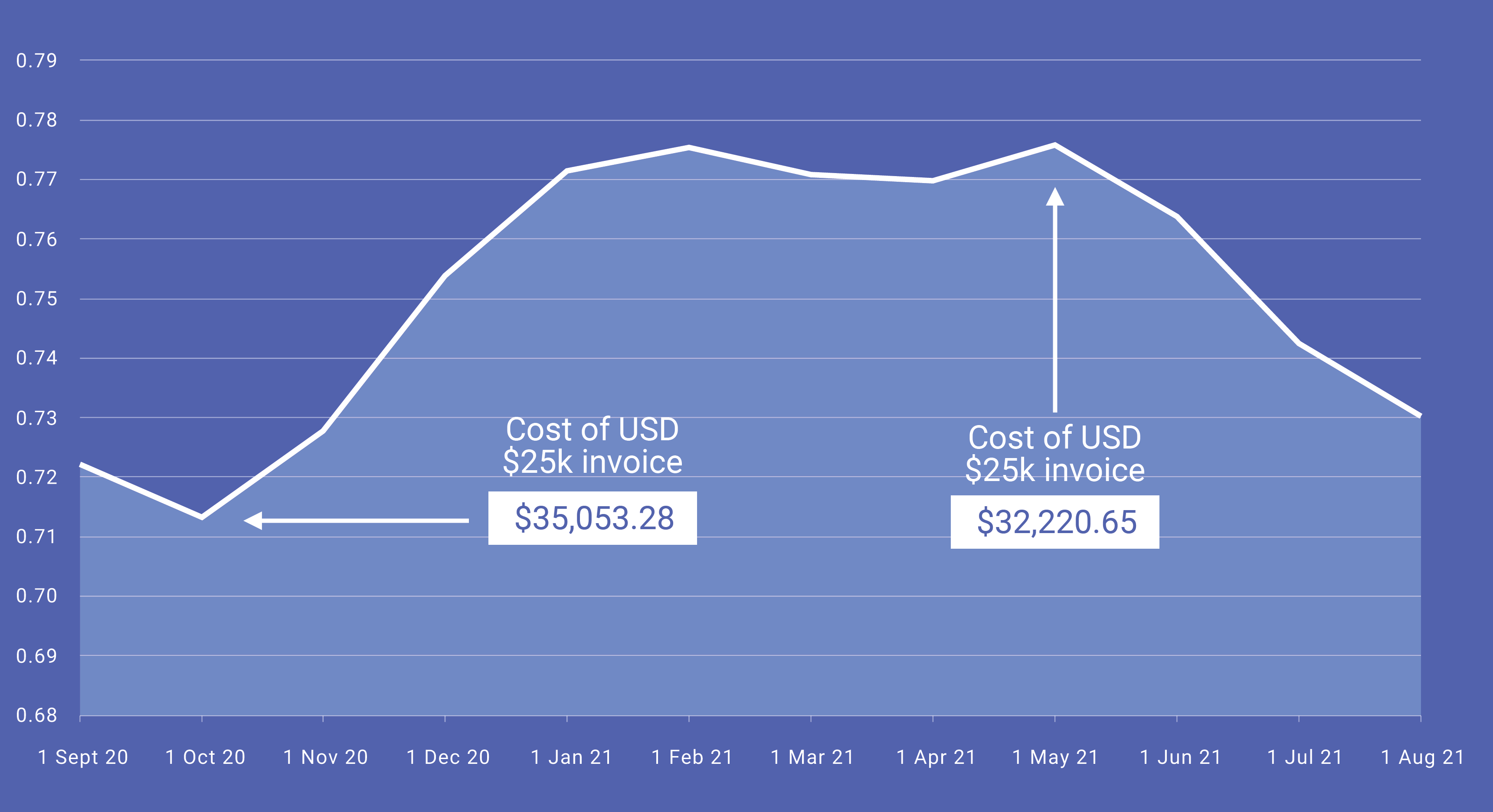

For a small-to-medium business with cross-border trade requirements, high inflation can greatly impact the cost of supplier payments as it devalues the buyer’s local currency. In the graph below, the lower value of the Australian dollar against the USD in late 2020 meant almost $3,000 difference in the invoice compared to just seven months later. While there are many complex factors contributing to the exchange rate between currency pairs, inflation is something that is closely watched by financial institutions and investors alike.

How do high interest rates affect businesses?

There are several ways that a hike in interest rates can affect businesses.

- Reduced borrowing power: As mentioned previously, a higher interest rate can result in banks being less willing to loan large amounts to businesses.

- Higher loan repayments: Higher interest rates means a higher percentage of the payment is going to pay the interest rather than the loan itself, which extends the life of the loan. Businesses that are financially stretched may move to interest-only payments.

- Lower consumer spending: Higher interest rates reduce disposable income as consumers use their cash to pay for loans. It also incentivises saving due to the interest earned.

- Reduced investment: Businesses may be hesitant to take on new risks and purchases.

How can small-to-medium businesses save money?

When interest rates and repayments rise, the last thing you want to do is spend money you don’t need to. WorldFirst helps SMEs save on their international money transfer costs. If you see that your preferred currency pair is fluctuating, you can lock in an exchange rate with a forward contract from WorldFirst. This allows you to lock in a rate for up to two years. It means that you’ll always know what rate you’re getting, so you can predict cash flow and be more accurate with your forward planning.

A forward contract is a hedging product, so you should consider your risk appetite – if the market moves against you during your contract, you won’t lose out, but you won’t benefit if a currency moves in your favour.

If this happens, WorldFirst’s spot contracts allow you to take advantage of the current live rate, while charging a maximum margin of 0.60%. Our bank-beating exchange rates mean lower supplier payments and more money in your account when repatriating funds. Some of the reasons over 250k clients have chosen WorldFirst for their international money transfers since 2004 include:

- Same-day transfers on major currencies

- No hidden fees

- Dedicated account management team

Disclaimer:

These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits.