Brief Summary:

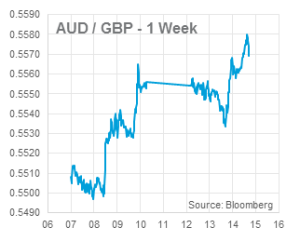

- The AUD climbed last night as Treasurer Joe Hockey delivered his first budget. The foreign exchange market liked it. Whilst the cuts and tax increases will probably drag on near-term economic growth, the path toward deficit reduction means Australia’s sovereign debt rating will probably remain AAA.

- The EUR fell as German Bundesbank officials expressed that they were more open to additional monetary policy measures.

Australian employment turnaround

Australian employment growth continued to post strong monthly numbers last week with 14,200 jobs added in April. The unemployment rate held steady at 5.8%, however, the participation rate declined as people left the work force.

The figure supported the AUD as the data supports the RBA’s latest monetary policy statement where they upgraded their view on the labour market. The board stated last Tuesday that, “More recently, there has been some improvement in indicators for the labour market, but it will probably be some time yet before unemployment declines consistently”. In April they were slightly more negative, stating, “The rate of unemployment has continued to edge higher. It will probably rise a little further in the near term.” The minutes of this latest decision will be released next Tuesday.

USD

U.S. retail sales missed expectations in April growing at 0.1% month-on-month. The reaction to the figure was minimal as it will not significantly alter the course of tapering or interest rate expectations. The U.S. consumer price index, the main measure of inflation, will be released tomorrow night. This measure remains well below the Fed’s 2% target and will become more important as their labour market objectives are slowly met.

U.S. retail sales missed expectations in April growing at 0.1% month-on-month. The reaction to the figure was minimal as it will not significantly alter the course of tapering or interest rate expectations. The U.S. consumer price index, the main measure of inflation, will be released tomorrow night. This measure remains well below the Fed’s 2% target and will become more important as their labour market objectives are slowly met.

EUR & GBP

Tonight may be busy for the GBP. The U.K. unemployment rate will be released that is expected to be 6.8%. Bank of England Governor Mark Carney will also speak and deliver the bank’s inflation report.

After instating a forward guidance that ended up forecasting much slower than realised labour market growth, the BoE have follow the U.S. Fed in making their goals and objectives vaguer. The bank adopted the phrase ‘slack’ to describe what they see as the gap between where we are now and full economic output. The market will pay close attention to their judgement of how much of this ‘slack’ is used up in tonight’s report. A more positive view of the economy will likely strengthen the GBP against most major currencies.

NZD

This morning, the Reserve Bank of New Zealand released semi-annual Financial Stability Report. The report reiterated the board’s intention to continue raising rates in order to cool the booming domestic housing market. It reinforced the need for loan-to-value ratios (LVR), that it introduced in 2013 to limit the risk of overleveraged households. It also expressed concerns that slower than expected Chinese growth may hurt dairy farmers, many of whom are also highly leveraged. Later in the morning, New Zealand Retail Sales came in slightly below expectations of 0.9% at 0.7% quarterly growth.

This morning, the Reserve Bank of New Zealand released semi-annual Financial Stability Report. The report reiterated the board’s intention to continue raising rates in order to cool the booming domestic housing market. It reinforced the need for loan-to-value ratios (LVR), that it introduced in 2013 to limit the risk of overleveraged households. It also expressed concerns that slower than expected Chinese growth may hurt dairy farmers, many of whom are also highly leveraged. Later in the morning, New Zealand Retail Sales came in slightly below expectations of 0.9% at 0.7% quarterly growth.

Chris Chandler