5 MIN read – *Article updated on 20th August 2020*

Although it may alleviate some financial strain, or be the leg up you need to finally put down that house deposit, repatriating an inheritance from an overseas estate isn’t always as simple as transferring the full amount directly to your Australian bank account.

Understanding the rules and restrictions surrounding repatriation of inheritance could save you lots of stress down the track, so here are some things to keep in mind before you start the process.

Identify any possible tax implications

Repatriating inheritance from overseas can come with tax implications and different countries have different inheritance tax laws. The best course of action is to reach out to local (and reputable) tax professionals for advice in the jurisdiction the inheritance is to originate from.

If you live in Australia, consider yourself lucky when it comes to paying tax on inheritance. Put simply, you don’t have to.

According to tax accountants, H&R block, an overseas inheritance is not taxable unless you are advised by the executor that a part of it is.

Bear in mind, however, there are some specific financial transactions that may still be taxed, despite Australia not having inheritance tax laws.

For example, the concerned estate could continue to make an income after the individual’s death from asset sale capital gains or interest incurred on savings accounts. Also, if you decide to invest the income from the estate, then any subsequent earnings will be taxable. Until complete administration of the estate is organised, a trust tax return is payable on any taxable income, and as the beneficiary of the estate, you may have full responsibility for this.

In addition, depending on the country the inheritance is coming from, you will need to determine who owns the tax – the executer of the estate or the beneficiary who it is being repatriated to. Often, it is the executer of the estate, however, there are some instances where this is the beneficiary’s obligation.

If in doubt, always seek professional tax advice.

2 Tips on Bringing Your Overseas Inheritance to Australia

1) It pays to employ a local tax professional

This might sound like contradictory advice, however, investing in a local tax professional to sort out your affairs can end up saving you a lot of time and money in the long run.

Get in touch with a local tax accountant in the country your inheritance is being repatriated from and investigate if there are any local tax costs, you’re not aware of.

2) Repatriate your overseas inheritance with a specialist payments company to save money

When it comes to transferring funds from overseas, you’ll often find better value with an independent money transfer company, like WorldFirst, as opposed to the Big 4 Banks with which you might conduct your everyday banking.

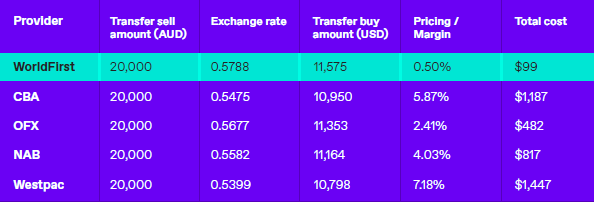

WorldFirst offers exchange rates that are up to 8 times cheaper than the Aussie banks, and when you’re transferring a big sum of money, such as the repatriation of an inheritance, it can help you save significantly on the exchange rate.

Transfer time/date AUD to USD FX rates – 14:59, 23 March 2020 UTC. Currency pair: AUD/USD | Market rate: 0.5817 | Source: FXC Intel

If you’re ready to transfer your inheritance right now, a spot contract could be the one for you. WorldFirst will offer you a rate based on the live exchange rate on the day, and you can make a payment there and then. This will save you up to 8x cheaper than the banks and with no fees.

If you want to lock in a rate, but aren’t ready to repatriate your inheritance immediately, you can ‘fix’ it up to 2 years in advance with a forward contract. The great thing about this is that you’ll know exactly how much you’ll receive when you’re ready to transfer your inheritance.

For more information on repatriating an inheritance to an overseas bank account, get in touch with a WorldFirst currency specialist today on 1800 835 506 or visit our website: worldfirst.com/au.

Disclaimer: These comments are the views and opinions of the author and should not be construed as advice. You should act using your own information and judgement. Whilst information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgement as of the date of the briefing and are subject to change without notice. Please consider FX derivatives are high risk, provide volatile returns and do not guarantee profits. We have no commercial affiliation with any organisation or commercial interest regarding the venues mentioned in this article. The information is only provided as gathered and should be verified before, using your own judgement.

*Although WorldFirst has prepared the Information contained in this website with all due care and updates the Information regularly, World First does not warrant or represent that the Information is free from errors or omission. Whilst the Information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact on the accuracy of the Information. The Information may change without notice and WorldFirst is not in any way liable for the accuracy of any information printed and stored or in any way interpreted and used by a user.

WorldFirst do not take into account your specific financial objectives and requirements. You should always seek advice from tax professionals in applicable local jurisdiction/s to ensure that all related tax payments are resolved.