Brief Summary:

- Iron ore prices fell sharply this week on fears of oversupply causing the AUD and local stock markets to fall. The AUD has fallen over 1.5% in two days.

- Market fears were fuelled by China and Vietnam reaching a new peak in its standoff over disputed territory in the South China Sea. Nearby, Thailand’s military declared martial law after political fallout in the country.

- The U.S. will release the minutes of its most recent monetary policy meeting tonight.

Is the AUD due for a turnaround?

The AUD broke from its two week trading range on Tuesday as the Reserve Bank of Australia released the minutes from its May monetary policy meeting. Earlier in the day, comments by Standard and Poor’s, a ratings agency, that the Federal budget may hurt state credit ratings didn’t budge the AUD. However, the response to the slightly less upbeat minutes opened the floodgates.

In particular, the board played down recent labour market strength stating, “monthly movements in labour market data could be volatile” and that, “Forward-looking indicators had also improved, but remained at low levels and were consistent with relatively moderate employment growth in coming months”. However, this was no more dismissive than April’s minutes where the board put labour market improvement down to statistical variance.

The most significant comments centred on inflation. While the board made no change to their outlook of inflation remaining contained, they acknowledged that it has been lower than first predicted a few months ago. In April, the board forecast underlying inflation reaching three percent in June; a forecast that is now not expected to materialise. This dampens the prospects of an interest rate rise early in 2015 which some market participants were speculating on when domestic confidence was peaking.

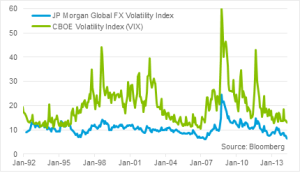

Searching for justification in the minutes alone may leave one empty handed. It will more likely be a global shift in sentiment that prompts a major AUD sell-off. One factor noted by the RBA are very low levels of volatility in financial markets. The chart below shows the JP Morgan FX volatility index, a measure of implied volatility in currency markets, and the Chicago Board Options Volatility Index, a share market volatility measure based on the S&P 500, commonly known as just VIX.

The current low level of FX volatility was only surpassed in 2007 prior to the global financial crisis. Volatility has rebounded each time this lower bound has been approached. The AUD and NZD have been the main benefactors of this low volatility environment. As U.S. monetary stimulus is removed, markets should become more volatile. It is possible that these carry currencies will be the biggest victims to a rebound when it occurs and events unfolding this week like an escalated China-Vietnam stand-off could be the trigger.

The HSBC Chinese Manufacturing PMI, a monthly gauge of Chinese manufacturing activity, will be released tomorrow at 12:45pm.

USD

Early tomorrow morning, the U.S. Federal Open Market Committee will released the minutes from its last monetary policy meeting. The decision revealed no significant change in Fed policy and the minutes are expected to be the same. Markets seem to have heeded to the Fed’s reiteration that rates will remain near zero for some time. This reassurance has been the main driver of extremely low volatility mentioned above.

Early tomorrow morning, the U.S. Federal Open Market Committee will released the minutes from its last monetary policy meeting. The decision revealed no significant change in Fed policy and the minutes are expected to be the same. Markets seem to have heeded to the Fed’s reiteration that rates will remain near zero for some time. This reassurance has been the main driver of extremely low volatility mentioned above.

EUR & GBP

European GDP figures were released last Thursday showing mixed performance by major economies. Germany’s economy grew by 0.8% in the first quarter of 2014 but France was flat and Italy went backwards 0.1%. The wider region grew by just 0.2% highlighting the continued sluggishness of the region despite many claims the crisis is over.

The U.K. Consumer Price Index, the main measure of inflation, was slightly higher than expected at 1.8%.

Chris Chandler