Brief Summary:

- Currency trading has been quiet and the AUD has drifted higher this week as the U.S. and U.K. were on holiday. Quietness may continue as France, Germany and Switzerland have their own bank holidays tomorrow.

- Australian Private Capital Expenditure will be released tomorrow morning at 11:30 AEST. This important quarterly figure details planned and actual capital investment by industry in Australia. Mining investment is expected to continue its decline and other industries are due to pick up the slack. The headline figure is expected to show a 1.6% overall decline.

AUD forecasts – less uncertain

The AUD’s recent strength has taken most people by surprise. Explanations have been wide and varied including multi-year low volatility, improved domestic data and a more dovish U.S. Fed. The only thing that is certain is that the market is less certain on the direction of the AUD.

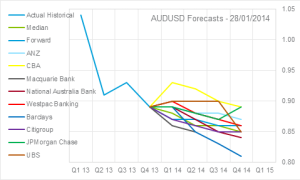

Below are market forecasts for AUDUSD compiled by Bloomberg as at the 28th January 2014. At the time, the spot rate was just below 0.9000 and the direction was a resounding ‘down’. The median forecast was for 0.8500 by year end and all houses were calling within a 10 cent range.

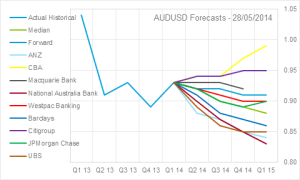

Fast-forward to 28th of May 2014 and things have changed slightly. The median forecast has risen to about 0.8800 but the range of forecasts is now almost 20 cents. The CBA and Citibank are leading the bullish charge forecasting the AUD to be 0.9500 or higher by year end. The CBA were the only house to predict the recent rally, however, were they just lucky and will their bullish forecast come to fruition once again?

A prediction that the AUD could again move back to parity flies in the face of the logic of most market participants. Downside risks include a slowing China and a resumption of speculation over the timing of the first U.S. interest rate rise. The majority continue to predict renewed USD strength across the board and consider the current environment as a temporary breather in the move back to ‘normal’. This ‘normal’ they refer to is a world without monetary stimulus and financial markets that are more volatile and less correlated.

GBP

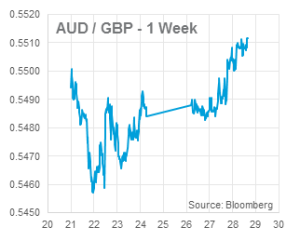

After peaking last week at 1.8334 against the AUD, the GBP continued to consolidate its recent gains this week. A higher than expected inflation print and stronger than expected retail sales boosted the Pound last week but excitement has waned over the U.K. bank holiday weekend. With the Bank of England shying from its firm unemployment rate target to the much more vague ‘slack’ in the economy, the Pound has become less reactive to positive data releases. It may be sometime before the high 1.80s are breached again without a serious shift in BoE rhetoric.

After peaking last week at 1.8334 against the AUD, the GBP continued to consolidate its recent gains this week. A higher than expected inflation print and stronger than expected retail sales boosted the Pound last week but excitement has waned over the U.K. bank holiday weekend. With the Bank of England shying from its firm unemployment rate target to the much more vague ‘slack’ in the economy, the Pound has become less reactive to positive data releases. It may be sometime before the high 1.80s are breached again without a serious shift in BoE rhetoric.

Chris Chandler