Brief Summary:

- The U.S. Federal Open Market Committee will hold its monetary policy meeting tomorrow morning and a continuation of tapering is expected.

- Financial markets are again disrupted this week with Europe celebrating May Day tomorrow.

- Next week will be important for the AUD. The Reserve Bank of Australia will hold an interest rate decision amongst a wave of domestic economic data including building approvals, trade figures, retail sales and employment. The RBA will also release its quarterly Monetary Policy Statement where they may revise the inflation outlook and growth targets.

USD

This week the U.S. Federal Open Market Committee will hold its monthly monetary policy meeting early tomorrow morning. The committee are expected to continue the quantitative easing tapering trajectory, trimming the program from $55 billion to $45 billion per month. Markets are calm assuming a non-event which paradoxically opens the door to risk of an event. Importantly, Fed Chairwoman Janet Yellen will speak later in the day where she may make some comments on the economy; which have been few and far between recently. Later in the week, U.S. employment data will be released for April. Expectations are for over 200,000 new jobs, the most ambitious figure since before winter.

This week the U.S. Federal Open Market Committee will hold its monthly monetary policy meeting early tomorrow morning. The committee are expected to continue the quantitative easing tapering trajectory, trimming the program from $55 billion to $45 billion per month. Markets are calm assuming a non-event which paradoxically opens the door to risk of an event. Importantly, Fed Chairwoman Janet Yellen will speak later in the day where she may make some comments on the economy; which have been few and far between recently. Later in the week, U.S. employment data will be released for April. Expectations are for over 200,000 new jobs, the most ambitious figure since before winter.

Rhetoric from the Fed has turned more dovish lately and currency markets have reflected this by allowing the AUD and NZD to rally. Looking forward, the combination of a more upbeat outlook from the Fed and a strong employment number could trigger a reversal in recent trends.

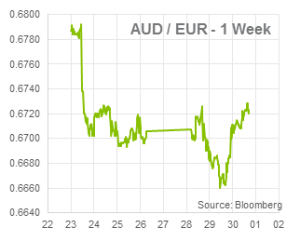

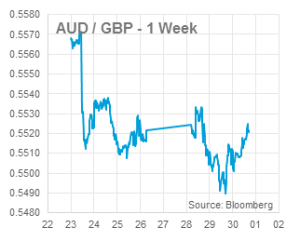

EUR & GBP

The Eurozone consumer price index will be released tonight, the main measure of consumer inflation. After touching a multi-year low of 0.5% last month, many called for and the European Central Bank (ECB) said they would consider extra policy measures such as quantitative easing. Market expectations are for inflation to bounce back to 0.8%. The ECB will hold an interest rate decision next Thursday where they may respond to a lower than expected figure.

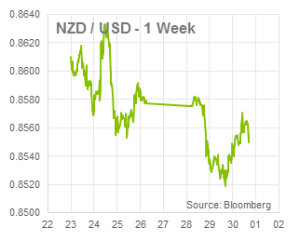

NZD

Last Thursday, the Reserve Bank of New Zealand raised the overnight cash rate to 3.00% as widely expected by the market. The NZD jumped on subtle changes to the accompanying statement. There were fewer references to the high exchange rate suggesting the bank are less concerned with its current level. These gains proved short lived, reverting by the end of the trading day. New Zealand employment numbers for April will be released next Wednesday.

Last Thursday, the Reserve Bank of New Zealand raised the overnight cash rate to 3.00% as widely expected by the market. The NZD jumped on subtle changes to the accompanying statement. There were fewer references to the high exchange rate suggesting the bank are less concerned with its current level. These gains proved short lived, reverting by the end of the trading day. New Zealand employment numbers for April will be released next Wednesday.

Chris Chandler