Brief Summary:

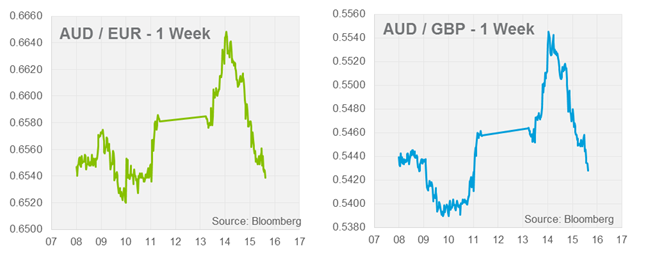

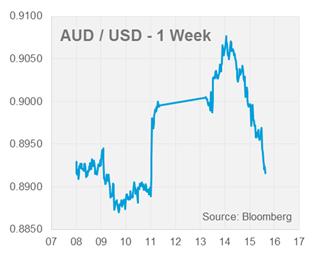

- The AUD has a volatile week of trading as the U.S. delivers mixed employment and retail numbers.

- Australian employment numbers for December will be released tomorrow at 11:30am. Market expectations are for 10,300 new jobs and for the unemployment rate to be steady at 5.8%. Employment growth in the second half of 2013 has been lacklustre averaging around 500 per month. The unlikely bullish case would involve a continuation or of November’s relatively strong figure of 21,000, whereas the bearish case looks to flat growth or a slight give up. The decline of the AUD through today’s trading suggests that a positive surprise is possible, however, any gains will likely be temporary.

- Chinese GDP figures will be released on Monday which will be important drivers of sentiment to start the week. Doubts about whether China can successfully manage its economic transformation have increased recently.

- Australian and New Zealand Inflation readings will be released next week. Expectations that the Reserve Bank of New Zealand will raise interest rates in coming months has driven the NZD to multi-year highs against the AUD. Interest rate markets are currently pricing in a full 1.0% increase in New Zealand’s benchmark lending rate by October 2014.

USD – Too cold to get a job but warm enough to keep shopping

Last Friday, North American employment data was released revealing the economic cost of the severe winter weather in the region. Both U.S. Non-Farm Payrolls and Canadian employment numbers missed expectations dramatically with 74,000 and -45,900 jobs added, respectively. Market expectations were for U.S. employment growth of around 200,000 and FX positioning reflected this. The surprise figure was a major driver of AUD price action as taper speculators pared their bets. The AUD shot up about 1 US cent on release, continuing gains through to Tuesday to reach a high of 0.9037.

Last Friday, North American employment data was released revealing the economic cost of the severe winter weather in the region. Both U.S. Non-Farm Payrolls and Canadian employment numbers missed expectations dramatically with 74,000 and -45,900 jobs added, respectively. Market expectations were for U.S. employment growth of around 200,000 and FX positioning reflected this. The surprise figure was a major driver of AUD price action as taper speculators pared their bets. The AUD shot up about 1 US cent on release, continuing gains through to Tuesday to reach a high of 0.9037.

By Wednesday morning this week, currency markets had staged a complete reversal driven by better than expected U.S. Retail Sales figures. Core Retail Sales, which excludes automobile sales, grew by 0.7% in December. Speculators rationalising from the mixed results that a seasonal employment set back is not enough to derail the current FOMC taper trajectory.

Early last Thursday the FOMC released the minutes from its December 18th decision to taper its quantitative easing program. The decision to taper asset purchases by 10 billion a month to 75 billion was coupled with a slightly more confident analysis of the economy. Comments on labour market conditions were upgraded from October’s minutes, yet this will likely be stalled given recent developments. Similarly, comments on fiscal policy were upgraded as the committee stated fiscal restraint on economic growth may have begun to diminish. Fed Chairman Ben Bernanke will deliver a speech this Friday.

EUR & GBP

U.K. Inflation data was release last night that showed consumer prices declined by 0.1% to 2.0% in December. On the other hand, producer prices, a forward indicator of consumer prices, increased unexpectedly to 0.1%. The data suggest that inflation remains within the Bank of England’s forward guidance threshold for accommodative policy; the forward guidance states that consumer inflation should not be above 2.5%.

Bank of England Governor Mark Carney will testify before the Financial Stability Report tonight. Bullish rhetoric may prompt GBP strength.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.