Brief Summary:

- Australian employment numbers miss expectations and inflation climbs higher than expected. The AUD declines and performs an almost full reversal in the week.

- The International Monetary Fund upgrade global growth forecasts for the first time in almost two years.

Where now for the RBA?

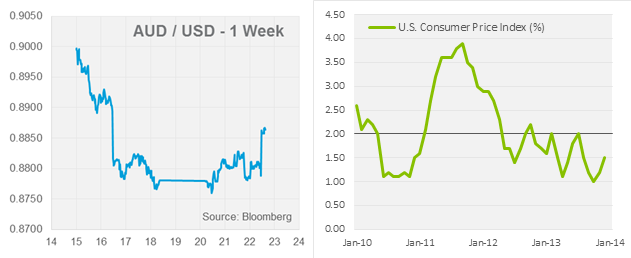

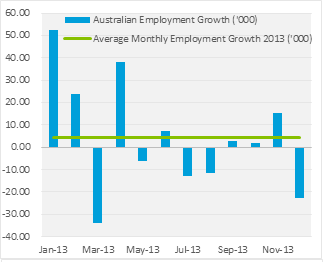

It has been a mixed week for the Australian dollar plunging on weak employment numbers then rebounding on rising inflation. Interest rate and currency markets now price in a lesser chance of further rate cuts in 2014 as the data may place the Reserve Bank of Australia (RBA) between a rock and a hard place.

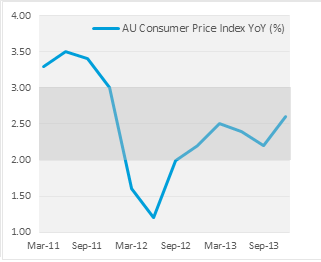

Last Thursday, data showed the Australian labour market continued its decline with 22,600 jobs lost in December. Market expectations were low considering November’s unexpected gains; these gains were fully unwound. The Unemployment Rate was steady at 5.8%, but this was largely due to the Participation Rate, the percentage of the population in the work force, declining by 0.2% to 64.6%. Aggregate monthly hours worked, the amount of hours that employed people worked, continued to increase. This indicator of demand for labour may translate into increased employment going forward. It is likely that the RBA will once again include weak labour market conditions as a major consideration for further easing of monetary policy, however this is where they will run into another problem; inflation.

Last Thursday, data showed the Australian labour market continued its decline with 22,600 jobs lost in December. Market expectations were low considering November’s unexpected gains; these gains were fully unwound. The Unemployment Rate was steady at 5.8%, but this was largely due to the Participation Rate, the percentage of the population in the work force, declining by 0.2% to 64.6%. Aggregate monthly hours worked, the amount of hours that employed people worked, continued to increase. This indicator of demand for labour may translate into increased employment going forward. It is likely that the RBA will once again include weak labour market conditions as a major consideration for further easing of monetary policy, however this is where they will run into another problem; inflation.

Completing the AUD’s big dip was inflation data released this morning. The headline Consumer Price Index (CPI), the main measure of consumer prices and the RBA’s inflation target, unexpectedly increased to 0.8%. The risk of a positive surprise was always known to some. In November, the RBA said, “It was likely that the effect of the exchange rate depreciation earlier in the year was yet to be seen in most tradable consumer prices” and this was the case as we saw falling inflation despite an about 15% fall in the AUD. This delay is largely due to invoicing terms and importers hedging their foreign exchange exposure.

Completing the AUD’s big dip was inflation data released this morning. The headline Consumer Price Index (CPI), the main measure of consumer prices and the RBA’s inflation target, unexpectedly increased to 0.8%. The risk of a positive surprise was always known to some. In November, the RBA said, “It was likely that the effect of the exchange rate depreciation earlier in the year was yet to be seen in most tradable consumer prices” and this was the case as we saw falling inflation despite an about 15% fall in the AUD. This delay is largely due to invoicing terms and importers hedging their foreign exchange exposure.

The most important words in the RBA’s current monetary policy stance are “consistent with the inflation target”. The RBA’s inflation target band can be seen above between 2-3%. The target refers to the medium-term average rather imposing a strict bound. However, the fact that we see inflation moving above the mid-point of this band means it may restrict the board’s ability to deliver further rate cuts. It is likely we will see an increased emphasis on inflation in the next statement on monetary policy due on the 7th of February.

Please see below for specific currency commentary.

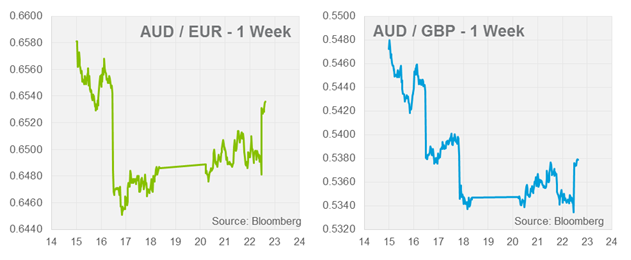

USD

Last Friday, the U.S. released consumer inflation data. The figured showed continued to be subdued at 0.1% for the month and 1.5% annualised. There was little reaction in markets though commentators like Bill Gross of PIMCO believes this number deserves more attention. He points out in his January investment outlook that inflation is one of three pillars of Fed policy – the others being economic growth and unemployment. It is clearly disclosed in the Fed’s statements that they will “Maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal”. We may see the inflation figure draw more attention as the other metrics such as unemployment nears the target.

EUR & GBP

The International Monetary Fund was the latest to express concerns that the Euro area continued to carry a high risk of deflation in its latest global outlook. They state that low inflation expectations increase real debt burdens which poses increased risk of non-performing loans. The regions troubled banks are already a problem and the situation risks descending into a Japan style decade of stagnation. On the plus side, the IMF did upgrade global growth forecasts for the first time in almost two-years.

The U.K. will release its Unemployment numbers tonight and the minutes of its latest monetary policy meeting.

By Chris Chandler