Brief Summary:

- Financial markets were volatile this week as risk sentiment took a multifaceted battering. Emerging market currencies were pummelled prompting the Turkish Central Bank to raise its benchmark interest rate significantly. The U.S. stock market also recorded its worst weekly performance, ending Friday 24th, since June 2012.

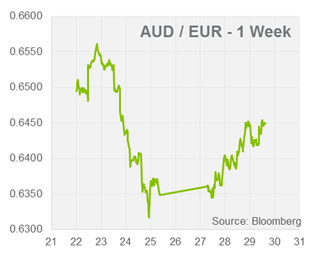

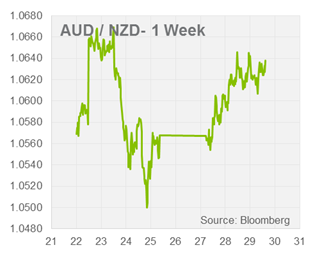

- The AUD fell sharply on Friday afternoon as new headlines surfaced that a Chinese investment trust issued by the shadow banking sector was bankrupt. Chinese authorities have since announced they will bail-out investors.

- The week ahead for Australia will see the Reserve Bank of Australia meeting for its first monetary policy decision of 2014; no change is expected. Building Approvals, Retail Sales and Trade Balance figure will also be released.

- The U.S. Federal Open Market Committee is expected to taper a further $10 billion per month in asset purchases from its quantitative easing program tonight.

Chinese Shadow Banking Jitters

At 3:45pm a headline flashed across traders’ screens that sent the AUD into a freefall. “China Bank Regulator Said to Issue Alert on Loans to Coal Miners” were the words that struck fear into markets that have been increasingly worried about China’s stressed shadow banking system. The American stock market went on to lose about 2.0%, catalysed by concerns over other emerging markets. We reported a few weeks ago that George Soros, a prominent investor, expressed his concerns over unsustainable and bad debts in China’s financial system. Soros stated, “There are some eerie resemblances with the financial conditions that prevailed in the U.S. in the years preceding the crash of 2008”, namely, the repackaging of debts into investment products in order to make them appear better than reality. The product now in the lurch were loans to a coal mining company packaged into the “2010 China Credit / Credit Equals Gold #1 Collective Trust Product”. The trust offered above benchmark returns and has a name as charming as “AAA rated collateralised debt obligation”, the toxic assets that begat the financial crisis.

Yesterday, Bloomberg reported that the Chinese government would bail-out the failed trust, avoiding “A Lehman moment”; in reference to the Federal Reserve’s September 2008 decision to allow Lehman Brothers to collapse which is widely regarded as the beginning of the financial crisis. Perhaps slightly sensational, the trust default is only worth USD 500 million and its investors almost exclusively wealthy Chinese. Lehman was the largest corporate bankruptcy in American history.

China’s shadow banking system remains a salient ‘known unknown’, as Donald Rumsfeld once put it, with the potential to cause widespread financial instability. Chinese authorities must walk a careful line in responding to defaults of this nature. If they too readily bail-out troubled investors, the safety net could foster further irresponsible lending. On the other hand, too little support may cause an actual “Lehman moment” and a possible collapse. Friday’s volatility was a gentle hint of the implications for the AUD should such a scenario eventuate. We can only hope the Chinese learnt from American mistakes of 2008.

Please see below for specific currency commentary.

USD

The U.S. Federal Open Market Committee will meet tonight and announce their monetary policy decision at 6:00am AEST tomorrow morning. Market expectations are for the pace of asset purchases, currently $75 billion per month, to be reduced to $65 billion per month. It is also expected that the committee maintain their forward guidance of ultra-low rates until unemployment is below 6.5% and inflation above 2.0%.

On Friday, U.S. fourth quarter GDP growth will be released. Expectations are for a 3.3% annualised expansion in the economy. Severe winter weather hampered employment growth in the fourth quarter, however other data like retail sales were stronger than expected.

EUR & GBP

The Eurozone will release its January Consumer Price Index, the main measure of inflation, on Friday night. The annualised figure was a lacklustre 0.8% in December, prompting many market commentators to warn that deflation is now a major threat to the region’s economy. Deflation occurs when inflation becomes so low that consumers foresee prices decreasing in future and therefore delay spending. This results in a cycle of declining spending, prices and therefore earnings, stagnating growth. If inflation continues to run at extremely low levels, the European Central Bank may be forced to undertake further monetary stimulus which may weaken the EUR. Eurozone Unemployment will also be released that night, it is expected to be steady at 12.1%.

The Eurozone will release its January Consumer Price Index, the main measure of inflation, on Friday night. The annualised figure was a lacklustre 0.8% in December, prompting many market commentators to warn that deflation is now a major threat to the region’s economy. Deflation occurs when inflation becomes so low that consumers foresee prices decreasing in future and therefore delay spending. This results in a cycle of declining spending, prices and therefore earnings, stagnating growth. If inflation continues to run at extremely low levels, the European Central Bank may be forced to undertake further monetary stimulus which may weaken the EUR. Eurozone Unemployment will also be released that night, it is expected to be steady at 12.1%.

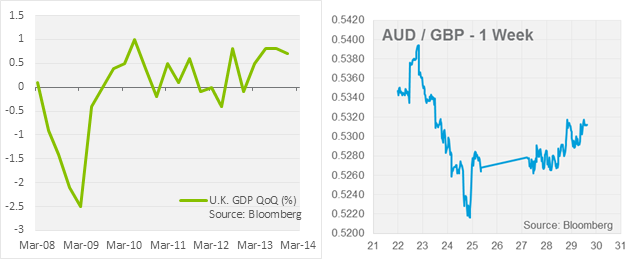

After a shaky few years the U.K. economy confirmed on Tuesday that it is in a genuine recovery. Gross domestic product, the broadest measure of economic growth, was 0.7% in the fourth quarter of 2013 first estimate; in line with market expectations. Overall, GDP remains 1.3% below its peak in 2008, however the economy has now posted 12 months of consecutive gains. Bank of England Governor Mark Carney will speak tonight at 11:15pm AEST. The market will be looking for commentary on these growth figures in anticipating the Bank’s next moves.

NZD

The Reserve Bank of New Zealand will meet tomorrow morning for its monetary policy decision. The decision will be delivered at 7:00am AEST and market consensus is for no change at 2.50%. The Bank stated in October that “OCR [Overnight Cash Rate] increases will likely be required next year”. Consumer Inflation is currently running at 1.6% for the year, below the 2.0% target. This paints the scene for the board to hold off an increase for now, especially given the undesired currency appreciation that may accompany it. The market is currently pricing at 25 basis point increase in March.

The Reserve Bank of New Zealand will meet tomorrow morning for its monetary policy decision. The decision will be delivered at 7:00am AEST and market consensus is for no change at 2.50%. The Bank stated in October that “OCR [Overnight Cash Rate] increases will likely be required next year”. Consumer Inflation is currently running at 1.6% for the year, below the 2.0% target. This paints the scene for the board to hold off an increase for now, especially given the undesired currency appreciation that may accompany it. The market is currently pricing at 25 basis point increase in March.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.