Brief Summary:

- The Reserve Bank of Australia holds interest rates at 2.50% and indicates no further rate cuts in the near-term.

- The U.S. Federal Open Market Committee taper an additional $10 billion from its quantitative easing program.

- Currency crises continue in selected emerging markets; namely Turkey and Argentina. Negative sentiment from these isolated cases threaten to spread to other markets and comparisons have been made to the emerging market crisis of 1997. Optimists maintain that the examples mentioned have poor fundamentals, political upheaval in Turkey and poor economic management in Argentina, and thus the sell-off is warranted. Other emerging markets, by comparison, are nowhere near as indebted as 1997 and have far stronger fundamentals which should halt contagion.

Central banks – the end of the RBA cutting cycle

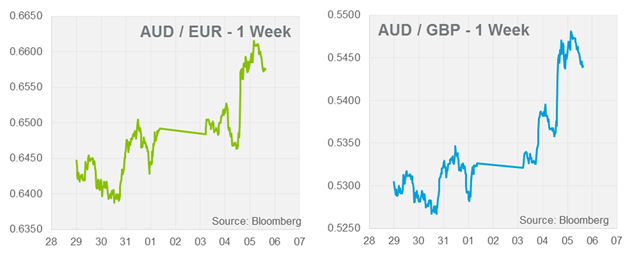

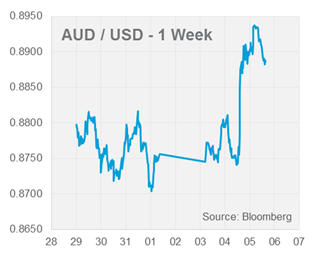

The AUD rallied against most currencies yesterday as the Reserve Bank of Australia held the cash rate at 2.50% and firmly stated no cuts would follow in the near-term. The concluding paragraph stated, “Monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target. On present indications, the most prudent course is likely to be a period of stability in interest rates.” This hawkish extra step surprised currency markets which were widely expecting just the removal of the easing bias. The statement shows the board’s concerns over both higher than expected inflation and the continued weak labour market. They forecast the unemployment rate ticking higher still, however, their hands seems tied as far as rate cuts go.

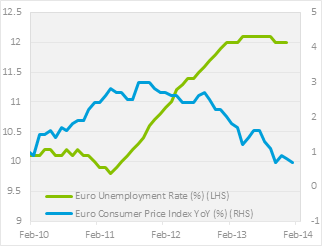

Later this week the European Central Bank (ECB) will hold its monthly monetary policy meeting. Last Friday, Euro area inflation again fell to its lowest level since the financial crisis at 0.7% YoY. The unemployment rate was slightly lower than expected but remained at record high levels of 12.0%. This may prompt the ECB to take further action to stimulate demand, however, its options are severely limited. The benchmark rate is 0.25%, approaching the dreaded zero bound, however, no further cut is expected. U.S. Fed style quantitative easing is not a viable option for the ECB and the risk is that Japanese style deflation becomes a serious problem in the region.

Later this week the European Central Bank (ECB) will hold its monthly monetary policy meeting. Last Friday, Euro area inflation again fell to its lowest level since the financial crisis at 0.7% YoY. The unemployment rate was slightly lower than expected but remained at record high levels of 12.0%. This may prompt the ECB to take further action to stimulate demand, however, its options are severely limited. The benchmark rate is 0.25%, approaching the dreaded zero bound, however, no further cut is expected. U.S. Fed style quantitative easing is not a viable option for the ECB and the risk is that Japanese style deflation becomes a serious problem in the region.

Across the channel, the Bank of England (BoE) is facing the opposite problem. During the period of ultra-low global interest rates, many central banks started issuing a forward guidance. This supplement to the monetary policy statement, declared the bank’s outlook and thresholds for changes to monetary policy. Most of the thresholds have set desired levels of unemployment and inflation in an economy.After following this global trend, the Bank of England have found they were too bearish in their outlook and their unemployment threshold has almost been reached two years early. Their forward guidance states an unemployment threshold of 7.0% which it now stands at 7.1%.

This has caused the GBP to rally and the guidance, which was meant to smooth market reactions, has actually fuelled volatility. With the guidance assumed unreliable, the currency reacts sharply to Mark Carney’s comments; which lately, have been to assure that interest rates won’t be raised. The poor management of this tool has implications for the recovery, the rapidly appreciating Pound makes life harder for exporters which may drag on growth. The BoE will meet just before the ECB on Thursday night.

USD

Early last Wednesday, the Federal Open Market Committee tapered another $10 billion per month from its quantitative easing program to $65 billion per month. At this pace, tapering will be finished in December and the committee maintains interest rates will remain at zero for an extended period.

Early last Wednesday, the Federal Open Market Committee tapered another $10 billion per month from its quantitative easing program to $65 billion per month. At this pace, tapering will be finished in December and the committee maintains interest rates will remain at zero for an extended period.

U.S. fourth quarter GDP was released on Friday. The data showed the economy growing by 3.2%, just shy of the 3.3% expected. This Friday, U.S. employment data will be released for January. Last month’s figure was well below expectations due to severe winter weather. It is possible that the cold caused disruptions again in January, however, market expectations are for 184,000 new jobs; we may also see an upward revision of last month’s figure.

EUR & GBP

NZD

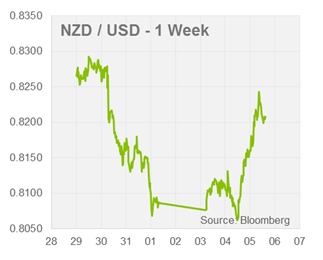

The Reserve Bank of New Zealand decided to hold interest rates at 2.50% last Thursday. Currency markets were positioned for a possible rise and the NZD depreciated on the decision. In our view, a rise was unlikely as inflation is below the 2.0% target at 1.6% and the bank prefer to stem unwarranted currency appreciation. Currently, a 0.25% cut is priced in for March, however, this is before the next inflation reading.

The Reserve Bank of New Zealand decided to hold interest rates at 2.50% last Thursday. Currency markets were positioned for a possible rise and the NZD depreciated on the decision. In our view, a rise was unlikely as inflation is below the 2.0% target at 1.6% and the bank prefer to stem unwarranted currency appreciation. Currently, a 0.25% cut is priced in for March, however, this is before the next inflation reading.

Quarterly employment data was released this morning showing continued labour market strength in New Zealand. Employment grew by 1.1% after only 0.6% was expected. The Labour Cost Index, a measure of wage growth, also increased by 0.6% after 0.5% was expected. Wage growth leads to inflation but it will have to climb over 2.0% to justify a monetary reaction. The RBNZ has indicated it will raise rates, however, we believe it will be more gradual than the market is expecting.

By Chris Chandler