Brief Summary:

- The AUD enjoys its strongest weekly performance of 2014 buoyed by a mixture of improved global sentiment and surprise domestic data. The next hurdle will be January employment numbers released tomorrow at 11:30am which has the potential to break the rally. Australian employment growth has been stagnant for months, however, RBA policy options are constrained.

- Fears over emerging market growth subside

- Severe winter weather in the U.S. results in another lacklustre employment number yet the Fed declare they will maintain the current tapering trajectory.

Australian data surprises

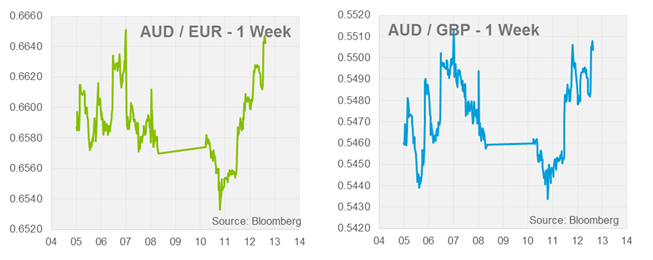

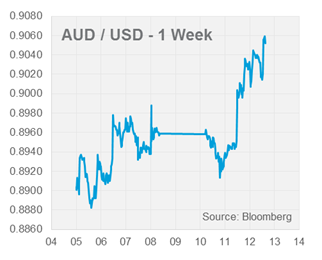

The AUD has enjoyed a run of surprise positive data releases this week which has helped it climb to a four week high. Improved global sentiment has paved the way for the rally as fears over emerging market growth have subsided. Reports of the tumult began in Argentina, where the peso has fallen 19% this year, followed by Turkey and Thailand, where political upheaval is brewing, further stoked by China’s shadow banking problems. Cool heads maintained that problems in selected emerging markets need not result in a wider crisis and this view seems to have prevailed.

Data wise, the first positive came with Australia’s December Trade Balance released last Thursday. The data showed a $470 million surplus largely driven by increases in soft and hard commodity exports. Sticking with trade numbers, China also surprised markets today posting a $31.9 billion surplus after $24.2 billion was expected. Chinese imports grew by 10.0% YoY in January, obviously some Australian exports were in the mix. The figures supported the AUD at 0.9050 against the USD.

Yesterday, data normally viewed as second tier even played their part. The House Price Index released at 11:30am showed prices increasing by 3.4% nationally, while NAB’s business confidence index edged higher to 8. The numbers pushed the AUD above 0.9000 for the first time since January.

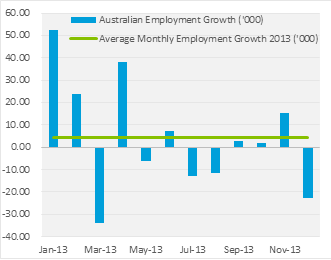

Tomorrow at 11:30am, Australian employment data will be released for January. The Australian economy has seen net jobs lost since July 2013; December reversing more than November’s gains. The market is optimistic looking for a 15,300 gain in January. It is possible that the New Year will bring a fresh stream of recruits, however, the trend of stagnant employment growth looks likely to persist in the longer term. Car manufacturers, most recently Toyota, have recently signalled that they will end production in Australia, however, there is little that can be done to halt the decline in Australian manufacturing.

Tomorrow at 11:30am, Australian employment data will be released for January. The Australian economy has seen net jobs lost since July 2013; December reversing more than November’s gains. The market is optimistic looking for a 15,300 gain in January. It is possible that the New Year will bring a fresh stream of recruits, however, the trend of stagnant employment growth looks likely to persist in the longer term. Car manufacturers, most recently Toyota, have recently signalled that they will end production in Australia, however, there is little that can be done to halt the decline in Australian manufacturing.

Given the inflation outlook, even a poor employment figure may have a limited monetary policy response. The Reserve Bank must primarily combat inflation which is currently running toward the top end of the target 2-3% range. As such, interest rate markets are currently pricing no further cuts to the cash rate in 2014. The minutes of the latest monetary policy decision will be released on Tuesday at 11:30am.

USD

Chairwoman of the U.S. Federal Reserve Janet Yellen testified to the U.S. Senate last night delivering the Semi-annual Monetary Policy Report. As expected, there was no new information delivered and she declared the Fed would continue on its course of tapering despite two months of lacklustre employment growth.

Chairwoman of the U.S. Federal Reserve Janet Yellen testified to the U.S. Senate last night delivering the Semi-annual Monetary Policy Report. As expected, there was no new information delivered and she declared the Fed would continue on its course of tapering despite two months of lacklustre employment growth.

Last Friday, U.S. employment numbers were released that, for the second month in a row, reflected severe winter weather conditions in the region. 113,000 jobs were added after 185,000 were expected. Winter weather has indeed been severe, blamed on the polar vortex, one would expect job growth to accelerate as spring arrives.

EUR & GBP

Last Thursday, the European Central Bank (ECB) made no change to monetary policy and maintained its forward guidance of “key ECB interest rates to remain at present or lower levels for an extended period of time”. Answering questions, Mario Draghi, stated that it would take some time for the November 0.25% rate cut to have its full effects. He specifically noted that the deleveraging of households and corporations delays the transmission of monetary policy.

The Bank of England (BoE) will deliver its quarterly inflation report tonight. Markets are anxious to know what the next steps are for the BoE’s forward guidance. The guidance has lost its credibility recently as the unemployment rate has reached their target two year ahead of schedule. The Bank have maintained they will not raise rates soon, however, with less clear objectives, markets are now unsure exactly what will trigger a rate increase and when this may occur.

By Chris Chandler