Brief Summary:

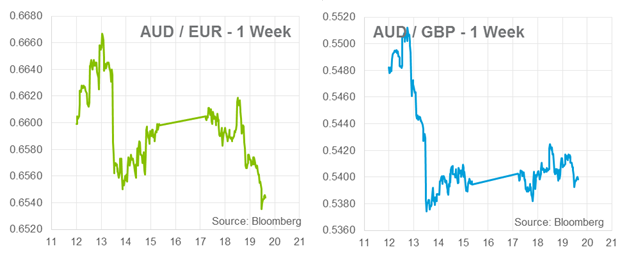

- The AUD was buoyant this week as the Reserve Bank of Australia reinforced its pledge for a period of interest rate stability.

- The U.S. Federal Open Market Committee will release the minutes from its latest monetary policy decision tomorrow morning.

- The GBP rallies as the Bank of England change its monetary policy forward guidance to include a broader range of economic indicators. The Monetary Policy Committee have been criticised for setting an unemployment rate threshold that has almost been reached two years early.

RBA’s next rate move could be up

Yesterday, the Reserve Bank of Australia released the minutes from its February monetary policy meeting. The decision to hold was backed up by a forward guidance that interest rates would be on hold in the near-term. The minutes contained some significant changes from last month, however, they are mostly borrow from the Monetary Policy Statement released on February 7th.

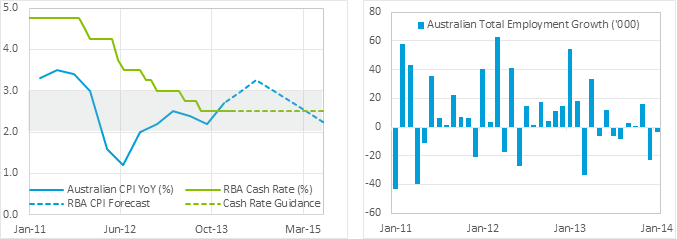

They predict (shown above) a period of higher inflation in the near term with headline inflation forecast to breach the upper bound of the RBA’s comfortable band, 3.0%, by June 2014. After this peak they see inflation falling back to normal levels by 2015. Two carbon price scenarios are seen to reduce inflation in the latter part of the year. The move to a floating carbon price will reduce the cost of carbon significantly, subduing inflation, or the Liberal government’s plan to scrap the carbon tax will reduce inflation even further.

The board forecast continued sluggishness in the labour market. The latest uninspiring figure was released last Thursday, showing another 3,700 jobs were lost in January. The figure places job growth in the last twelve months at just 1,300. The demographic decline in the participation rate, the percentage of the population in the work force, has slowed the increase in the unemployment rate. The board noted that in the last few years, about half of the participation rate decline has been due to the retirement of older workers.

The board expect GDP growth to pick back up above trend in 2016. Their firm stance against further rate cuts and the elevated inflation forecast suggests their next rate move will be upward. As a result, domestic data, even if weak, will have a lesser impact on the AUD. This was evident last week where the negative employment figure was shrugged off by currency markets. AUDUSD fell over a percent on release and then recovered to its pre-release level the day after. So long as inflation remains high, the RBA’s hands are tied.

USD

The U.S. was mostly closed on Monday as Presidents’ Day was observed.

On Friday, Retail Sales missed expectations losing 0.4% in January and adding to a raft of U.S. data that has been derailed by severe winter weather.

Tonight, the U.S. Federal Open Market Committee will released the minutes from its most recent monetary policy decision. Commentators have been questioning whether two months of disappointing data have in fact been the result of severe winter weather or an underlying slow-down. The market will analyse whether more committee members object to the current trajectory of tapering. In December, Eric Rosengren voted against the taper on the grounds that inflation was still too low. Janet Yellen, Federal Reserve Chairwoman, will testify before the senate again this Friday.

Tonight, the U.S. Federal Open Market Committee will released the minutes from its most recent monetary policy decision. Commentators have been questioning whether two months of disappointing data have in fact been the result of severe winter weather or an underlying slow-down. The market will analyse whether more committee members object to the current trajectory of tapering. In December, Eric Rosengren voted against the taper on the grounds that inflation was still too low. Janet Yellen, Federal Reserve Chairwoman, will testify before the senate again this Friday.

EUR & GBP

Last Wednesday, the Bank of England sought to provide some much needed clarity on its monetary policy forward guidance. The forward guidance, introduced last year, stated that an unemployment rate of 7.0% would be a threshold for an interest rate rise. With unemployment most recently measured at 7.1%, two year ahead of schedule, markets have become uncertain over what this so called threshold actually means.

Rather than scrap the guidance, the Monetary Policy Committee have added some extra, currently unsatisfied, conditions. Whether it has cleared or muddied the water further is up for debate. A rate rise will now require ‘spare capacity’ in the economy to be used up; whatever that means. Simply, ‘spare capacity’ is the room for GDP growth without fuelling inflation; so GDP and inflation will be important going forward. The improvement of other labour market measures will also be required; such as, the participation rate, average hours worked and wage growth. Despite the apparent rigmarole that the forward guidance has become, its desired effect of stoking confidence by convincing businesses and markets that interest rates would remain low has been achieved.

The MPC reiterated that any rate rises will be gradual and the economy still faces significant headwinds. Currency markets saw this as GBP positive and the currency rallied. GBPUSD gained over 2.0% from the release to Monday’s high, GBPAUD also outperformed other major crosses. U.K unemployment numbers will be released tonight at 20:30 AEST.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.