Brief Summary:

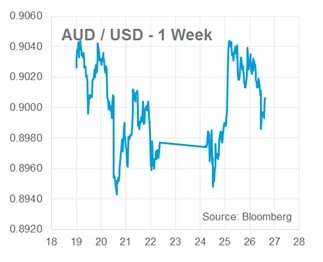

- A worse than expected Chinese manufacturing index failed to leave an impression on the AUD which remains supported around the 0.9000 level.

- Australian Private Capital Expenditure will be release tomorrow at 11:30am AEST. The release will detail industry investment levels in the last quarter of 2013.

- The U.S. Federal Open Market Committee reiterate the current trajectory of quantitative easing tapering at $10 billion per month. Committee members acknowledged that severe winter weather has hampered growth but do not see it reflecting underlying weakness.

AUD well supported at 0.9000

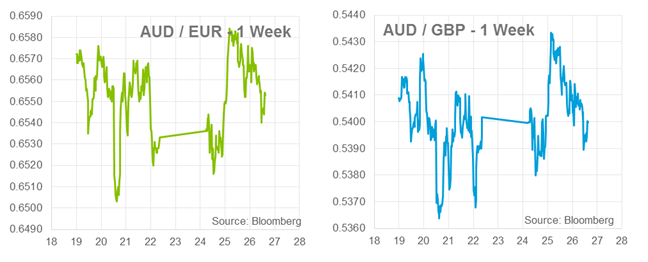

The AUD has been well supported in February, hovering around the 0.9000 level despite a flurry of negative data releases. The support stems from the Reserve Bank of Australia’s change in monetary stance to a period of stable interest rates. Dismal local employment numbers and poor Chinese data have been shrugged off by currency markets. The increased certainty of the pace of U.S. quantitative easing tapering has allowed carry trades in AUD to rebuild and volatility to decline. Given this outlook, a period of range bound trading may characterise the near term.

Last Thursday the HSBC Flash Manufacturing PMI, a monthly survey of Chinese manufacturers, read 48.3 in February; indicating worst contraction in seven months. The survey show prices or inputs and outputs declining which according to HSBC, “disinflationary pressures implies that the underlying momentum for manufacturing growth could be weakening”. The AUD fell sharply, albeit temporarily, on this grim outlook as a weaker China reduces demand for Australian imports. However, from a monetary policy perspective, a slowing China will not prompt further rate cuts. Current inflation forecasts, as a result of currency depreciation, mean the RBA cannot cut rates further in the near-term. Negative Chinese sentiment is negative for the AUD, however, this will only further exacerbate inflation.

Tomorrow, the Australian Bureau of Statistics will release the Private Capital Expenditure for the fourth quarter of 2013. Expectations are for a headline figure of -1.0%, however, the industry specific numbers are the most important factors in this release. Mining investment made a surprise gain in the third quarter of 2013 despite expectations of a decline. BHP, the world’s largest miner and a simple bellwether for the industry, last week reported a 28% decline in capital expenditure in the second half of 2013. It is likely that this downturn will be recorded in this release. Importantly, other selected industries recorded a sharp uptick in investment in the last release. In our view, markets will be primarily looking to see this trend extended as the Australian economy makes the shift away from mining led investment. Declining mining investment is expected and an increase or flat result can be seen as a positive.

Please see below for specific currency commentary.

USD

Last Thursday, the U.S. Federal Open Market Committee (FOMC) released the minutes from its January 28-29 monetary policy meeting. The market was keen to see if recent lacklustre employment numbers would receive much attention from committee members; it didn’t, “A number of participants indicated that the December payrolls figure may have been an anomaly, perhaps importantly reflecting bad weather”. Unconvinced that underlying weakness was present, the linearity of asset purchase reduction was reiterated at $10 billion per month; now $65 billion. With the program currently at $65 billion, tapering will be finished by year end.

Last Thursday, the U.S. Federal Open Market Committee (FOMC) released the minutes from its January 28-29 monetary policy meeting. The market was keen to see if recent lacklustre employment numbers would receive much attention from committee members; it didn’t, “A number of participants indicated that the December payrolls figure may have been an anomaly, perhaps importantly reflecting bad weather”. Unconvinced that underlying weakness was present, the linearity of asset purchase reduction was reiterated at $10 billion per month; now $65 billion. With the program currently at $65 billion, tapering will be finished by year end.

The committee also took steps to avoid Bank of England style forward guidance confusion. With the unemployment rate approaching the 6.5% target, currently 6.6%, “The Committee decided to repeat the qualitative guidance, introduced in December, clarifying that a range of labor market indicators would be used when assessing the appropriate stance of policy once the unemployment rate threshold had been crossed.” These alternative measures may include the numbers of long-term unemployed and people working part-time for economic reasons; both have been elevated post-crisis.

EUR & GBP

U.K. employment data missed the mark for the first time in ten months with the unemployment rate ticking up to 7.2% unexpectedly. The Bank of England have been under pressure over their forward guidance threshold for unemployment almost being met. The give up may slightly temper expectations of an early interest rate rise but the strength of the Pound was hardly affected.

The Eurozone Consumer Price Index will be release on Friday. The figure is at dangerously low levels of 0.7% YoY. Andrew Bosomworth of PIMCO, on of the world’s largest bond managers, is the latest commentator to voice concerns over low inflation in the Eurozone. PIMCO’s inflation forecasts for the zone are for more downside risk than those of the European Central Bank and they warn that a lack of action may cause inflation expectations to be permanently shifted lower than the desired 2.0%.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.