Brief Summary:

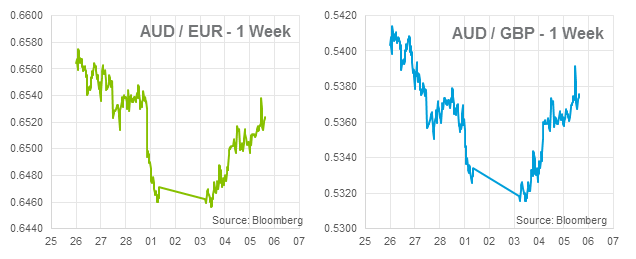

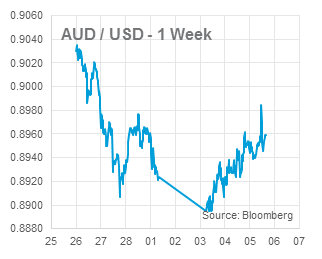

- Russia attempts to protect its interests in the Ukraine by mobilising its military. In particular, Russia is looking to secure the mostly Pro-Russian region of Crimea where its Black Sea naval fleet is based. The fear of a conflict caused investors to reduce risky assets in favour of safe havens. Russia have since eased the strength of their rhetoric and assets markets have recovered.

- Yesterday, the Reserve Bank of Australia made no change to the cash rate (2.50%) and reiterated its neutral stance on further rate cuts.

Resilient growth in 2013

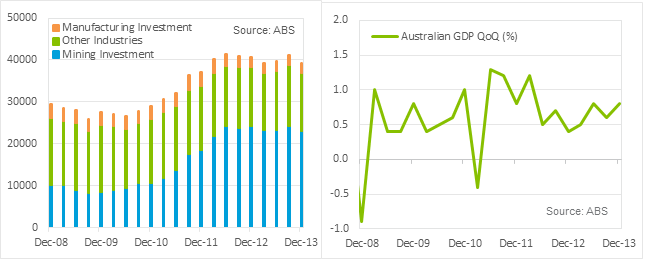

Two key pieces of Australian data were released this week that confirmed the economy was resilient in the latter part of 2013. The data show that the softer AUD is indeed playing an important role supporting the economy. It also shows that the transformation away from mining investment has begun, however, the pick-up of the rest of the economy has been lacklustre.

Last Thursday, Private Capital Expenditure detailed forecast and actual industry investment. The headline figure was -5.2% which caused an initial AUD sell off. Actual mining investment declined by 5.5% as anticipated, however, other selected industries also declined by 4.4% unexpectedly. The decline of other industries is most worrying as it signals weak future growth of the non-mining economy.

The RBA expect the decline in mining investment to be coupled with a pick-up in other sectors. The second part of the release details forecast investment for 2014-15. The forecasts thus far confirm the continued slow-down in mining, however, the other industries forecast no increase from 2013 levels.

GDP numbers for the same period were released today at 11:30am. The headline figure beat expectations with quarterly growth of 0.8%, up from 0.6% in the previous period. GDP amalgamates the performance of the entire economy. The data showed weaker private sector investment caused a 0.5% drag on growth. On the plus side, exports grew significantly from last measure as a result of the lower AUD; contributing 0.6% to growth. It should be noted that GDP is a fairly backward looking indicator and thus its impact on the AUD was limited.

Ukraine

It was a tense start to the week on Monday after Russia took steps to exert its authority in the power vacuum left by the overthrown Ukrainian government. The Russian parliament authorised the mobilisation of troops into the Ukraine and the Ukraine hit back saying such action would be an act of war.

Albeit temporarily, financial markets felt the grip of Vladimir Putin. The AUD opened almost a percent down from Friday and the Russian Ruble (RUB) fell to an all-time low against the USD. Likewise, stock markets fell and safe haven assets, such as gold, rallied. The oil price also spiked on the prospect that Russian supplies, a significant share of the world, would be disrupted by sanctions.

Yesterday afternoon, the headline “Putin orders troops in military exercise back to base” brought relief to markets. Risks still remain, however, the Crimea region at the centre of the dispute will hold a referendum on its political status on the 30th of March. Putin has left the door open to military action should it be needed; for example, should the vote go against him.

Rest of the World

The U.S. will release employment numbers this Friday. The last two months have seen weak employment growth blamed on severe winter weather. Markets will be looking to see if this trend continued in February which may indicate underlying weakness. Expectations are for 151,000 jobs added in February. In general, 200,000 jobs is seen as a strong monthly print.

The U.S. will release employment numbers this Friday. The last two months have seen weak employment growth blamed on severe winter weather. Markets will be looking to see if this trend continued in February which may indicate underlying weakness. Expectations are for 151,000 jobs added in February. In general, 200,000 jobs is seen as a strong monthly print.

The European Central Bank and Bank of England will hold their monetary policy meetings on Thursday night. No change in their respective policies is expected.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.