Brief Summary:

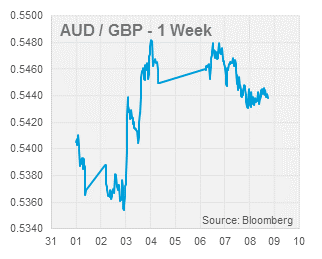

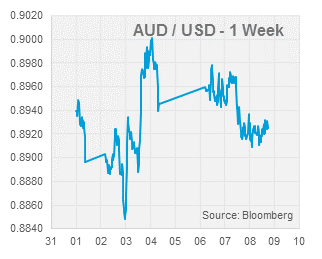

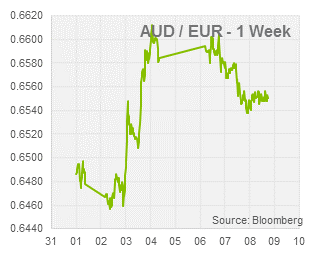

- Commodity currencies, namely the AUD and CAD, declined this week as the market braces for U.S. employment data on Friday. The FOMC will begin tapering its quantitative easing program this month, however, strong employment numbers may accelerate this taper. The minutes of December’s FOMC decision to taper will be release tomorrow morning at 6am.

- Key Australian data will be released tomorrow at 11:30am. Building Approvals are expected to decline seasonally by 0.9% whilst Retail Sales are expected to have grown by 0.5% leading up to Christmas.

Themes for 2014

The most important theme of this year will be the recovery of the world’s developed economies and the return to a monetary stimulus free world. Most importantly, in the U.S., the long awaited tapering of quantitative easing will begin on the 25th January at the next Federal Open Market Committee meeting as announced on the 18th of December. The minutes of this meeting will be released early tomorrow morning which may reveal more about the future trajectory of tapering. Uncertainty and market volatility will likely arise with speculation that the pace of tapering may increase. So far, the FOMC’s tapering action has been more gentle than expected and as a result stock markets have continued to rally and currency markets have been relatively stable. For Australians, the tapering process will result in a further depreciation of the AUD which will be important for the rebalancing of the economy. As we have seen previously, the biggest driver of volatility in the AUD is volatility itself. If the Fed once again let their forward guidance become ambiguous, watch the volatility return and hold on for the ride.

On the other side of the Atlantic, the U.K. recovery has continued to gain momentum and at some point this year the Bank of England will be a position to remove its own version of quantitative easing.

Further east, the European Union continues to stagnate and many commentators expect further action to be required to prevent deflation in the region. As of last night’s Euro area CPI release, the main consumer price measure, inflation is just 0.8% per annum; the all-time low is 0.7% set in October. This figure is well below the 2.0% target set by the European Central Bank (ECB) and many are calling for the bank to undertake further stimulatory action. The problem is the ECB are at an impasse of policy options. It could cut its benchmark interest rate further from 0.25% but this has obvious limitations. Beyond this it could start levying negative interest rates, charging banks to hold deposits with it. This, however, rather than encourage lending it may simply prompt banks to increase their rates and profit margin to offset the cost, leading to the opposite effect. Quantitative easing is the other option, however it too has roadblocks. Firstly, there are no Euro Area bonds for the ECB to buy as there are U.S. treasury bonds for the Fed to buy. Secondly, German officials oppose such measures due to significant legal hurdles and the tying together of monetary and fiscal policies required. While the peak of the Euro area crisis has passed, the potential for years of economic stagnation continue to be a threat.

Concerns have been growing that China may be headed for a financial crisis. Legendary investor George Soros, who has been consistently been bearish on China, reiterated his sentiments in a recent column. He stated, “The major uncertainty facing the world today is not the euro but the future direction of China. The growth model responsible for its rapid rise has run out of steam.” High levels of debt financing a cited as a potential problem that has reared its head several times in the last twelve months; most recently around Christmas time. The Peoples’ Bank of China were forced to inject liquidity into money markets as interbank borrowing costs soared. Rising borrowing costs may force overburdened borrowers to default on loans in an economy where, according to Bloomberg’s Patrick Chovanec, bad debts are already rife. The strong export links between Australia and China mean that such crises pose a threat to the Australian economy. If such events unfold the AUD may be in for a volatile year.

Please see below for specific currency commentary.

USD

U.S. Non-Farm Payrolls, the monthly measure of employment growth, will be released on Friday. Market expectations are for 194,000 new jobs in December. The Unemployment Rate is expected to be steady at 7.0%.

U.S. Non-Farm Payrolls, the monthly measure of employment growth, will be released on Friday. Market expectations are for 194,000 new jobs in December. The Unemployment Rate is expected to be steady at 7.0%.

EUR & GBP

The European Central Bank and Bank of England will hold their first monetary policy decisions of 2014 on Thursday night. No change to either bank’s policy is expected however the ECB may react to another worryingly low inflation reading.

The European Central Bank and Bank of England will hold their first monetary policy decisions of 2014 on Thursday night. No change to either bank’s policy is expected however the ECB may react to another worryingly low inflation reading.

By Chris Chandler