Brief Summary:

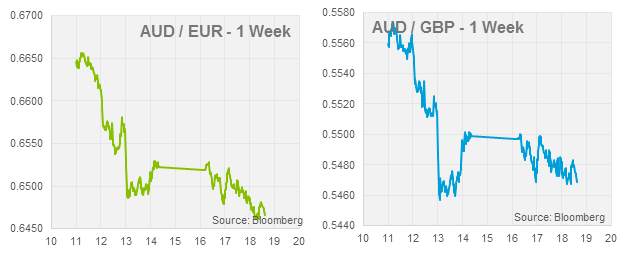

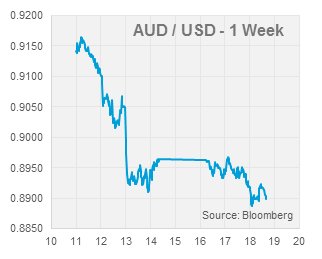

- The U.S. Federal Open Market Committee will deliver its December monetary policy decision at 6am AEST tomorrow morning. The decision is the focus of markets with uncertainty over the possible outcomes. The AUD has continued to sell off ahead of the decision which may provide headroom for a positive move in the wake of a ‘no-taper’ decision.

A higher RBA rate cut hurdle

Reserve Bank of Australia governor Glenn Stevens address the market twice this week firstly through the December monetary policy meeting minutes and secondly at the House of Representatives Standing Committee on Economics. Aside from the usual negative spin on the currency, the rhetoric delivered no new information or change in outlook.

The minutes were almost a carbon copy last month’s, retaining the boards neutral positioning toward further rate cuts. If anything, the minutes suggest that the hurdle to trigger a further rate cut is now set higher than a couple months earlier. The board mentioned the considerable strengthening of the housing market and noted that further effects were expected.

Further pointers to the board’s intention not to deliver another cut were apparent in today’s speech. “At this point, however, there are few serious claims that the cost of borrowing per se is holding back growth”, Stevens said. Commenting on the broader outlook of the Australian economy, however, he suggested that unfamiliar tough times lie ahead, “It is hard to escape the feeling that we as a society have tended, for quite a long time now, to go about our decisions on such matters while making the assumption, perhaps without realising it, that solid growth of the economy will simply continue”. He went on to assert that the legislature needs to ensure policy decisions promote growth and productivity

USD

Early tomorrow morning at 06:00 AEST, the Federal Open Market Committee will meet for their December monetary policy decision. ‘Dec-taper’, a scaling back of the Fed’s $85 billion per month asset purchase program, is priced into markets at about 30% according to Citibank currency strategy. Most market surveys show expectations of the first taper weighted to begin in January or March. Given this expectation there is room for a surprise reaction either way. What will be most salient is the rhetoric of the statement and press conference.

Early tomorrow morning at 06:00 AEST, the Federal Open Market Committee will meet for their December monetary policy decision. ‘Dec-taper’, a scaling back of the Fed’s $85 billion per month asset purchase program, is priced into markets at about 30% according to Citibank currency strategy. Most market surveys show expectations of the first taper weighted to begin in January or March. Given this expectation there is room for a surprise reaction either way. What will be most salient is the rhetoric of the statement and press conference.

The two most likely outcomes expected by the market are for no taper and a dovish statement or a slight taper and a dovish statement. A statement would be considered dovish if it stated that the economy still needs further help and that the tapering process would be more gradual than proposed earlier this year of tapering to be finished by the middle of 2014.

The AUD has been the prime victim of taper speculators with market position indicating traders are holding the most AUD short positions, bets the currency will decline, in recent months. On the plus side for AUD sellers, this opens the door to a positive AUD bounce if the Fed deliver no change.

Last night, U.S. inflation data showed consumer prices increased by 0.2%, growing for the first time in three months. The yearly figure remains subdued at 1.2%, well below the yearly target held by most central banks of 2.0%. The Fed are less active than some central banks in meeting inflation targets, however, the data caused taper speculators to bid the USD ahead of Thursday’s meeting.

Early on Friday morning AEST, the U.S. released monthly retail sales numbers that beat expectations. Total retail sales grew by 0.7% in the month and, excluding the volatile auto sector, core retail sales grew 0.4%. The stronger than expected figures caused markets to adjust their quantitative easing taper bets. The AUD sold off sharply over 1 US cent on the release.

EUR & GBP

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.