Brief Summary:

- Several central banks will meet for their monthly monetary policy meetings this week. The RBA held its benchmark rate steady at 2.50% yesterday. Markets now await decisions from the Bank of England, European Central Bank and Bank of Canada in coming days.

- Australian Private Capital Expenditure impresses but GDP growth disappoints in the third quarter.

Investment and GDP

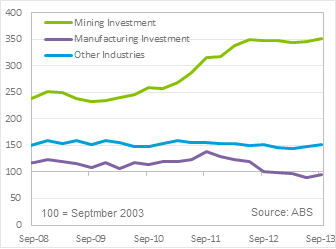

Last Thursday, the Australian Bureau of Statistics released third quarter Private Capital Expenditure, the main measure of company investment across industry sectors. Crucially and surprisingly, mining investment gained 4.0%, in seasonally adjusted terms. Also adding to the positive figure, Manufacturing investment halted its two year decline, rising 2.5%, and Other Industries investment rose 3.1%. Forecasts of future investment across all sectors were also raised. The data show not only the decline in mining investment being less severe, but, the pick-up in non-mining investment that was forecast to occur has begun. This trend, if continued, will be a crucial part of the re-balancing of the Australian economy.

Last Thursday, the Australian Bureau of Statistics released third quarter Private Capital Expenditure, the main measure of company investment across industry sectors. Crucially and surprisingly, mining investment gained 4.0%, in seasonally adjusted terms. Also adding to the positive figure, Manufacturing investment halted its two year decline, rising 2.5%, and Other Industries investment rose 3.1%. Forecasts of future investment across all sectors were also raised. The data show not only the decline in mining investment being less severe, but, the pick-up in non-mining investment that was forecast to occur has begun. This trend, if continued, will be a crucial part of the re-balancing of the Australian economy.

Yesterday, the Reserve Bank of Australia decided to keep interests rates on hold at 2.50%. The decision was widely expected and priced in, as a result, the AUD hardly budged on the announcement. The accompanying statement was brief, neutral and almost a carbon copy of last month’s. European and North American traders must have interpreted this as a sign of no further rate cuts; bidding the AUD up in their sessions.

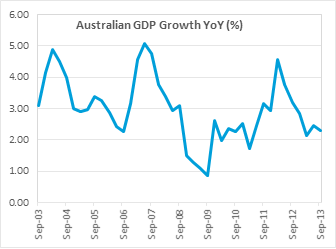

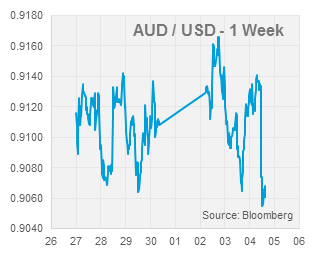

Today at 11:30am, Australian GDP was released, the all-encompassing measure of growth in an economy. The figure missed expectations slightly posting a third quarter expansion of 0.6% after 0.7% was expected; this places the yearly figure down from 2.60% to 2.30%. The report revealed some other details about underlying economic conditions including a rise in the Household Saving Ratio to 11.1%, echoed by consistently weaker Retail Sales figures across the period. The soft figure may prompt the RBA to cut rates to support growth, a prospect which caused the AUD to touch a low of 0.9046.

Today at 11:30am, Australian GDP was released, the all-encompassing measure of growth in an economy. The figure missed expectations slightly posting a third quarter expansion of 0.6% after 0.7% was expected; this places the yearly figure down from 2.60% to 2.30%. The report revealed some other details about underlying economic conditions including a rise in the Household Saving Ratio to 11.1%, echoed by consistently weaker Retail Sales figures across the period. The soft figure may prompt the RBA to cut rates to support growth, a prospect which caused the AUD to touch a low of 0.9046.

Please see below for specific currency commentary.

USD

‘Taper talk’ has quietened down in recent weeks with AUDUSD weakness largely being driven by bearish Australian sentiment. This week will deliver some telling data for taper speculators, however, with U.S. employment growth and GDP figures. U.S. third quarter GDP growth will be released at 12:30am Friday and is expected to be 3.0% annualised. Following this on Friday night is monthly employment data where Non-Farm Payrolls are expected to show 180,000 jobs were created in November. A better than expected will no-doubt bring ‘taper talk’ to the fore and possibly hurt the AUD.

‘Taper talk’ has quietened down in recent weeks with AUDUSD weakness largely being driven by bearish Australian sentiment. This week will deliver some telling data for taper speculators, however, with U.S. employment growth and GDP figures. U.S. third quarter GDP growth will be released at 12:30am Friday and is expected to be 3.0% annualised. Following this on Friday night is monthly employment data where Non-Farm Payrolls are expected to show 180,000 jobs were created in November. A better than expected will no-doubt bring ‘taper talk’ to the fore and possibly hurt the AUD.

EUR & GBP

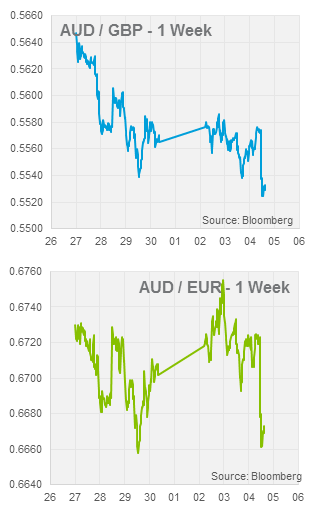

The Pound has been a performed particularly strongly against the Aussie over the last few weeks. The cross has risen 25% in 2013 and now sits at the highest level since 2010. Pound strength was driven further last week as headlines flooded markets during the Bank of England Governor Mark Carney’s delivery the November Financial Stability Report. The headlines centred on his introduction of new measures to ensure the risks of a potential housing market were mitigated. The measures described were non-monetary policy based including checks on lender capital reserves and mortgage quality. However, the speech caused speculators to conclude that monetary stimulus is due to be removed and interest rates raised sooner strengthening the Pound. This simple interpretation can be rebuked. Such targeted policies are more likely to allow monetary policy to be easier for longer. U.K. PMI surveys of Manufacturing and Construction sectors indicated accelerated growth in November; the Construction PMI now sits at pre-GFC levels of 62.6, indicating expansion when over 50.0.

The Pound has been a performed particularly strongly against the Aussie over the last few weeks. The cross has risen 25% in 2013 and now sits at the highest level since 2010. Pound strength was driven further last week as headlines flooded markets during the Bank of England Governor Mark Carney’s delivery the November Financial Stability Report. The headlines centred on his introduction of new measures to ensure the risks of a potential housing market were mitigated. The measures described were non-monetary policy based including checks on lender capital reserves and mortgage quality. However, the speech caused speculators to conclude that monetary stimulus is due to be removed and interest rates raised sooner strengthening the Pound. This simple interpretation can be rebuked. Such targeted policies are more likely to allow monetary policy to be easier for longer. U.K. PMI surveys of Manufacturing and Construction sectors indicated accelerated growth in November; the Construction PMI now sits at pre-GFC levels of 62.6, indicating expansion when over 50.0.

The Bank of England and European Central Bank will meet for their monthly monetary policy meeting tomorrow night, no change is expected from either authority.

Eurozone Unemployment declined from its record high of 12.2% to 12.1% and inflation rose from its multi-year low of 0.7% to 0.9% in November. However, most other European data releases continued to show weak economic conditions.

By Chris Chandler