Brief Summary:

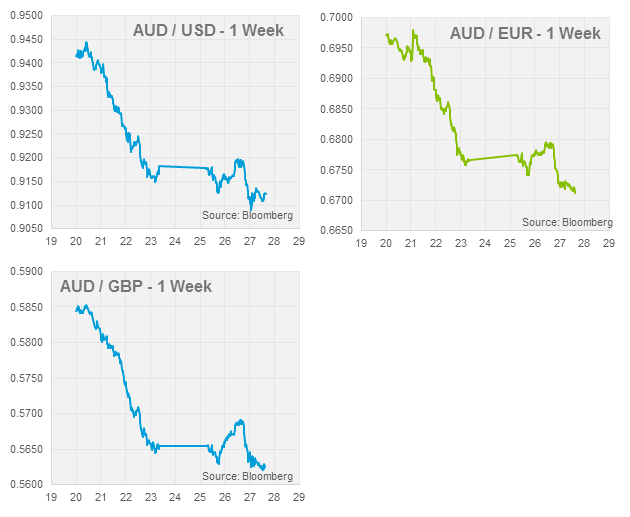

- The AUD declines almost four percent from high to low in a week as Glenn Stevens stirs the markets with comments on intervention. Goldman Sachs also voiced its bearish AUD view on the AUD yesterday adding to the downward momentum.

- Currency markets will be largely closed tomorrow as the United States celebrate Thanksgiving.

- Tomorrow, Australian Private Capital Expenditure will be released for the third quarter. The figure will detail investment in industry sectors over the period. Importantly, the pace of the decline in mining investment and the expected pick-up, if any, of other sectors will be closely examined.

- Next Tuesday, the Reserve Bank of Australia will meet for its monthly monetary policy meeting. We see the cash rate remaining on hold at 2.50%, with the primary reason for our view being comments about inflation being “a touch higher than expected” in the latest minutes.

Will the RBA intervene?

Last Thursday night, the Governor of the RBA Glenn Stevens delivered a speech that brought a stir to foreign exchange markets and the Australian media alike. The speech, entitled The Australian Dollar: Thirty Years of Floating, was always expected to be an AUD negative as it is well publicised that the RBA would prefer a lower currency.

The rhetoric that drew the most attention were comments on FX intervention. The SMH rolled with the headline “Dollar falls as RBA stays open to intervention”, however, the section of the speech on intervention makes no case for such a policy in the current circumstance. Stevens stated regarding the AUD, “We sometimes didn’t like the pathway. But if I ask the question of whether I would have consistently done a better job setting that price [the AUD], even had that been feasible (which it wasn’t), I don’t think I could confidently answer in the affirmative.” Also adding to arguments against, “the Bank has not been convinced that large-scale intervention clearly passed the test of effectiveness versus cost”.

The pro-intervention argument is also refuted, albeit indirectly, by Deputy Governor Philip Lowe who spoke yesterday at UNSW, “It is a task where monetary policy can make a contribution by keeping inflation low and stable … Our medium-term inflation targeting framework – which has been in place for two decades now – has achieved this and we are committed to making sure that we continue to deliver.” In short, given Australia’s circumstances, the overlooking of the inflation target in order to redress a temporary high level of exchange rate would be a drastic change in the RBA’s policy. It is our opinion that the RBA will not intervene in FX markets as it does not have the right conditions or need to do so, however as we have seen, the were prospect of intervention is enough to achieve the goals of a lower exchange rate. The comments may be viewed as ‘verbal intervention’, however, there is also a great deal of misinterpretation by the market.

Yesterday, the Goldman Sachs Chief Economist Tim Toohey said the AUD could fall below 80 as carry trades and reserve flows reverse. This is certainly a possibility, which we already saw in the middle of this year, however lets breakdown these two types of flow?

Reserve flows are funds flowing into the AUD from central banks around that world. When central banks diversify their holdings it is normally a long-term strategy and not something that can be reversed overnight. Glenn Stevens commented on this in this speech last week stating, “The flows have surely been important at times, though not necessarily lately. The available data suggest that foreign holdings of Australian government debt stopped rising in the middle of last year.” The International Monetary Fund tracks the allocation of reserve funds in several currencies. We can see increases in holdings of AUD have slowed significantly over the past three quarters.

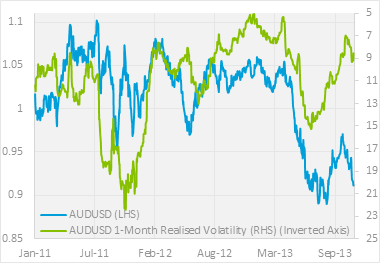

The carry trade, on the other hand, is driven by the interest rate differential between countries. Quantitative easing has kept U.S. interest rates at zero meaning a decent return can be made by borrowing in USD at near 0% and buying AUD earning 2.5% on cash; simple. Unless, the AUD falls rapidly and your 2.5% yearly profit is wiped out. Therefore, the other factor that determines demand for a carry currency is volatility; the rate of change in price over time. We have seen the chart on the right before. It shows AUDUSD on the left axis and the 1-month volatility on the right inverted axis; volatility is higher at the bottom.

The carry trade, on the other hand, is driven by the interest rate differential between countries. Quantitative easing has kept U.S. interest rates at zero meaning a decent return can be made by borrowing in USD at near 0% and buying AUD earning 2.5% on cash; simple. Unless, the AUD falls rapidly and your 2.5% yearly profit is wiped out. Therefore, the other factor that determines demand for a carry currency is volatility; the rate of change in price over time. We have seen the chart on the right before. It shows AUDUSD on the left axis and the 1-month volatility on the right inverted axis; volatility is higher at the bottom.

The relationship is obvious, when volatility increases the AUD declines. When talk of an event such as the beginning of the tapering quantitative easing is on the horizon, carry trades are unwound in anticipation. The carry currency is sold off which increases volatility begetting further depreciation as more carry trades are unwound. This is the reason we see the AUD fall so quickly when ‘taper talk’ begins. Conversely, when the horizon clears of an uncertain event, the build-up of carry trades slowly appreciates the AUD again. This is why the FOMC forward guidance is so important. Even if the decision to taper is made, if there is certainty on the timeline, carry trades will build as long as the interest rate differential exists. This also explains why a comment by the RBA on intervention, even if misinterpreted, can cause carry flows to reverse quickly.

NZD

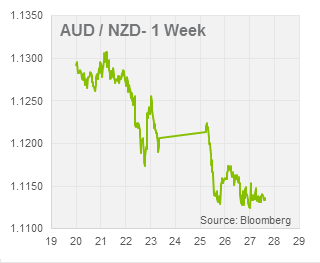

The NZD touched another multi-year high against the AUD yesterday. AUDNZD traded at 1.1118 the lowest level since the 2008 Global Financial Crisis. Some of the NZD strength has been driven by Glenn Stevens’ aforementioned comments on intervention. Although the Reserve Bank of New Zealand (RBNZ) have disclosed strongly that they are prepared in intervene in the NZD, the market knows that they are not in a position to do so. Expectations that the RBNZ will be the first developed nation to raise interest rates in 2014 have prompted carry-trade flows into the currency. The market move also highlights the beggar thy neighbour nature of intervening in currency markets. Intervention by the RBA would result in a torrent of yield seekers flowing out of the AUD and into the next best, or soon to be

The NZD touched another multi-year high against the AUD yesterday. AUDNZD traded at 1.1118 the lowest level since the 2008 Global Financial Crisis. Some of the NZD strength has been driven by Glenn Stevens’ aforementioned comments on intervention. Although the Reserve Bank of New Zealand (RBNZ) have disclosed strongly that they are prepared in intervene in the NZD, the market knows that they are not in a position to do so. Expectations that the RBNZ will be the first developed nation to raise interest rates in 2014 have prompted carry-trade flows into the currency. The market move also highlights the beggar thy neighbour nature of intervening in currency markets. Intervention by the RBA would result in a torrent of yield seekers flowing out of the AUD and into the next best, or soon to be

Other Weekly Charts

By Chris