Brief Summary:

- The USD traded choppily this week as traders priced and re-priced comments from both the Fed Chairman Ben Bernanke and Fed Chairwoman nominee Janet Yellen. Their comments were generally interpreted as dovish, depending on which new source delivered the news. They both reiterated their commitment to quantitative easing stating that the labour market was not yet strong enough to wind back stimulus.

- AUDNZD traded at its lowest level since the 2008 global financial crisis. The cross touched 1.1198 on Monday before staging a reversal. The pair have been converging to parity for the last twelve months as interest rate expectations diverge. New Zealand’s interest rates must rise in 2014 to cool the housing market whereas in Australia the RBA are considering whether to cut rates further.

A minute change to the minutes

Yesterday, the Reserve Bank of Australia released the minutes of its November interest rate decision. The minutes show the board maintain a neutral position indicating no imminent rate adjustments. Their comments on the latest inflation data suggest the board leaning on the ‘no cut’ side of neutral. They stated, ”underlying inflation were between ½ and ¾ per cent in the quarter, which was a touch higher than had been expected, and a little above 2¼ per cent over the year”. Remember that the RBA’s comfortable band is 2-3% per annum, however, they add another line regarding their outlook, “it was likely that the effect of the exchange rate depreciation earlier in the year was yet to be seen in most tradable consumer prices”. The board is expecting further upward price pressures are yet to flow through and the wait-and-see rhetoric is the crux of these minutes.

Glenn Stevens, Governor of the RBA, will speak at the Australian Business Economists Annual Dinner on Friday at 8:05pm. We can expect him to talk down the AUD, an opportunity he has grasped at every opportunity this year. With the European and North American sessions in full swing major AUD moves will depend on how believable he sounds. Without signalling a rate cut, central bankers’ attempts to talk down their own currencies have limited efficacy.

Australia is about to run up against its government debt ceiling of $300 billion. Similar to the U.S., the ceiling permits the maximum amount that treasury can issue in government bonds, however, unlike the U.S. no left vs. right show-down is expected. Also unlike the U.S., a government shut-down and teeter on the edge of default in Australia would be a wrecking ball through the AUD. The majority Australian treasury bonds are foreign owned and investors can flee at the drop of a hat. Perhaps it would be a quick way to get the AUD down to that lower level the RBA are seeking? Unlikely. A rise to either $400 or $500 billion is expected to be passed through parliament in early December.

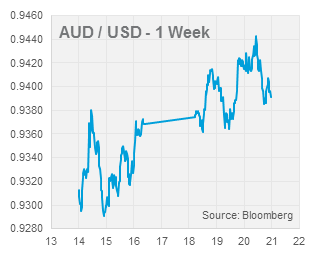

USD

With little hard data out, AUDUSD trading has been driven almost exclusively by comments from Fed Chairman Ben Bernanke and nominated Fed Chairwoman Janet Yellen this week. Last Thursday, Janet Yellen testified to the U.S. Senate before her upcoming confirmation for the position. Her testimony delivered no major shift in policy, but continued the Fed’s recent dovish stance or prolonging monetary stimulus via quantitative easing. Today, Bernanke delivered a very similar speech, reiterating the same points as Yellen.

With little hard data out, AUDUSD trading has been driven almost exclusively by comments from Fed Chairman Ben Bernanke and nominated Fed Chairwoman Janet Yellen this week. Last Thursday, Janet Yellen testified to the U.S. Senate before her upcoming confirmation for the position. Her testimony delivered no major shift in policy, but continued the Fed’s recent dovish stance or prolonging monetary stimulus via quantitative easing. Today, Bernanke delivered a very similar speech, reiterating the same points as Yellen.

As the headlines scrolled across trading screens the USD was sold off, buoying the AUD in particular. Most commentators continue to see the next possible tapering of quantitative easing in March at the earliest. The Federal Open Market Committee will release the from its October 30th decision tomorrow morning at 6am AEST.

U.S. Retail Sales figures for October will also be released early tomorrow morning. Expectations are for a slim 0.1% growth due to damped consumer confidence in the wake of the government shut-down. With expectations so low, the market may be caught short USD. Even a modest improvement may reverse the USD losses of the last few days.

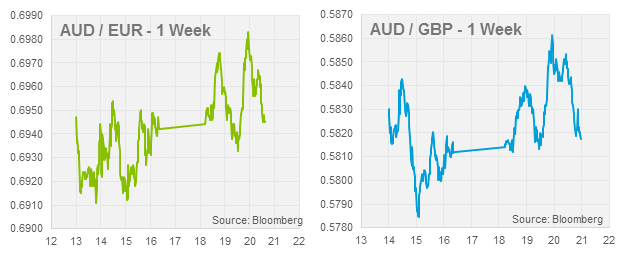

EUR & GBP

PMI figures will be released for the Eurozone tomorrow night. All sectors are expected to indicate modest growth except French Manufacturing which is uncompetitive due to overzealous labour regulations and red tape.

Last Wednesday, the Bank of England delivered its quarterly U.K. inflation report. It is hard to argue with the confidence of Governor Mark Carney’s opening remarks to the bullish report, “Inflation is now as low as it has been since 2009. Jobs are being created at a rate of 60,000 per month. The economy is growing at its fastest pace in 6 years. For the first time in a long time, you don’t have to be an optimist to see the glass as half full. The recovery has finally taken hold.” Importantly, the Monetary Policy Committee (MPC) now see their 7% unemployment threshold to raising interest rates being hit earlier than before. The upgraded view supported the GBP against most currencies as traders price the prospects of a higher interest rate.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.