Brief Summary:

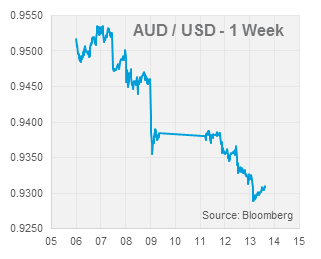

- Last Friday, the U.S. delivered two positive data releases. The first was GDP, growing at 2.8% in the third quarter, the second was employment, which saw 200,000 jobs added in October when only 120,000 were expected. The data caused the AUD to fall sharply into the weekend.

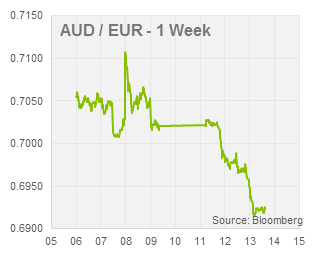

- The European Central Bank unexpectedly cut its benchmark interest rate to 0.25% from 0.5%. The decision came after inflation posted multi-year lows and unemployment reached an all-time high last week.

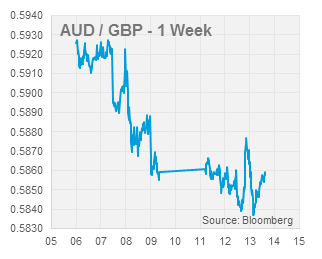

- Central Banker rhetoric will again be the flavour of the second half of this week with Bank of England Governor Mark Carney delivering the U.K. quarterly inflation report and future Fed Chairwoman Janet Yellen testifying before the U.S. Senate early on Friday morning AEST.

Surprise! U.S. Jobs

On Friday, U.S. employment data was released that showed the labour market conditions improving more than expected in October. Non-Farm Payrolls (NFP), the monthly measure of jobs added, posted 200,000 new jobs from the meagre 120,000 expected. The Unemployment Rate was steady at 7.3%, however, the Participation Rate declined 0.4% to 62.8, representing the loss to the workforce as people retire or give up looking for a job.

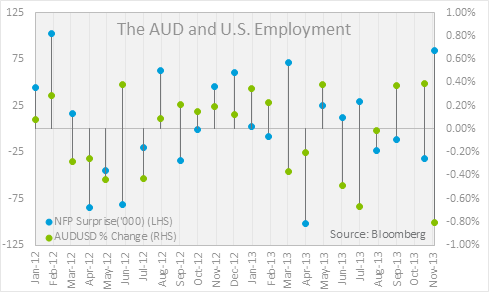

The release prompted a fall in AUDUSD of about 1 US cent as traders priced in their quantitative easing expectations. The chart on the right shows how the relationship between the AUD and NFPs has changed over the past two years. The left axis plots how far above or below expectations the NFP figure was and the right axis is the change in AUDUSD from one hour before the release to one hour after.

With some exceptions, throughout 2012 and the start of 2013, a stronger than expected NFP would be positive for the AUD (green and blue dots lying above or below the zero line). However since June this year, tapering expectations have meant a stronger NFP figure is a negative for the AUD (green and blue dots on either side of the zero line). The most recent figure was the biggest positive surprise since February 2012 and the AUD negative move was the biggest in the period. This relationship change rings true with most U.S. data releases, however, since the Fed quantitative easing program is directly tied to employment this comparison is most pronounced.

Last Thursday, Australian employment data was released that undershot expectations. Only 1,100 jobs were added in October which consisted of a loss of 27,900 full-time and a gain 28,900 part-time positions. The Unemployment Rate was steady at 5.7% and the AUD fell about a half a cent against the USD.

Comparing the two reactions, Australian employment and U.S. employment, illustrates the significance of the quantitative easing taper story on foreign exchange markets. The surprise U.S. data had a far greater effect on the AUD, the corollary, the currency is being supported primarily by taper speculators. This echoes the point made by Glenn Stevens a couple weeks ago that once again the AUD’s level is not supported by fundamentals and will be ‘materially lower’ in future.

Please see below for specific currency commentary.

USD

Early on Friday morning, Janet Yellen will testify to the U.S. Senate at the confirmation hearing for her Fed Chair nomination. Her words will likely fuel further taper speculation, with the established market view that she is dovish (favours low interest rates) and favours the use of quantitative easing. Considering this market expectations, any rhetoric regarding the tapering timeline or concerns about the extent of the program may prompt strengthening the USD. We can expect criticism from some Senate members who have previously expressed their concerns over the use of unconventional policy in similar hearings with Ben Bernanke. The market will read into how strongly Yellen defends against these criticisms in order to judge her commitment to the program. The event will be an important first impression of Chairwoman Yellen and likely result in a volatile end of the week for the AUD.

Early on Friday morning, Janet Yellen will testify to the U.S. Senate at the confirmation hearing for her Fed Chair nomination. Her words will likely fuel further taper speculation, with the established market view that she is dovish (favours low interest rates) and favours the use of quantitative easing. Considering this market expectations, any rhetoric regarding the tapering timeline or concerns about the extent of the program may prompt strengthening the USD. We can expect criticism from some Senate members who have previously expressed their concerns over the use of unconventional policy in similar hearings with Ben Bernanke. The market will read into how strongly Yellen defends against these criticisms in order to judge her commitment to the program. The event will be an important first impression of Chairwoman Yellen and likely result in a volatile end of the week for the AUD.

The U.S. released the first estimate of third quarter GDP growth last Thursday. The broadest available measure of economic growth showed the U.S. economy expanded 2.8% annualised over the period, better than the 2.0% market consensus. Forecasts vary between analysts, however most believe about half a percentage point will be shaved off fourth quarter GDP as a result of the budget crisis and government shut-down in October.

EUR & GBP

Last Thursday the European Central Bank (ECB) unexpectedly cut its benchmark interest rate from 0.5% to 0.25% maintaining its forward guidance of “[rates] at present or lower levels for an extended period of time”. Market expectations were strangely aligned with ‘no change’ despite record unemployment and multi-year low inflation readings delivered last week. This may have been due to the perceived influence of inflation fearful German members and the ECB’s history of being less proactive than other central banks.

Last Thursday the European Central Bank (ECB) unexpectedly cut its benchmark interest rate from 0.5% to 0.25% maintaining its forward guidance of “[rates] at present or lower levels for an extended period of time”. Market expectations were strangely aligned with ‘no change’ despite record unemployment and multi-year low inflation readings delivered last week. This may have been due to the perceived influence of inflation fearful German members and the ECB’s history of being less proactive than other central banks.

In the press conference ECB President Mario Draghi, stated that the bank see inflation staying low, below its 2% target, for an extended period of time though they so not see deflation occurring. Euro area third quarter GDP figures will be released tomorrow night.

Across the channel, the Bank of England kept their interest rates at 0.5% and their forward guidance unchanged. The minutes of the meeting will be released on the 20th of November. Governor Mark Carney will speak tonight and deliver the quarterly BoE Inflation Report. Last quarter, the Bank introduced its forward guidance for monetary policy. This quarter, the market will watch the Bank’s updated growth, employment and inflation forecasts closely that were considered more bearish than market consensus in the previous report. A shortening of the timeline for low interest rates or upward revision of forecasts will likely strengthen the Pound. The Unemployment Rate will also be released shortly before the report; it is expected to tick down to 7.6%.

Across the channel, the Bank of England kept their interest rates at 0.5% and their forward guidance unchanged. The minutes of the meeting will be released on the 20th of November. Governor Mark Carney will speak tonight and deliver the quarterly BoE Inflation Report. Last quarter, the Bank introduced its forward guidance for monetary policy. This quarter, the market will watch the Bank’s updated growth, employment and inflation forecasts closely that were considered more bearish than market consensus in the previous report. A shortening of the timeline for low interest rates or upward revision of forecasts will likely strengthen the Pound. The Unemployment Rate will also be released shortly before the report; it is expected to tick down to 7.6%.

U.K Industry PMI’s, gauges of economic growth which all missed the mark last month, outdid expectations this month. All three surveyed sectors are indicating solid growth with the large important services sector leading the charge.

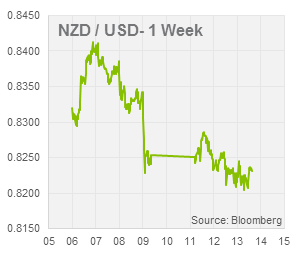

NZD

Reserve Bank of New Zealand Governor Graeme Wheeler spoke today and made attempts to talk the NZD down. The comments had little impact on the market as speculators now expect at least a 0.25% interest rate rise by March and further rises through 2014. A booming housing market will force the RBNZ to be the first developed nation to raise interest rates a move that will inevitably push the currency higher. Given the opposing position of the RBA, who may need to cut rates further, AUDNZD weakness is likely to persist.

Reserve Bank of New Zealand Governor Graeme Wheeler spoke today and made attempts to talk the NZD down. The comments had little impact on the market as speculators now expect at least a 0.25% interest rate rise by March and further rises through 2014. A booming housing market will force the RBNZ to be the first developed nation to raise interest rates a move that will inevitably push the currency higher. Given the opposing position of the RBA, who may need to cut rates further, AUDNZD weakness is likely to persist.

By Chris Chandler