Brief Summary:

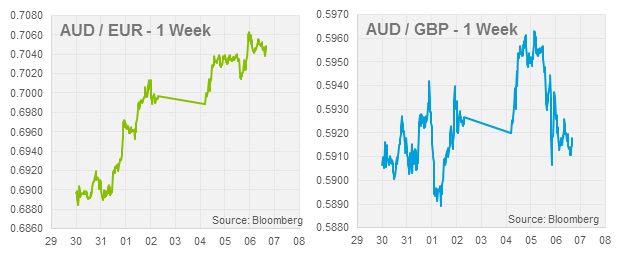

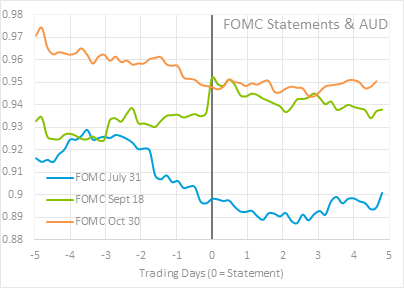

- The AUD remained fairly range bound this week awaiting direction from a bulk of overseas data later this week. U.S. employment and GDP figures will be released on Friday that will resume tapering speculation that has abated since the government shut-down and FOMC decision last Thursday.

- This week’s Australian data has been relatively positive supporting the AUD with employment numbers to come tomorrow at 11:30am.

- In the Euro area, inflation fell to a multi-year low as unemployment rose to an all-time high prompting the need for further stimulus by the European Central Bank. They will deliver a monetary policy decision on Thursday and possible insight from ECB President Mario Draghi.

Things looking up for the AUD

Australia has been awash with positive data in the past week. With quantitative easing sticking around for some time longer, foreign exchange markets have also had plenty of domestic data to justify AUD support. The Citigroup Economic Surprise Index, a measure of how much data has overshot market expectations, has risen from its October low of -45.0 to -7.3 yesterday. Today’s slimmer than expected Trade Deficit will bump the index up a little more, and October employment data will be released tomorrow. Expectations are for 10,000 new jobs and the Unemployment Rate to tick up to 5.7%.

Starting last Thursday, Building Approvals, a measure of construction activity shot up 14.4% in September. A clear uptrend can be seen in a chart of the notoriously volatile monthly figure; a result of low interest rates fuelling demand.

On Friday, the Producer Price Index, a measure of inflation for producers and thus a forward indicator for consumer inflation, also unexpectedly increased to 1.3% quarter on quarter. This likely reflects the mid-year currency depreciation which has been little felt in prices thus far due to currency hedging by importers. The AIG Manufacturing Index also climbed to 53.2, the highest reading since 2010 for the struggling sector.

Additionally on Monday, September Retail Sales numbers that delivered an upside surprise of 0.8% after 0.4% was expected.

Yesterday afternoon, the Reserve Bank of Australia left the cash rate unchanged at 2.50%. The statement gave little away on further rate cuts and, as usual, the board expressed its dissatisfaction with the exchange rate, “The Australian dollar, while below its level earlier in the year, is still uncomfortably high. A lower level of the exchange rate is likely to be needed to achieve balanced growth in the economy.” The comments caused a temporary dip in the AUD, however, European and North American weren’t convinced and bid the AUD back up.

USD

Early last Thursday morning the U.S. Federal Open Market Committee (FOMC) released is October monetary policy statement. The committee wordsmiths made virtually no changes from the September statement; when they surprised markets by not beginning to taper its quantitative easing assets purchase program.

Early last Thursday morning the U.S. Federal Open Market Committee (FOMC) released is October monetary policy statement. The committee wordsmiths made virtually no changes from the September statement; when they surprised markets by not beginning to taper its quantitative easing assets purchase program.

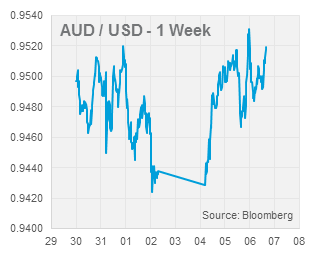

The currency market reaction was fairly muted and the rhetoric delivered none of the language changes mooted in last week’s update. The committee placed greater emphasis on fiscal drag in response to the budget crisis, giving it its own sentence, “Fiscal policy is restraining economic growth”.  The chart tracks the reaction of the AUD to FOMC statements. In September, we see the AUD jump as the decision not to taper surprised markets. On the contrary, October’s decision quelled the excitement created by the government shut-down as market rationalised that tapering will occur, it’s just a matter of when.

The chart tracks the reaction of the AUD to FOMC statements. In September, we see the AUD jump as the decision not to taper surprised markets. On the contrary, October’s decision quelled the excitement created by the government shut-down as market rationalised that tapering will occur, it’s just a matter of when.

Third quarter GDP growth for the U.S. will be released on Friday morning Sydney time. Expectations are for 2.0%, down from 2.5% in the second quarter. Monthly employment data will follow late Friday night and will provide a source for renewed taper speculation.

EUR & GBP

Last Thursday, Eurostat published October Inflation figures that showed Euro area inflation declining to 0.7% annualised, well below the 2.0% target and the lowest reading since the Global Financial Crisis. Regional Unemployment also unexpectedly increased to 12.2%, the highest level since the formation of the currency union.

The EUR weakened on the release as the data supports the case for the European Central Bank (ECB) to cut rates and provide further monetary stimulus. Expectations for tomorrow night’s monetary policy decision are for no change at 0.5% but they could surprise markets. The data show that although the crisis has been deemed over the region is not out of the woods just yet. The risk now is that the ECB does too little to prevent Japanese style stagflation.

NZD

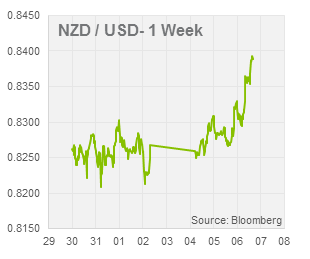

Last Thursday the Reserve Bank of New Zealand held the cash rate at 2.50%. Yesterday, quarterly employment numbers showed employment increased by 1.2% in the third quarter and the unemployment rate was steady at 6.2%. The stronger than expected numbers boosted the NZD.

Last Thursday the Reserve Bank of New Zealand held the cash rate at 2.50%. Yesterday, quarterly employment numbers showed employment increased by 1.2% in the third quarter and the unemployment rate was steady at 6.2%. The stronger than expected numbers boosted the NZD.

By Chris Chandler