Brief Summary:

- The U.S. Federal Open Market Committee will meet tonight where it is not expected to make any change to the quantitative easing program. The market will look to interpret the committees tapering timeline given recent U.S. domestic developments.

- The Reserve Bank of Australia will meet for its November monetary policy meeting on Tuesday; no change is expected. Yesterday, Glenn Stevens said in a speech that he expected the AUD to depreciate; markets heeded his advice.

- Moody’s, discussed downgrading its AAA sovereign debt rating for New Zealand, the only one of three ratings agencies to maintain the highest grade. The agency cited increased government debt, persistent current account deficits, risk of natural disaster and the country’s reliance on few major export sectors as potential reasons for a downgrade. The headline temporarily rattled the NZD which fell about half a cent against the USD and AUD; the losses had reversed within the hour.

Waiting on comments from Central Bankers

The Reserve Bank of Australia will meet for its November monetary policy meeting on Tuesday. Glenn Stevens spoke yesterday at the Citibank Investment Conference. He took the opportunity to talk down the AUD stating, “So it seems quite likely that at some point in the future the Australian dollar will be materially lower than it is today.” He defended developments in the housing market, which include a median rise of 8.0% in the last twelve months, stating that credit growth remains subdued and losses are simply being regained. He also commented on the U.S. monetary outlook, “It would be a mistake to relax for very long in the face of this delay. Surely the ‘taper’ will come.”

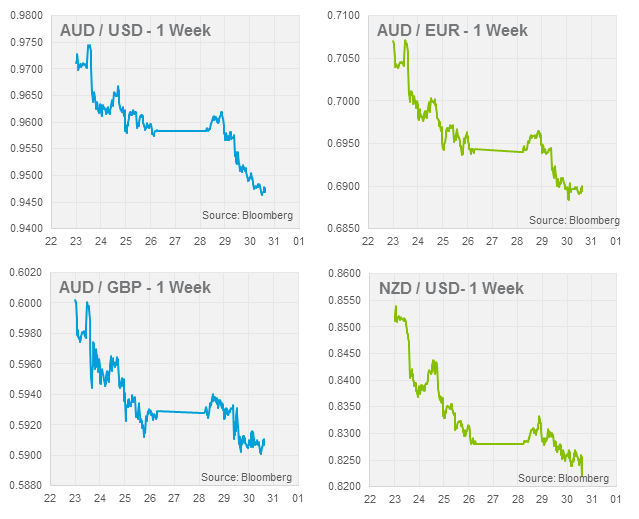

His comments on the currency were effective, the AUD has fallen about a cent since the speech. What Stevens didn’t do, which he has done in the past, is let the cat out of the bag regarding Tuesday’s interest rate decision. One can only assume it means there is no cat. We believe last week’s higher than expected inflation data does not close the door to future rate cuts, but the board will wait before making any further cuts; if any.

The U.S. Federal Open Market Committee (FOMC) will meet tonight for its October monetary policy meeting. Although not official, the tapering of quantitative easing has been ruled out by the market. The attention now turns to the statement and changes, if any, to their economic outlook and the language of the assessment. Jon Hilsenrath, a Wall Street Journal columnist known as The Fed Whisperer, has written an article on what to expect from the meeting.

Hilsenrath, in line with the market, expects no reduction in the $85 billion per month asset purchase program. In September, the committee decided to wait for further evidence that the economy was strengthening. Any strength they saw then has certainly been eroded due to the uncertainty caused by the political break-down.

Specific language the market will look for include a downgrade from ‘moderate’, ‘improvement’ and ‘strengthening’; present in the September statement. The addition of ‘downside risks’ will also add to any dovish outlook.

For currency markets, we can expect dovish statements to suggest a continuation of quantitative easing which debases the home currency; weakening the USD. This bodes well for the AUD which hit a high of 0.9758 last week. The market currently see the next possibility of tapering to be the March 13th meeting. With the crisis simply delayed until the 7th of February, the December 18th and January 25th meetings do not allow for the uncertainty to be resolved; or so the pundits reckon.

By Chris Chandler