Brief Summary:

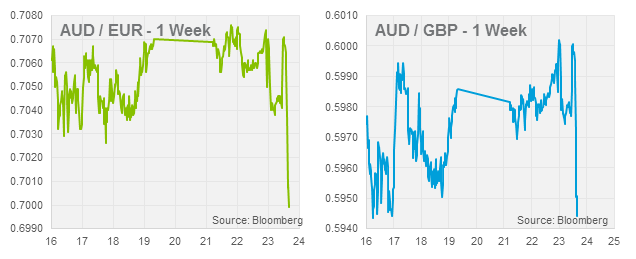

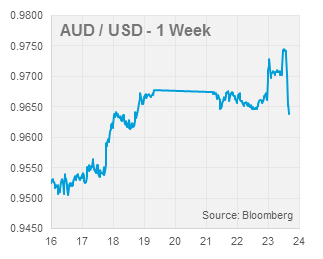

- After rallying sharply to a high of 0.9758 on the back of U.S. employment data and Australian inflation data, the AUD has fallen over a cent in as many hours. The fall was triggered by the People’s Bank of China (PBOC) withdrawing liquidity from money markets leading to a sharp increase in short term interest rates.

- The U.S. Congress break the debt ceiling impasse but make little progress towards a real solution. The debt ceiling is raised until February 7th but employment data released last night was weaker than expected. Most market participants are now expecting the Fed to begin tapering asset purchases in March at the earliest.

The Inflation Outlook

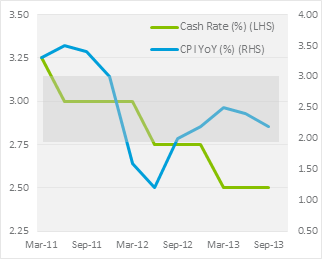

This morning, the Australian Bureau of Statistics released inflation data for the third quarter. The surprise figure showed the quarterly Consumer Price Index (CPI) increasing from 0.4% last month to 1.2% undershooting the 0.8% expected. However, the yearly CPI was down from 2.4% last quarter to 2.2%, although also undershot at 1.8%. The AUD bounced about 40 points on the release as the figure supposedly reduces the chances of further rate cuts. That being said, the details of the release do not suggest a change to the inflation outlook and, in our view, will not form a barrier to further rate cuts. The yearly CPI figure remains at the lower end of the RBA’s comfort zone of 2-3%.

This morning, the Australian Bureau of Statistics released inflation data for the third quarter. The surprise figure showed the quarterly Consumer Price Index (CPI) increasing from 0.4% last month to 1.2% undershooting the 0.8% expected. However, the yearly CPI was down from 2.4% last quarter to 2.2%, although also undershot at 1.8%. The AUD bounced about 40 points on the release as the figure supposedly reduces the chances of further rate cuts. That being said, the details of the release do not suggest a change to the inflation outlook and, in our view, will not form a barrier to further rate cuts. The yearly CPI figure remains at the lower end of the RBA’s comfort zone of 2-3%.

Examining the break-down down main contributors to the figure, the standouts were mostly exchange rate sensitive items such as automotive fuel and international travel. Housing costs stood out, although largely due to increases in local council rates. Underlying consumption based prices remain subdued and the exchange rate sensitive will revert in fourth quarter given the recent AUD appreciation.

Please see below for specific currency commentary.

USD

Last Thursday, the U.S. Senate and House of Representatives came to a compromise and ended the debt crisis (for now) that saw the U.S. government shut-down for 17 days and toe the line of sovereign default. The compromise, described as kicking the can down the road, will raise the debt ceiling until February 7th 2014 where the two sides will face-off once again.

Last Thursday, the U.S. Senate and House of Representatives came to a compromise and ended the debt crisis (for now) that saw the U.S. government shut-down for 17 days and toe the line of sovereign default. The compromise, described as kicking the can down the road, will raise the debt ceiling until February 7th 2014 where the two sides will face-off once again.

Financial markets never believed that the two sides would allow the country to default and risk assets rallied throughout the crisis. The rally underwritten by the premise that the more damage Congress does to the economy, the longer the Fed will have to stimulate it using quantitative easing. Since the middle of this year, markets have anticipated the Fed to start tapering its quantitative easing program in September. When this did not come to fruition, markets re-priced this expectation December. Given the developments and the FOMC meeting schedule, most participants now believe tapering to being in March 2014 at the earliest.

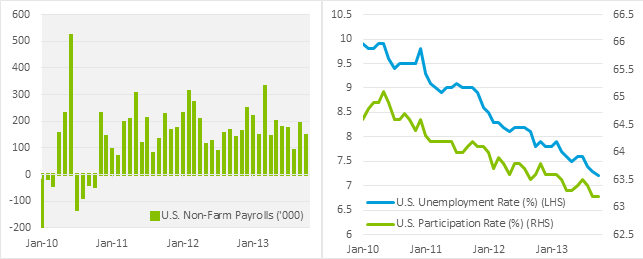

With labour market conditions pivotal to Fed policy, the key piece of data supporting a delayed taper was the release of September U.S. employment data last night. The release show Non-Farm Payrolls, the number of jobs created in the month, languishing at 148,000; a far cry from the 180,000 expected. The Unemployment Rate declined to 7.2%, however the Participation Rate, the percentage of the population in the labour force, was flat at 63.2%.

Last Thursday, Chinese GDP figures showed the economy moving at exactly the anticipated rate in the third quarter. GDP, the broadest measure of economic growth, grew at 7.8% with Industrial Production, important for Australian export demand, held steady at 10.1%. Tomorrow at 12:45pm, HSBC / Markit Economics will release its Chinese Manufacturing PMI. The survey of manufacturing industry members indicates expansion when over 50.0 and is expected to hold just above this level at 50.5.

EUR & GBP

With the U.S. stealing the show, market action has been fairly quiet out of Europe. The AUD remained in a tight ranges against both the EUR and GBP at around three month highs. A break-out occurred this afternoon when the Peoples’ Bank of China raised short term money market rates.

Industry PMIs will be released for the Eurozone tonight. The figures have recovered markedly in recent months as regional growth slowly returns.

By Chris Chandler