Brief Summary:

- The U.S. celebrated Columbus Day on Monday meaning lighter than normal trading volumes to start the week.

- Financial markets are calm even in the 11th hour of the U.S. debt ceiling crisis; see details below.

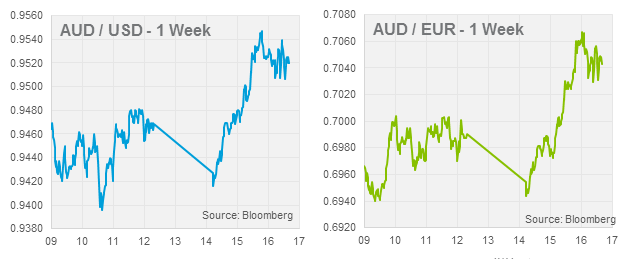

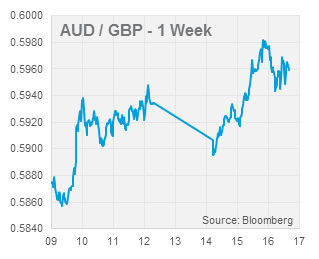

- The Reserve Bank of Australia released the minutes from its October 1st monetary policy decision. The statement read neutrally reiterating that “the Bank should again neither close off the possibility of reducing rates further nor signal an imminent intention to reduce them”. Developments regarding U.S. monetary policy and the resulting appreciation of the AUD was mentioned several times. The minutes caused the market to price a lesser chance of another rate cut in 2013 supporting the already rallying AUD.

The Tale of Two Crises

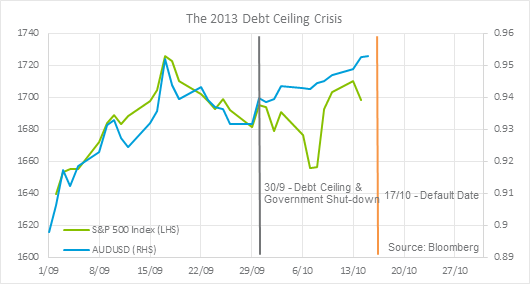

To revisit an increasingly tedious opening line, the U.S. debt ceiling stand-off continued this week as the House of Representatives and the White House fail to compromise. However, rather than fret about the imminent default, markets are pretty much ignoring the events and remain supportive of risk assets. The AUD has benefited from the risk rally, reaching a four month high against the USD. Likewise, U.S. equities remain supported at record levels; the S&P 500, a major stock index, close at 1698.06 yesterday from its record of 1725.52 set mid-September. As you will see below, the AUD has a tendency to be highly correlated with U.S. equities at pure risk-on risk-off times like these.

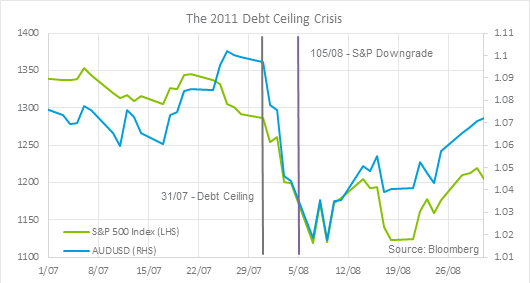

The current market resilience is the antithesis to the volatile gyrations caused by the seemingly less severe debt ceiling crisis of 2011. From the date the ceiling was reached risk assets tumbled. In the week that followed the S&P 500 fell over ten percent and the AUD; the most volatile week since the Global Financial Crisis. Following this, Standard and Poor’s, a ratings agency, downgraded U.S. sovereign debt one level from AAA to A+1.

This time around, markets are surprisingly resilient. As we approach the supposedly daunting orange default line no one seems to care, but why? The debt ceiling has been an unsolved scourge on the U.S. political system since this first serious dispute in 2011. Since then, with multiple 11th hour stand-offs and supposed deadlines, markets have become thick skinned on the issue.

Prominent commentators and officials such as Larry Summers, Fed New York President William Dudley and PIMCO boss Andrew Bosomworth have dismissed the possibility of a U.S. default. Similarly, opinion pieces like this one in The Economist point out that a U.S. default of this flavour, while it would no-doubt cause some turmoil, would not really be a disaster. Their point, say the U.S. technically defaults, debt holders would almost certainly recover 100 cents to the dollar on their securities when an agreement is inevitably reached and the ceiling raised. Aside from some complexities like the triggering of credit default swaps, the market could not collapse as the sheer size of the U.S. treasury market, derived in the global reserve currency, means there isn’t really anywhere else for the money to go.

A second powerful factor holding markets firm is the effect of the crisis on U.S. monetary policy. Markets were anticipating the U.S. Federal Reserve would start tapering its quantitative easing program at the latter end of 2013; this will likely be delayed now. The damage to the economy and business confidence due to fiscal uncertainty would damage jobs growth and pro-long the program. Similarly, any deal involving spending cuts will shave GDP growth also pro-longing the program. Quantitative easing drives demand for higher yielding assets like shares and commodity currencies, the market is now pricing a taper free 2013.

Bringing these two factors together, a default may not only delay tapering but lead to an expansion of quantitative easing. The Fed’s quantitative easing program has worked tirelessly to lower these yields by purchasing 45 billion in treasury bonds per month. The yield of a debt security is effectively the interest rate on the debt or the risk premium. A default would damage U.S. treasuries’ reputation as the ultimate risk-free asset and raise these yields; reverberating increased risk premiums through all other securities. So far, there has been slight increase in treasury yields during the crisis, but the adjustment is still heavily in favour of a resolution being met.

In short, the world has concluded that the multi-pronged fork in the road can only lead to more cheap money to play with and no one seems to care about the pitfalls of a U.S. default. Given the complexity of the situation and the full spectrum of market views being considered, your correspondent will refrain from making any calls – no one really knows what is going to happen.