Brief Summary:

- The U.S. government shut-down enters its ninth day with no end in sight.

- President Obama will appoint Janet Yellen as the next Chairperson of the U.S. Federal Reserve.

- PIMCO (Pacific Investment Management Company), the world’s largest bond investor, released its October economic insight for Australia. The report’s main points were that mining investment is tapering and that the RBA will have to cut rates further and leave them low for a pro-longed period. The report also outlined the good, bad and ugly growth scenarios that may result from the loss of outsized mining investment levels in the economy. The good outcome sees other industry sectors pick up the slack of decreased mining investment, though they have doubts. Their money seems to be behind the bad that will see no immediate pick-up of investment in other sectors followed by further rate cuts. Even worse, the bad sees no pick-up in other sectors coupled with a property market bubble driven by low interest rates; this would place the RBA in a serious policy conundrum.

- Tomorrow at 11:30am, the Australian Bureau of Statistics will release monthly employment data. The figures are expected to show 15,200 new jobs were added in September and the Unemployment Rate steady at 5.8%.

USD

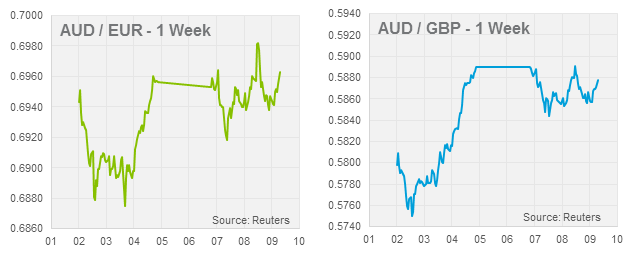

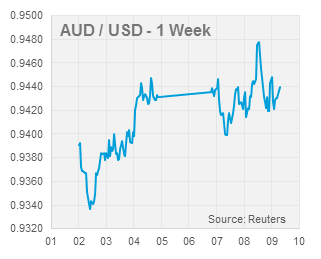

The U.S. government shut-down enters its ninth day as the White House and the House of Representatives continue their debt ceiling stand-off. The market is eyeing the 17th of October which is widely understood as the date that the U.S. will be unable to meet its debt obligations and bring about the first default in the sovereign’s history. A U.S. sovereign default would be a financial disaster, it is dearly hoped the partisan divide can be bridged in time. The market remains firmly priced towards a resolution before this deadline, however, fears have been felt through financial markets. The USD remains weak across the board as the economic damage will pro-long the need for quantitative easing. The most immediate repercussions have appeared in bond markets.

The U.S. government shut-down enters its ninth day as the White House and the House of Representatives continue their debt ceiling stand-off. The market is eyeing the 17th of October which is widely understood as the date that the U.S. will be unable to meet its debt obligations and bring about the first default in the sovereign’s history. A U.S. sovereign default would be a financial disaster, it is dearly hoped the partisan divide can be bridged in time. The market remains firmly priced towards a resolution before this deadline, however, fears have been felt through financial markets. The USD remains weak across the board as the economic damage will pro-long the need for quantitative easing. The most immediate repercussions have appeared in bond markets.

For the first time in at least twelve years the yield on one-month U.S. treasury bills climbed above the equivalent LIBOR (London Inter-Bank Offered Rate). Simply, the yield is the interest rate on a short term loan as determined by the bond market. The yield represents the reward for lending so the higher the yield the higher perceived risk. In other words, the market has priced a greater risk for lending for one-month to the U.S. treasury than to a bank. Similarly, this yield was the highest since the 2008 global financial crisis. Last Friday would normally have been Non-Farm Payrolls day, the release of monthly U.S. employment data. The Bureau of Labor Statistics, however, are non-essential government staff and therefore not open. The release is expected as soon as a resolution is found. With no one at work counting jobs, the work will stack up for staff compiling the next release.

After much speculation by political and market commentators, Barack Obama will nominate Janet Yellen as Chairwoman of the Federal Reserve when Ben Bernanke’s term ends on the 31st of January. Many thought Obama would opt for a more hawkish replacement. Larry Summers, viewed as a hawk, was tipped for the job a few months though withdrew from the race a couple weeks ago; prompting USD weakness. This week, Forbes published an opinion piece tipping Donald Kohn due to his crisis management experience. Yellen, the obvious candidate and current vice-chair, comes from the same school of thought as the outgoing Bernanke; her appointment should therefore see no major adjustment in Fed policy trajectory.

Tonight, the Fed will release the minutes from its September 17-18 monetary policy decision where it chose not to taper quantitative easing.

EUR & GBP

Last week, U.K. Industry PMIs were released that undershot market expectations for the first time since April. The surveys of manufacturing, construction and service sectors indicate economic expansion when over 50.0 and have recently climbed to their highest levels since the global financial crisis. Last week however, things took a breather softening the GBP slightly against major currencies.

The Bank of England will hold its monetary policy meeting tomorrow night; no change in policy is expected.