Brief Summary:

- The Reserve Bank of Australia held the cash rate at 2.50%.

- Failed negotiations between the White House and Republican controlled Congress have meant the U.S. debt ceiling has not been raised in time to stop a government shut-down. Non-essential public sector services are now closed and employees are on leave without pay until a resolution is found.

No return of the scope

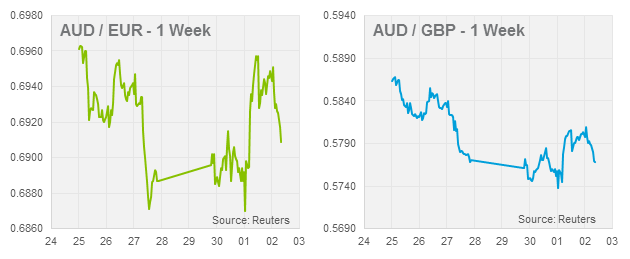

Yesterday, the Reserve Bank of Australia held the cash rate at 2.50%. The decision was as expected coupled with a statement that did not appear to reinstate an easing bias. Some market commentators were expecting a return of the “scope to ease rates further” sentence to no avail. The AUD rallied as the market priced in lesser chances of a rate cut in the coming months.

This week’s Australian data has been mixed. Retail Sales expanded 0.4% in August beating expectations of 0.3%. On the other hand, Building Approvals, a measure of construction activity, fell 4.7% in August though it is an inherently volatile figure. The Trade Balance unexpectedly recorded a wider deficit of 820 million. The underlying numbers continued to show strength was largely driven by changed measurements to imports and exports to China reached a record high.

USD

U.S. Congress resumed its stalemate from earlier in the year, this time resulting in a government shut-down as budget negotiations break down earning the title, the 2013 debt ceiling crisis. No resolution is in sight with both sides standing off. What is a government shut down? Public sector employees in non-essential sectors will be placed on annual leave without pay until a resolution is met. These sectors include national parks, war memorials, medical research and customs administration; among others.

U.S. Congress resumed its stalemate from earlier in the year, this time resulting in a government shut-down as budget negotiations break down earning the title, the 2013 debt ceiling crisis. No resolution is in sight with both sides standing off. What is a government shut down? Public sector employees in non-essential sectors will be placed on annual leave without pay until a resolution is met. These sectors include national parks, war memorials, medical research and customs administration; among others.

It is not the first time this has happened, the following is a brief history on the dreaded U.S. debt ceiling and the financial toll of its use as a political weapon.

The U.S. debt ceiling is a statutory restriction on the amount of debt that can be issued by the Treasury. It was brought into law in 1917 and was useful in prompting debates on the budget. In recent decades, subsequent reforms have removed its prior usefulness and rather the law has become a tool for opposed houses of parliament to block budgets. The three recent debt ceiling crises all involve a wholly or partly Republican controlled Congress blocking the budget proposed by the democratic White House.

In 1995, the Republicans controlled both the Senate and the House of Representative layers of congress. The Republican congress led by Newt Gingrich refused to raise the debt ceiling in an attempt to block Democratic President Bill Clinton’s budget. The resulting shut-down lasted 28 days, costing tax payers $1.4 billion and proved a boon for Clinton who saw his approval rating strengthen and a re-election in the following year.

In 2011, a similar stand-off ensued resulting in Standard &Poor’s, a ratings agency, downgrading U.S. government bonds from AAA. The resulting financial tumult saw the Dow Jones Industrial Average, a major U.S. stock market index, fall 5.6%, the biggest fall since the 2008 global financial crisis.

Today, the Republicans only control the House of Representatives, however, they still wield enough power to block raising the debt ceiling. This time, John Boehner plays the antagonist in an attempt to make the White House fold on budget issues; namely, Obamacare. The White House are holding firm and not negotiating in what Obama claims to be an ‘ideological crusade’.

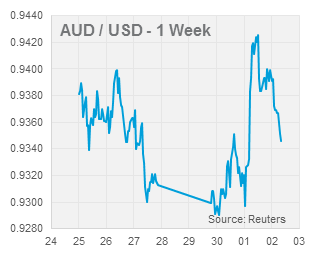

Markets at this stage appear relatively calm. The USD has weakened across the board as the economy damaging shut-down pro-longs the need for quantitative easing; that was scheduled to be tapered in the latter part of 2013. What is more worrying, the events show the deepening ideological divide between the two halves of American politics. The system is almost unworkable and a reason that fiscal concerns were paramount in the FOMC’s decision not to taper quantitative easing two weeks ago.

EUR & GBP

The European Central Bank will meet tonight for their monetary policy meeting. No change is expected to monetary policy, though Mario Draghi, President of the bank, indicated that further stimulus may be implemented if the Euro recovery stalls.

Last night, the U.K. Manufacturing PMI, a gauge on industry performance, was released missing expectations for the first time since April at 56.7. Figures for Construction and Service sectors will be released over the next two nights though it is possible that these expectations are also over stretched.

If you would like to discuss your foreign exchange requirements, please call 1800 701 540 or email australia@worldfirst.com for a live exchange quote.

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.

Please read our Product Disclosure Statement and our Financial Services Guide. E&OE. Definitions of jargon/market terms can be found in our Glossary of Foreign Exchange Terms.

World First Pty Ltd is regulated in Australia by ASIC (AFS Licence number 331945). ACN 132 368 971

Member of Financial Ombudsman Service (membership number 13405)