Brief Summary:

- The U.S. Federal Open Market Committee chose to maintain its current asset purchase program at 85 billion per month surprising global markets. The AUD rallied as the market priced not only the decision but a more dovish FOMC stance.

- Angela Merkel was re-elected as German Chancellor.

- Oracle Team USA wins its seventh race in a row against Emirates Team New Zealand to tie the America’s Cup with at eight wins each. The first-to-nine wins regatta will be decided tomorrow at 06:00 AEST. The result is not expected to affect NZDUSD trading.

The FOMC surprise

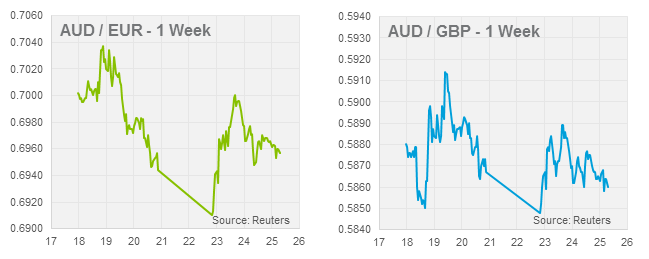

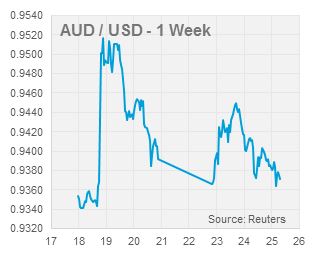

Early last Wednesday, the Federal Open Market Committee (FOMC) decided not to taper monthly asset purchases of $85 billion per month. The move surprised markets worldwide which had largely priced in a cut in purchases to about $70 billion. The USD fell sharply on the release. DXY, a weighted index of the USD against a basket of currencies, fell about 1.3% in a matter of minutes. The AUD and NZD were big winners climbing 2.0% and 2.6%; respectively.

Early last Wednesday, the Federal Open Market Committee (FOMC) decided not to taper monthly asset purchases of $85 billion per month. The move surprised markets worldwide which had largely priced in a cut in purchases to about $70 billion. The USD fell sharply on the release. DXY, a weighted index of the USD against a basket of currencies, fell about 1.3% in a matter of minutes. The AUD and NZD were big winners climbing 2.0% and 2.6%; respectively.

The chart on the right shows the spike in the AUD. The next obvious question; how did everyone get it so wrong? Financial markets were absolutely sold on Septaper; even your correspondent changed his view and followed growing the crowd. The long break between Fed comments on monetary policy fuelled plenty of irrational speculation and even as people like “The Fed Whisperer” Jon Hilsenrath voiced his doubts on any tapering. Retracing FOMC rhetoric it seems obvious tapering was too early, the committee has not done anything they said they wouldn’t.

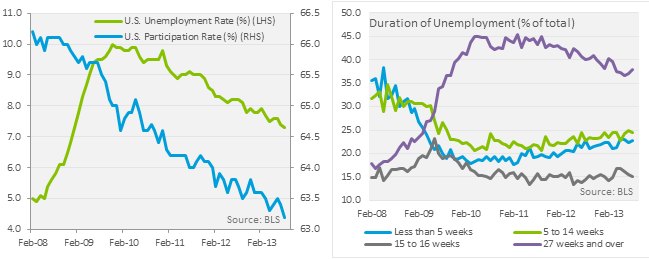

The FOMC never said they would begin tapering in September. Furthermore, Ben Bernanke has stressed throughout the year that tapering would not be on a pre-set course and that labour market conditions would be measured on more than simply the unemployment number. He specifically stated in June that if unemployment rate declines were due to participation rate declines, tapering would not occur. This has been the overriding theme of the post-GFC labour market in the U.S; shown in the chart on the below. Wednesday’s statement reiterated this major concern, “Not all labor market developments over the past year were positive, however; notably, the labor force participation rate fell by about 0.3 percentage points over the past year”.

Another issue cited in the decision was the high levels of long-term unemployed. The chart above shows how the percentage of unemployed people out of work for 27 weeks or more has remained high since the GFC. These two symptoms of underlying labour market weakness are the biggest concerns for economist and central bankers alike. Several studies have shown the long-term unemployed are less likely to get a job than equivalent candidates who have been unemployed for only a short time. Bernanke voiced such concerns on Wednesday “Ongoing declines in labour force participation, which likely reflects discouragement on the part of many potential workers”. This labour capacity may now be lost to the economy for ever whilst at the same time increasing the welfare burden.

With the labour market fresh in people’s minds, next week Friday’s U.S. Non-Farm Payrolls figure, monthly employment numbers, will be closely watched by taper speculators. The FOMC expect to have finished tapering by the time unemployment reaches the vicinity of 7.0%, currently at 7.3%; the latest FOMC projections see this happening by the middle of 2014. The committee have tried hard to project a dovish stance where if in doubt – they will leave stimulus on. Tapering may not have occurred this month but it will happen eventually, the risk asset bounce is only as good as the next round of tapering talk.

Please see below for specific currency commentary.

EUR & GBP

Angela Merkel was re-elected as German Chancellor on Monday to become the only major European leader to do so since the 2008 financial crisis.

Industry PMIs in Europe extended gains in recent months. All sector surveys released on Monday, barring French Manufacturing, were above 50.0 indicating economic growth in the region.

By Chris Chandler

Disclaimer: The above comments are only our views and should not be construed as advice. You should act using your own information and judgment. Although information has been obtained from and is based upon multiple sources the author believes to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the author’s own judgment as of the date of the briefing and are subject to change without notice. This information has been prepared for distribution via email and without taking into account investment objectives, financial situation and particular needs of any particular person. World First Pty Ltd makes no recommendations as to the merits of any financial product referred to in this article.

Please read our Product Disclosure Statement and our Financial Services Guide. E&OE. Definitions of jargon/market terms can be found in our Glossary of Foreign Exchange Terms.