U.S. political turkeys ruin Thanksgiving

Brief Summary:

• It was another relatively quiet week in terms of economic data. The AUD traded mostly on headlines that saw it hit a high against the USD of 1.0459, followed by a low of 1.0288, only to settle at 1.0356. AUDEUR traded on headlines out of Greece to be 0.8121 from a high of 0.8224 last week. AUDGBP followed the same trend to be 0.6511 after a high of 0.6587 (all rates at time of writing).

• Uncertainty over the U.S. fiscal cliff continues and Greece continues to negotiate its bailout terms.

• The Reserve Bank of Australia (RBA) released the minutes of their 6th of November interest rate decision. The decision to hold was primarily justified by the recent improvement in global economic conditions, namely the stabilisation of Chinese growth. Inflation was noted as higher than expected; however, the board recognised the carbon price introduction was the major contributor to this figure. Overall, the minutes illustrate the RBA’s easing bias, a favour for dropping rates; however another cut will be delayed for now. The December decision will be another close call, interest rate markets are pricing in a 68 percent chance of a rate cut to 3 percent.

• On Thursday, Purchasing Managers’ Indices (PMI) will be released for several countries’ manufacturing and services sectors. The PMI is a figure derived from a survey of purchasing managers that quantifies perceived business conditions. The index uses 50 as a midpoint where a figure above 50 indicates expansion and vice versa. The HSBC Flash Manufacturing PMI was mildly negative last month, where it has been since the middle of 2011. An improved figure this month may boost the AUD. PMI figures will also be released for France, Germany and the Euro zone (see below).

•Please see below for specific currency commentary.

Officially a reserve currency… almost

• The AUD and CAD gained on Monday, after the International Monetary Fund said they would be reclassified as reserve currencies in their Currency Composition of Official Foreign Exchange Reserves report. The quarterly report details the different currencies held by central banks around the world and currently lists the USD, GBP, EUR, JPY and CHF as official reserve currencies. The AUD jumped on the news; however, the revelation is nothing new.

• Since the global financial crisis, the traditional blue-chip economies have performed poorly and become overloaded with debt. Countries such as Australia and Canada stood out with sound financial systems, low debt levels, stable democratic political systems and strong export driven economies. Australia and Canada are two of only a handful of sovereigns to hold stable AAA ratings from all three ratings agencies.

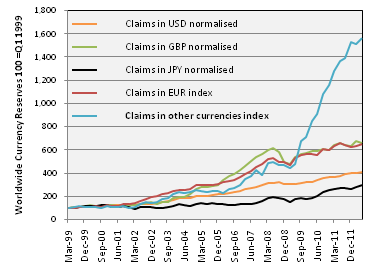

• The figure shows the growth of reserve currencies since 1999, notably, the inexorable rise of “other currencies”, where the AUD and CAD are currently housed. As mentioned in previous weekly updates, the AUD can be seen as a risk currency and a safe haven. The IMF’s reclassification can be seen as simply the IMF catching up with the market. With this in mind, we do not expect any sudden increase in demand for the AUD. Whilst the official reserve status may lead to more long term support and decreased volatility, as central banks tend to be slow at adjusting their holdings; this could become a curse.

• The figure shows the growth of reserve currencies since 1999, notably, the inexorable rise of “other currencies”, where the AUD and CAD are currently housed. As mentioned in previous weekly updates, the AUD can be seen as a risk currency and a safe haven. The IMF’s reclassification can be seen as simply the IMF catching up with the market. With this in mind, we do not expect any sudden increase in demand for the AUD. Whilst the official reserve status may lead to more long term support and decreased volatility, as central banks tend to be slow at adjusting their holdings; this could become a curse.

• A long-term inflated AUD may stress the Australian economy further. The ‘reserve currency’ status has proven a burden for countries like Switzerland, Japan and the United Kingdom. In 2011, the Swiss Central Bank placed a EUR/CHF floor in place in an attempt to protect its manufacturing industry. Similarly, the Japanese Central Bank and the Bank of England have both undertaken quantitative easing in order to devalue their currency. As a result of its strong currency, Japan’s exports have become uncompetitive against equivalent goods from China and Korea.

• The RBA repeatedly mention the high AUD in their statements of monetary policy. Manufacturing, tourism and other exports are already suffering due to the high AUD. Even the resources sector, the golden child of the economy, is feeling the impact. Australia is already seen as a high cost provider of coking coal (an ingredient in steel); a result of a high cost base and strong AUD. As the mining boom subsides in the years ahead, a strong currency may prove a significant obstacle for the Australian economy.

AUDUSD

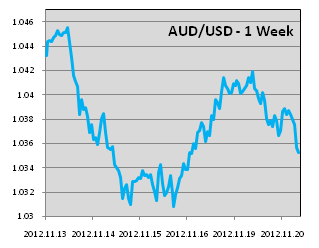

• AUDUSD had another bouncy week falling from a high of 1.0459, to a low of 1.0288, to be 1.0356 at time of writing.

• AUDUSD had another bouncy week falling from a high of 1.0459, to a low of 1.0288, to be 1.0356 at time of writing.

• Uncertainty over the fiscal cliff continued to dominate headlines in the U.S.. Commentators are becoming increasingly confident a deal will be reached. Republicans in the House of Representatives have become more willing to accept tax increases on the wealthy, although they continue to demand social spending cuts.

• Some worse than expected data was released last week, causing the dip we see in the weekly chart. U.S. Retail Sales Data for October was released on Wednesday night. Core Retail Sales, that excludes motor vehicles, was 0.0% from 0.2% expected and Retail Sales, including vehicles, was -0.3% from 0.2% expected. The data dampened risk sentiment and knocked AUDUSD from its high of 1.0459.

• Additionally, the Philly Fed Manufacturing Index, a monthly measure of manufacturing activity, was -10.7 from 1.1 expected. The index is derived from a survey of business managers, the majority of which claimed Hurricane Sandy had a negative effect on business activity in October. The Empire State Manufacturing Index, a measure of manufacturing business conditions in New York was also negative at -5.2.

AUDEUR

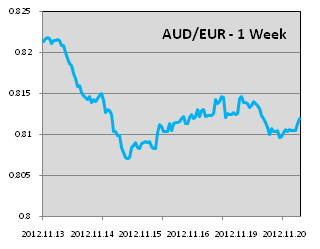

• AUDEUR traded headlines for the week touching a high of 0.8224, and a low of 0.8065, to be 0.8121 at time of writing.

• AUDEUR traded headlines for the week touching a high of 0.8224, and a low of 0.8065, to be 0.8121 at time of writing.

• Moody’s downgraded France’s sovereign rating to AA from AAA. The key drivers in the decision were structural rigidities hampering long term growth, an uncertain fiscal outlook caused by continued budget deficits and its lack of resilience to the Euro area crisis. The downgrade coincidentally came a day after The Economist newspaper published a special report on France called “The time-bomb at the heart of Europe”.

• On Thursday, manufacturing and services PMI will be released for Germany, France and the Euro zone. The figures are all expected to be below 50 indicating industry contraction. European PMI figures earned a particular mention in the RBA’s November minutes, “Economic activity in Europe remained weak. The PMIs and household and business sentiment remained at low levels across the region, including in France and Germany, which until recently had been more resilient.”

• Negotiations continue over Greece’s bailout package. The IMF are now calling for a form of debt forgiveness, terms that the Euro zone creditors will not accept.

By Chris Chandler