The AUD finds its legs

Brief Summary:

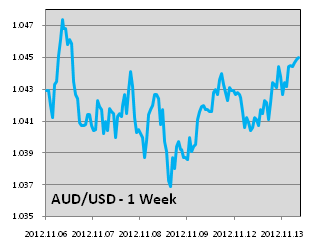

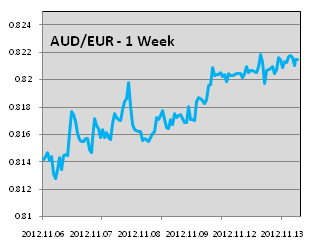

• Markets traded thinly on little data for the week starting Monday. Remembrance Day was observed worldwide on Sunday the 11th with North American markets closed on Monday as a result. The AUD found strength against all the major currencies, AUDUSD climbed to 1.0449, AUDEUR continued trended up to 0.8214 and AUDGBP also made gains to 0.6579 (all rates taken at time of writing).

• Positive Chinese data was released over the weekend that lent the AUD some support. The Chinese trade balance for October was 32.0billion from 27.1billion expected. A country’s trade balance measures exports minus imports of goods and services. The continued strength of Chinese exports subsequently drives demand for Australian raw materials and hence the AUD. Reading further into the data reveals exports have increased 11.6% from this time last year. Specifically, exports to South-East Asia have increased 45% from the same time last year, a result of the rising middle class and consumerism in the region. Additionally, exports to the U.S. were 9% up from the same time last year, highlighting the moderate U.S. recovery. On the other hand, exports to Europe have fallen by 8% for the year as the debt crisis crimps demand.

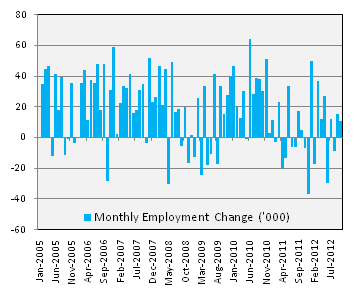

Australian Employment

• Australian employment data for October was released last Thursday. The figures beat expectations with 10,700 new full time jobs from only 200 expected. The unemployment rate also unexpectedly stayed steady at 5.4%. The data reduces the chances of a December interest rate cut after the Reserve Bank of Australia (RBA) kept rates on hold last Tuesday and reverted to a much more neutrally positioned statement. As will be discussed below, further cuts remain likely.

• Australian employment data for October was released last Thursday. The figures beat expectations with 10,700 new full time jobs from only 200 expected. The unemployment rate also unexpectedly stayed steady at 5.4%. The data reduces the chances of a December interest rate cut after the Reserve Bank of Australia (RBA) kept rates on hold last Tuesday and reverted to a much more neutrally positioned statement. As will be discussed below, further cuts remain likely.

• Two weeks ago the weekly update gave a little insight into U.S. employment. This week we will examine Australia’s. Unlike the U.S., Australia’s employment is a picture of health thanks in part to the mining boom.

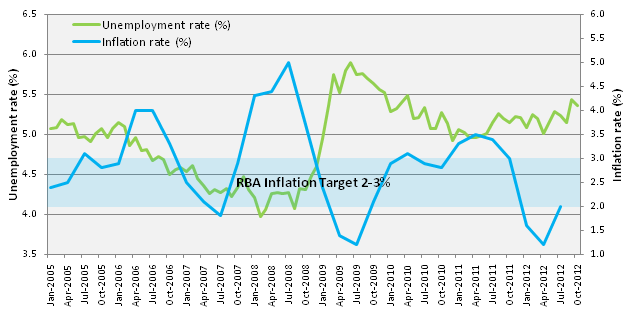

• The figure shows the simplistic relationship between the Australian unemployment rate and the inflation rate since January 2005. It is also a simplistic illustration of an economic principle called the natural unemployment rate or Non-accelerating inflation rate of unemployment (NAIRU).

• The hypothesis states that if the actual unemployment rate is below the natural unemployment rate, inflation tends to accelerate. Put simply, there is a natural amount of the labour force that are unemployed as they are between or changing jobs. Demand for workers that pushes the unemployment rate below this natural rate must be accompanied by higher wages that therefore leads to inflation.

• The NAIRU has been estimated by the federal government at between 4.5% and 5%. The figure above shows two distinct times since 2005 when the unemployment rate approached this level causing inflation to accelerate. Both were periods when the economy was booming from 2006 to the financial crisis in 2008 and in 2010. The RBA responded to this inflation by raising the benchmark interest rate six times between 2006 and 2008 and four times during 2010.

• In 2012, unemployment has trended up slightly and inflation is low. The RBA has become increasingly responsive to global economic conditions and is in a cycle of monetary easing or cutting rates. With the mining boom stabilising in the medium term, and industries such as financial services and manufacturing declining, we expect the unemployment rate to continue ticking up next year. This combined with continued fragile global economic conditions; we expect one to two rate cuts by the end of the first quarter of 2013. A lower interest rate will reduce demand for the AUD, although Australia will continue to have the highest interest rate in the G10 even after a 50 basis point reduction.

• The RBA will release the minutes from the November interest rate decision on Tuesday. The minutes may give further insights into their stance on economic conditions.

• On the east side of the Tasman, New Zealand’s employment figures went notably south. Quarterly employment growth was -0.4% from 0.3% expected and the quarterly unemployment rate soared to 7.3% from 6.8% last quarter. A historically high NZD has hurt manufacturing exports and the data may prompt the Reserve Bank of New Zealand to cut rates further. NZDUSD fell 1.5 cents on the news to 0.8171 at time of writing, whilst AUDNZD recovered most of the ground lost during September and October to be 1.2788 at time of writing..

•Please see below for specific currency commentary.

AUDUSD

• AUDUSD had a bouncy week as the result of the RBA interest rate decision, the U.S. election, Australian employment data and fears over the U.S. fiscal cliff. The AUD jumped to a high of 1.0481 after Obama’s re-election before the markets turned to the next problem of the fiscal cliff.

• AUDUSD had a bouncy week as the result of the RBA interest rate decision, the U.S. election, Australian employment data and fears over the U.S. fiscal cliff. The AUD jumped to a high of 1.0481 after Obama’s re-election before the markets turned to the next problem of the fiscal cliff.

• Fiscal cliff is the affectionate name given to automatic tax increases and spending cuts in the U.S. that will begin occurring in January. The challenge ahead is for Obama to negotiate tax reforms and extensions of spending through the Republican controlled House of Representatives.

• Fears are that the Republicans will block Obama’s reforms that include raising taxes on the wealthiest Americans. Such political wrangling takes time and may mean the U.S. economy goes off the fiscal cliff, albeit temporarily. Such fears dampen risk sentiment and hence soften the stock market and risk currencies like the AUD and NZD.

• Ahead this week is U.S., Retail Sales data is released on Thursday and the Philly Fed Manufacturing Index, a measure of manufacturing activity, is released on Friday. Better than expected figures will continue the trend of positive U.S. data and may boost risk sentiment.

AUDEUR

• AUDEUR traded on news headlines this week continuing its uptrend as uncertainty over Greece came back to the fore. AUDEUR was 0.8214 at time of writing.

• AUDEUR traded on news headlines this week continuing its uptrend as uncertainty over Greece came back to the fore. AUDEUR was 0.8214 at time of writing.

• Last week, the Greek parliament narrowly approved a new EUR 13.5 billion austerity plan, much to the dismay of Greeks who protested in response. Approval of the package was crucial for the EUR 31.5-billion-euro tranche of rescue funding to be released.

• The Centre for European Economic Research (ZEW) released their German Economic Sentiment index last night (Tuesday). The figure disappointed markets at -15.7 from -9.9 expected. The figure shows German business conditions being hampered by the debt crisis.

AUDGBP

• In the UK, monthly Consumer Price Inflation was released and came in higher than expected at 2.7%. The reaction was relatively muted as much of the inflation figure was due to sharp increases in university tuition fees whilst most other price measures remained fairly steady. The figure may lead the Bank of England to stop increasing its quantitative easing program.

By Chris Chandler