Four more years

Brief Summary:

• Green Moon wins the Melbourne Cup paying $20; much to the dismay of everyone in the World First office.

• Barack Obama is successfully re-elected as President of the United States.

• The Reserve Bank of Australia decided to keep interest rates on hold at 3.25%. The move was not predicted by many, interest rate markets had priced a fifty percent chance before the decision, and twenty of twenty-seven economists surveyed by Bloomberg were calling for a 25 basis point cut. The AUD rallied on the news jumping sharply from 1.0365 to reach a high of 1.0446 later in the evening.

• As expected, the RBA’s accompanying statement reverted to a more neutral stance. Noteworthy moments include “recent data from China suggest growth there has stabilised”, although they reiterated concerns about slower resultant growth in Asia and continued uncertainty over Europe. With regard to inflation, “Recent outcomes on inflation were slightly higher than expected, though they still show inflation consistent with the medium-term target”. Much of the inflation figure was put down to the introduction of the carbon price with expectations of further effects to come. The board also stated, “there are signs of easier conditions starting to have some of the expected effects” referring to the fact previous cuts have been effective, yet they maintain the exchange rate is higher than expected. The detailed statement of monetary policy is released on Friday the 9th.

• The Australian Bureau of Statistics (ABS) released Australian monthly retail sales growth and the trade balance on Monday. Retail sales grew 0.5% for the month from 0.4% expected and, as mentioned above, is a sign earlier rate cuts are having an effect on the economy. The trade balance was also better than expected at -1.46 billion; the trade balance measures the difference between imported and exported goods in the economy.

• The ABS also releases Australian employment data for October on Thursday 8th. Expectations are for just 2000 new jobs and unemployment ticking up slightly to 5.5%. Worse than expected figures may increase the chances of a December or early 2013 rate cut and could soften the AUD.

• New Zealand also releases employment data for October on Thursday. The market is expecting 0.3% quarterly employment growth and an unemployment rate of 6.7%.

The U.S. Election

• American news networks have unanimously projected Obama will be re-elected for a second term. Our friends at Google are tracking the result with this interesting interactive map http://www.google.com/elections/ed/us/results.

• The foreign exchange market priced in the Obama victory early. Risk currencies rallied on the news, boosting the AUD, NZD and CAD. This is due to the expectation that the Federal Reserve’s (Fed) quantitative easing measures are likely to continue under a second Obama term. Conversely, Romney had declared he would not reappoint Fed chairman Ben Bernanke, creating uncertainty over future easing. The election was a major risk event that had kept trading volumes light and reactions to data muted.

• The next hurdles ahead for the U.S. will be the debt ceiling and much anticipated fiscal cliff. Although the Democrats hold the White House, the Republicans control the House of Representatives and the battle is still waging over the Senate. This scenario is likely to cause extended political wrangling over the fiscal cliff.

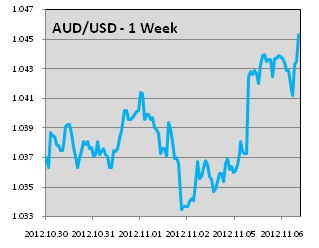

AUDUSD

• AUDUSD remained well supported above 1.0350 for most of the week. Tuesday’s interest rate decision caused the AUD to rally above 1.0400, with the Obama victory adding momentum. AUDUSD was 1.0455 at time of writing.

• AUDUSD remained well supported above 1.0350 for most of the week. Tuesday’s interest rate decision caused the AUD to rally above 1.0400, with the Obama victory adding momentum. AUDUSD was 1.0455 at time of writing.

• As we covered in last week’s update, U.S. Non-Farm Payrolls was released on Friday. The figure, a measure of the number of jobs created in the previous month excluding agriculture, showed 171,000 jobs were created in October. Despite this much better than expected figure, the unemployment rate ticked up slightly to 7.9%. This was due to people re-entering the work force shown in the participation rate; ticking up from 63.6% to 63.8%. Risk assets, including the AUD, rallied leading up to the figure but faded after it was released somewhat counter intuitively. The reversal was said to be due to expectations quantitative easing measures by the Fed may be cut short given a stronger recovery.

• The Institute of Supply Management released its U.S. Manufacturing Purchasing Managers’ Index (PMI), a survey that measures manufacturing activity. The figure was 51.7, showing expansion when above 50, and adds to the trend of better than expected U.S. data.

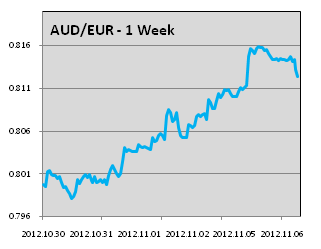

AUDEUR

• AUDEUR continued to gain traction above 0.8000 as renewed uncertainty over Greece’s bailout led to EUR weakness. AUDEUR was 0.8125 at time of writing.

• AUDEUR continued to gain traction above 0.8000 as renewed uncertainty over Greece’s bailout led to EUR weakness. AUDEUR was 0.8125 at time of writing.

• The Greek parliament will vote on the latest round of austerity measures this week. Approval of the measures is required by November 12th to unlock the next EUR 31 billion portion of aid. The Greek public are striking in protest and left wing members of parliament are predicted to abstain from voting. The tumult is raising uncertainty over Greece’s ability to bailout conditions although officials claim a deal will be reached.

• The European Central Bank will set the benchmark interest rate on Thursday night; expectations are that they will maintain the status quo.

• The alarm bells are ringing for France. Within 24 hours, the International Monetary Fund and Louis Gallois, the investment commissioner, have release separate reports on the sorry state of French competitiveness. Their warnings included over-taxation and complex bureaucracy for corporations, and the risk of falling being Italy or Spain.

By Chris Chandler