The storm has passed… Or are we in the eye?

Brief Summary:

• Markets were thinly traded this week due to the impending doom of Hurricane Sandy. Financial markets in New York were closed, namely, the New York Stock Exchange was closed for consecutive days due to weather for the first time since 1888. As day dawned on Tuesday, the extent of the physical damage was revealed whilst the financial costs will be counted for months to come.

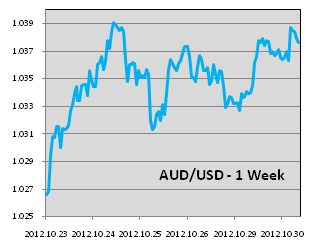

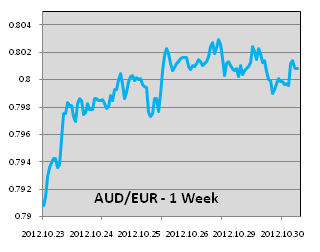

• In foreign exchange markets the USD counter intuitively made gains before the storm as risk sentiment waned and investors sought a ‘safe haven’. AUDUSD has since recovered to 1.0377, AUDEUR at 0.8013 and AUDGBP 0.6452 at time of writing.

• A potentially volatile first week of November lies in wait. The Reserve Bank of Australia (RBA) will decide the cash rate on Tuesday the 5th. The decision has gained uncertainty after last quarter’s inflation figure was higher than expected at 1.2%. Annual inflation however remains at the bottom of the RBA’s target range at 2%. Additionally, Australian employment figures are released next Thursday.

• Tuesday is also Melbourne Cup day and likely to steal punters’ attention from financial markets.

A big week ahead for the U.S.

• Financial markets will remain focused on the U.S. as important employment and manufacturing figures are released this Friday, and the 57th presidential election will take place on Tuesday the 6th.

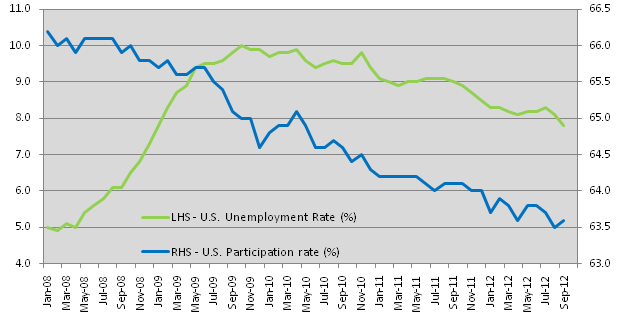

• This year’s election has been a melting pot of social and economic issues. With a fragile economic recovery taking place in the U.S., the most resounding theme has been that of jobs. The post global financial crisis labour market in the U.S. has been markedly worse compared to previous economic crises. Whilst people cheered last month when the unemployment ticked below 8.0% for the first time since 2008, the figure alone is misleading.

• The graph above overlays the U.S. unemployment rate with the U.S. participation rate. The unemployment rate measures the percentage of the work force that is unemployed and looking for work, where as the participation rate measures the size of the work force as a percentage of the total population. The perceived improvement in employment conditions has been overstated due to reductions in the participation rate. Put simply, unemployed people are becoming disenchanted and giving up looking and leaving the work force.

• There a several reasons for the decline. One is the demographic shift taking place as baby boomers reach retirement age. Another is the severe lack of certainty about future government policy. The election result will start to clear the air; the next hurdle is the ‘fiscal cliff’. The fiscal cliff is set to begin early next year where tax concessions and spending increases are set to automatically expire. The cliff is equivalent to pulling 5% of the GDP out of the economy all at once. The newly elected president, be it Romney or Obama, is unlikely to let the economy go off the cliff, but the uncertainty is hampering business conditions. The recovery in the labour market is dependent on certainty over government policies.

• Until business conditions improve, low levels of employment will remain a medium term ailment of the financial crisis. On November 6th the American people will decide the route to recovery, Romney’s path of fostering business conditions at the expense of the safety net, or Obama’s mission for equality, healthcare and education. According to a poll by CNN, Obama face masks outsold Romney masks 60 to 40% over Halloween. These sales have accurately predicted the presidential election since 1996.

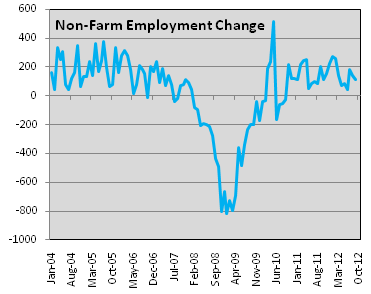

• On Friday, the Bureau of Labor Statistics releases Non-Farm Employment Change, a monthly measure of jobs created excluding agriculture. Expectations are for 123,000 new jobs last month, a slight increase from 114,000 in September, but remains lacklustre compared with the boom times between 2004 and 2006 (see right). The unemployment figure will also be released; a slight tick up to 7.9% is expected.

• On Friday, the Bureau of Labor Statistics releases Non-Farm Employment Change, a monthly measure of jobs created excluding agriculture. Expectations are for 123,000 new jobs last month, a slight increase from 114,000 in September, but remains lacklustre compared with the boom times between 2004 and 2006 (see right). The unemployment figure will also be released; a slight tick up to 7.9% is expected.

• Additionally on Friday, The Institute of Supply Management will release Purchasing Managers’ Index (PMI) for October. The figure is expected to be 51.2 showing a slight expansion of manufacturing activity.

• Better than expected figures may improve risk sentiment and boost currencies like the AUD and NZD. They may also help to quell the Republican argument that Obama’s policies are not aiding the recovery going into the election.

• Better than expected figures may improve risk sentiment and boost currencies like the AUD and NZD. They may also help to quell the Republican argument that Obama’s policies are not aiding the recovery going into the election.

• In the past week, AUDUSD has jumped back from below 1.0300 to 1.0377 at time of writing. The bounce back was the result of a better than expected CPI figure, reducing the chances of an RBA rate cut in November.

AUDEUR

•AUDEUR climbed back above 0.8000 on Friday where it remained until time of writing.

•AUDEUR climbed back above 0.8000 on Friday where it remained until time of writing.

• Last week, German Manufacturing PMI was 45.7 from 48.1 expected and Services PMI was 45.3 from 46.6 expected. Next door, French PMI Manufacturing was 43.5 from 43.9 expected and Services PMI was 46.2 from 45.6 expected. The figures, all below 50, indicate contraction. The crisis continues to hurt business confidence and conditions even in relatively healthy Germany and France.

• The headlines continue to repeat themselves with regard to Greece and Spain. In Spain, regional elections continue with separatists in Basque country increasing their majority. The Spanish government continues to hold off on their bail out request. The Greeks continue to negotiate with creditors.

AUDGBP

• Last Thursday, the U.K. released their preliminary GDP of 1.0% growth for the quarter. The figure was better than expected and ends the double dip recession that has entrapped the U.K. since the beginning of the year. The Olympics are said to have contributed, the real test will be sustaining the growth. The Pound strengthened immediately following the figure, AUDGBP falling to 0.6400 only to return to 0.6452 at time of writing.

By Chris Chandler