November RBA rate cut now the dark horse

Brief Summary:

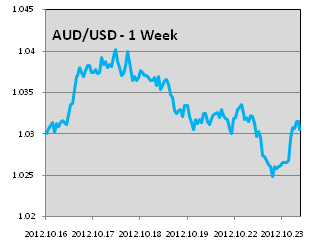

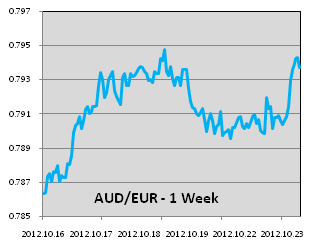

• The AUD had mixed movements against the majors in the week past. AUDUSD gained late last week on the back of improved risk appetite to reach a high of 1.0412, only to settle back when it started at 1.0313 at time of writing. AUDEUR continued to sit in its 1.5 cent range between 0.7850 and 0.8000 where it has been since October 9th. AUDEUR’s latest was 0.7942. AUDGBP made gains through the week from a low of 0.6384 to 0.6467 at time of writing.

• Australian Consumer Price Index (CPI), a measure of inflation, was released today. The seasonally adjusted quarterly figure was 1.2% from 0.9% expected and the highest figure since the second quarter of 2011. The yearly figure is now placed at 2%, at the bottom end of the RBA’s 2-3% target range. Noted significant price increases were electricity, up by 15.3%, and the cost of international travel up by 6.6%. Both increases may be attributed to the carbon tax. The most significant decrease was petrol at -3.9%, this is in line with the recent decline in oil prices. Market commentators now see a slimmer chance of a rate cut in November, but interest rate swap markets continue to price in another full cut by early next year.

Chinese Manufacturing and GDP

• China’s GDP growth was released on Thursday 18th at 7.4%, meeting expectations, whilst Chinese Retail Sales followed, with a year on year increase of 14.2% compared with 13.2% expected.

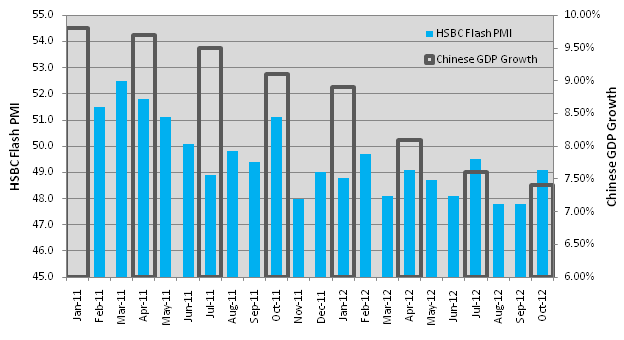

• The HSBC Flash Purchasing Managers’ Index (PMI) was released today (Wednesday) at 49.1. The measure of manufacturing activity, which indicates expansion when greater than 50, is the highest figure in three months, although, has not been convincingly above 50 since June 2011. This piece of data tends to bump the AUD if it is much better or worse than previously. This month’s figure was much better than the 47.8 reading of the last two months. The AUD jumped on the news, though a move on this data tends to be short lived.

• The constant fears of a Chinese ‘hard landing’ have plagued the AUD with bearish swings and led the media to declare the mining boom over in Australia. The figure above illustrates the decline of GDP growth and the HSBC measure of manufacturing activity since the beginning of 2011.

• China’s golden years of 10% GDP growth may be gone but it can be argued that they were never sustainable. The current rate remains solid, and as argued by the RBA, is more sustainable. The decline in manufacturing activity reflects the difficult global economic conditions caused by the Euro crisis. Continued solid increases in retail sales figures in spite of the weak global economy, embodies the view of The People’s Bank of China that the transition from a manufacturing export based economy to a consumer based economy is occurring.

• Additional PMI data is released tonight for manufacturing and service sectors in France and Germany. While the figures are expected to show a continued decline, a less severe decline may show steps taken to resolve the crisis may have boosted business confidence.

• The US released the Fed Philly Manufacturing Index on Friday that read 5.7 from 1.3 expected, adding to the positive surprises from US economic data recently. The Federal Open Market Committee (FOMC) will deliver their monetary policy statement on Thursday. Rates are expected to remain near zero; however, the accompanying statement may provide insights into future monetary policy decisions such as quantitative easing measures.

•Please see below for specific currency commentary.

AUDUSD

• A slightly volatile week for AUDUSD. The AUD rallied soon after the last WF weekly update to reach a high of 1.0412 on Friday. Good Chinese GDP and U.S. manufacturing figures helped to boost sentiment; however, the shine wore off ahead of Australia CPI and Chinese PMI figures setting a low of 1.0236. In the end the AUD finished up where it started a week ago at 1.0313.

• The FOMC will deliver their monetary policy statement on Thursday. The statement may provide insight into future policies on monetary easing. The market is cautious that the recent trend of better than expected US economic data will lead to a less accommodative statement from the FOMC. The USD made gains across the board on Tuesday night in anticipation of such a result.

• US Advanced quarterly GDP is released late on Friday with 1.9% expected. July 2012 and October 2011 aside, US quarterly GDP growth as disappointed for the last ten quarters. A good figure this quarter may give Barrack Obama a much needed boost to his economic record going into the November 6th presidential election. A good figure may lend the AUD some further support along with other risk assets.

AUDEUR

• Uncertainty over the ‘imminent’ Spanish bailout and a lack of market moving news kept AUDEUR fairly range bound just above 0.7900, to be 0.7942 at time of writing.

• In Spain, the PM Rajoy’s party Partido Popular (PP) has won the regional elections in the region Galicia, a minor relief as the threat grows that they will lose control of more regions. While the country clawed onto its investment grade rating last week, several Spanish regions were downgraded by Moody’s yesterday including the separatists Catalonia.

• German and French manufacturing and service sector PMIs are released tonight. A slowdown in declines may indicate steps taken to resolve the crisis are boosting business confidence.

• The European Central Bank (ECB) president Mario Draghi speaks tonight about the ECB’s emergency bond buying program. Critics fear the move breaks the ECB tradition of strong inflation control through monetary responsibility. The speech may also clarify conditionality attached to any bailout that Spain will receive. This is the crucial factor holding Spain back in making a bailout request.

AUDGBP

• The GBP has softened across the board ahead of this quarter’s GDP figure.

• The UK releases preliminary GDP figures on Thursday. 0.6% annualised growth is expected for this quarter from -0.4% last quarter. A good figure may indicate the beginning of the end of the double dip recession that has hampered the UK since the global financial crisis.

By Chris Chandler