A Band-Aid for a Broken Leg

Brief Summary:

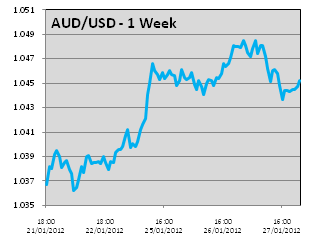

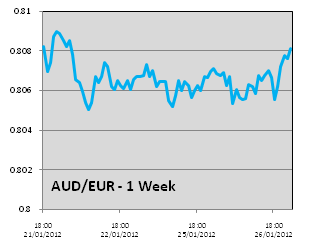

• Risk sentiment took the wheel this week and steered the AUD to 2-month highs against the USD. AUDUSD touched a high 1.0490 on Tuesday before retreating slightly to 1.0447. The EUR found support on the back of news a Greek bailout deal had been reached. AUDEUR traded within a half cent range for most of the week to be at 0.8083. AUDGBP made slight gains from a low of 0.6486 last week to 0.6530 (all rates taken at time of writing).

• Greece dominated headlines this week as a tentative deal was reached releasing the next tranche of bailout funds. The deal is said to bring debt levels down to 124% of GDP by 2020, a level that has been defined as sustainable by the Troika aka The Three Horsemen of the Greek Apocalypse. Many market commentators continue to view the deal as a ‘band-aid’ fix, although, the deal has generally been supportive of the EUR. EURUSD gained from a low of 1.2829 last week to a high of 1.2994 on the news.

• The U.S. Fiscal Cliff is set to continue dominating headlines for the remainder of 2012. The painfully slow negotiations have dampened risk sentiment, softening share markets and risk currencies. Senate Majority Leader Harry Reid, a democrat, stated “There’s been little progress with the Republicans, which is a disappointment to me”.

• The Reserve Bank of Australia (RBA) will meet on Tuesday the 4th of December to make their final monetary policy decision of 2012. Commentators are split over whether a cut will be made or not. The November monetary policy minutes released last week Tuesday showed the RBA has a clear bias towards cutting rates, although, the board noted the recent improvement in global outlook. Given there is no meeting in January, the RBA may pre-empt any fallout from the U.S. Fiscal Cliff by cutting the cash rate next week. Interest rate swap markets are pricing a 61 percent chance that the cash rate will be cut from 3.25% to 3.00% on Tuesday.

• A couple important pieces of Australian data will be released early next week. Australian monthly retail sales growth will be released on Monday; October’s figure was 0.5%. Australian GDP growth for the third quarter will be released on Wednesday, last quarter’s figure was 0.6%.. Better than expected figures may boost the AUD against the majors.

• Chinese Manufacturing data for was released last Thursday. The HSBC Flash Manufacturing Purchasing Managers’ Index (PMI) was better than expected at 50.8, a 13-month high. The survey of purchasing managers conducted by Markit Economics indicates expansion when above 50 and vice versa. The figure adds weight to the RBA’s position that Chinese growth appears to be stabilising and paved the way for the AUD to rally on Friday. Another Chinese Manufacturing PMI is released on Saturday; expectations are for a reading of 50.8.

•Please see below for specific currency commentary.

AUDUSD

• AUDUSD speculatively rallied on Friday on news a Greek bailout deal would be reached and Fiscal Cliff negotiations were progressing. AUDUSD reached a high of 1.0490 to be 1.0447 at time of writing.

• AUDUSD speculatively rallied on Friday on news a Greek bailout deal would be reached and Fiscal Cliff negotiations were progressing. AUDUSD reached a high of 1.0490 to be 1.0447 at time of writing.

• The Institute of Supply Management will release U.S. Manufacturing PMI on Tuesday; the figure was 51.7 last month.

• US Preliminary GDP for the third quarter was released overnight on Thursday. This release is the first revision of the 2.0% Advance GDP figure released on the 26th of October. The market is expecting an upward revision to 2.8%.

• So long as the Fiscal Cliff continues to steal the limelight, market reactions to U.S. data are likely to be fairly muted.

The Fiscal Cliff

• According to Harry Reid, the Democratic leader of the Senate majority, little progress has been made towards a compromise on the Fiscal Cliff. Ideological and political wrangling continues as Republicans attempt pressure Obama to reduce spending and keep taxes low.

• The following is just one illustration of the current stand-off between left and right. John Boehner, the speaker of the Republican controlled House of Representatives, has allegedly drawn a line in the sand at increases in marginal tax rates. Obama would like to see Bush’s tax cuts for the wealthy expire, raising their contribution to tax revenue. This front on approach to redistribution is an ideological deal breaker for Republicans, who traditionally believe in trickle-down economics. Other means of raising taxes from the wealthy seem more palatable to House Republicans such as, setting limits on tax deductions or eliminating certain deductions. One such deduction being targeted is that for interest paid on one’s own home. In Australia, interest paid is only deductable for an investment property, whereas in the U.S., interest paid is deductable for all properties. The deduction favours wealthy people with large houses, whilst it also encourages people to take out large mortgages.

• Eliminating the deduction makes logical sense, however the political motivation for Republican support is more complex. Safe Democratic states can be found in the North East and West coasts of the country. Property prices in these coastal areas are also generally higher than the Republican held inland states. A cessation of this deduction will therefore hit wealthy property owners in safe Democratic states hardest, minimising the impact on the Republican supporter base dwelling inland.

AUDEUR

• AUDEUR was fairly range bound for the week, staying within a half cent range. AUDEUR fell from last week’s high of 0.8129 as the EUR found support on the back of the Greek bailout deal. AUDEUR was 0.8083 at time of writing.

• AUDEUR was fairly range bound for the week, staying within a half cent range. AUDEUR fell from last week’s high of 0.8129 as the EUR found support on the back of the Greek bailout deal. AUDEUR was 0.8083 at time of writing.

• Most importantly, the next tranche of Greek bailout funds will be released from the European Financial Stability Facility (EFSF), staving off imminent default.

• The deal has been labelled by many commentators as a ‘band-aid’ solution that does not fix the structural issues the Greek economy faces. The Troika, approved the austerity measures implemented by the Greek parliament and their fiscal strategy.

• Some of the talking points of the deal include; debt is to be reduced to 124% of GDP by 2020 from the 190% forecast for 2014. As a comparison, Australia’s debt to GDP ratio is about 27% and the U.S.’s is about 73.5%. As austerity crimps GDP, such targets will be increasingly hard to achieve. Interest payments to the EFSF will also be deferred for the first 10 years. The full report can be read here.

• The debt crisis is by no means solved. We expect the same issues to continue playing out next year with Spain still embroiled in crisis and France next in line.

• Eurozone manufacturing and service PMIs were released last Thursday yielding several positive surprises. Manufacturing figures were better than expected in France, Germany and the Eurozone, and services figures were better than expected in France. Click to view the full releases for the Eurozone, France and Germany. Reaction to the figures was muted as they continue to show a contraction in industry activity, albeit at a slightly less severe rate.

AUDGBP

• Bank of Canada Governor Mark Carney will take over from Mervin King as Governor of the Bank of England (BoE). He is considered more hawkish, less in favour of monetary easing, causing speculation that Quantitative Easing undertaken by the BoE may be cut short. Carney will be taking over on 1 July 2013 after a year that has seen a $ 2.3 billion trading fraud and a LIBOR rigging scam unearthed. The U.K. also pulled itself from a double dip recession after a successful Olympic Games; the question will be whether growth can be sustained.

By Chris Chandler