Ho Ho Ho! Merry Rate Cut and a Happy New Loan

Brief Summary:

• The Reserve Bank of Australia (RBA) decided to cut the cash rate 25 basis points from 3.25% to 3.00% just in time for Christmas. The AUD bucked the trend climbing about 0.25% against the majors immediately after the decision and extending gains later. This week is loaded with Australian economic data that will set the scene for the remainder of 2012.

• Fiscal cliff negotiations continue in the U.S. although little progress seems to have been made.

• Australian GDP growth was released today at 0.5% for the quarter, slightly worse than the 0.6% expected. Mining contributed 0.4 percentage points to the figure and Manufacturing and Healthcare contributed the remaining 0.1 percentage points.

• Additional Australian data this week; Australian employment data is released on Thursday, and the Australian trade balance, the value of imports less exports, is released on Friday.

• A Chinese Manufacturing Purchasing Managers’ Index was released over the weekend and read 50.6 from 50.8 expected. The figure shows a continued slight expansion of manufacturing activity and adds weight to the view that Chinese growth has stabilised.

The End of the Line

• The RBA’s decision to cut the cash rate was predicted by many; however, the market reaction seemed to break from normal. The AUD made gains after the decision and extended these gains overnight. The gains can be put down to the markets interpretation of the concluding paragraph of the accompanying statement.

“Over the past year, monetary policy has become more accommodative. There are signs of easier conditions starting to have some of the expected effects, though the exchange rate remains higher than might have been expected, given the observed decline in export prices and the weaker global outlook. While the full effects of earlier measures are yet to be observed, the Board judged at today’s meeting that a further easing in the stance of monetary policy was appropriate now. This will help to foster sustainable growth in demand and inflation outcomes consistent with the target over time.”

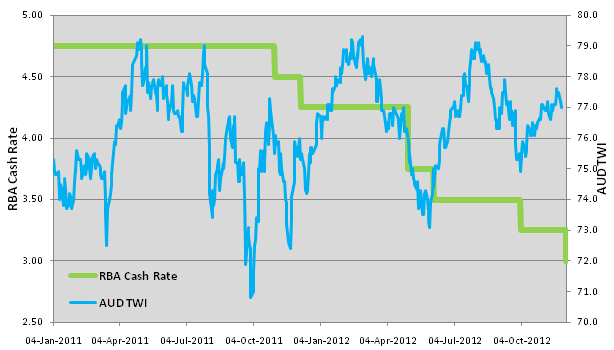

• The statement has a closing tone, suggesting that this marks the end of the easing cycle. Below is a timeline of the easing cycle that took the cash rate from 4.75% to 3.00%, the latter equal with that at the height of the global financial crisis and before that, half a century ago. The statement reiterated once more, a sense the “higher than might have been expected” AUD, that will be explained below.

• •The writing was on the wall on Monday with regard to the rate cut, a swathe of poor data was released that led interest rate swap markets to price the cut in as a certainty. Monthly retail sales growth for October was 0.0% from 0.4% expected. Quarterly capital expenditure, a measure of business investment released last Thursday, was 2.8% and although better than expected, the details reveal capital expenditure in the struggling manufacturing sector continues to decline sharply. Other minor pieces of data disappointed including ANZ Job Advertisements, down 2.9% and Company Operating Profits, down 2.9% in the quarter.

• •The writing was on the wall on Monday with regard to the rate cut, a swathe of poor data was released that led interest rate swap markets to price the cut in as a certainty. Monthly retail sales growth for October was 0.0% from 0.4% expected. Quarterly capital expenditure, a measure of business investment released last Thursday, was 2.8% and although better than expected, the details reveal capital expenditure in the struggling manufacturing sector continues to decline sharply. Other minor pieces of data disappointed including ANZ Job Advertisements, down 2.9% and Company Operating Profits, down 2.9% in the quarter.

• So why the continued support for the AUD? As discussed previously, the AUD has become an increasingly popular reserve currency for central banks and global investors. The logical underpinning of a higher interest rates leading to currency appreciation, and vice versa, is the currency carry trade. From our perspective, this is global investors’ demand for Australia’s interest rate, the highest in the developed world.

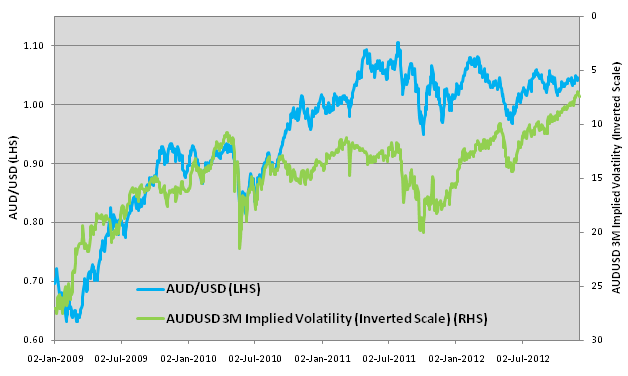

• Despite the fact interest rates have been cut to levels last seen during the 2009 financial crisis, the AUD has continued appreciating to historically high levels. One reason for this is the multi-year low levels of volatility in the AUD. Volatility measures the variance in prices over a given period of time. The chart below overlays AUDUSD (left scale) with AUDUSD 3-month implied volatility (inverted right scale) since the beginning of 2009.

• As we know, the carry trade relies on earning income from the higher yielding currency. However, increased volatility means there is an increased chance of an unfavourable exchange rate move. The relationship above is due to the fact that as volatility decreases, the chance that this income will be wiped out by a sudden unfavourable move in exchange rates decreases. In other words, the return has become more certain. This explains why despite multiple rate cuts, the AUD maintains strong support.

• As we know, the carry trade relies on earning income from the higher yielding currency. However, increased volatility means there is an increased chance of an unfavourable exchange rate move. The relationship above is due to the fact that as volatility decreases, the chance that this income will be wiped out by a sudden unfavourable move in exchange rates decreases. In other words, the return has become more certain. This explains why despite multiple rate cuts, the AUD maintains strong support.

• With rate cut expectations largely dissolved by the most recent RBA statement, and volatility remaining at multi-year lows due to the AUD’s safe haven status, we expect to see continued AUD support.

•Please see below for specific currency commentary.

AUDUSD

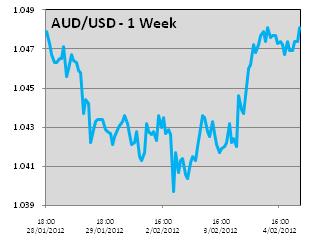

• AUDUSD dipped late last week as uncertainty over the fiscal cliff dampened risk and the market started pricing in the looming interest rate cut. The AUD recovered all lost ground after the rate decision.

• AUDUSD dipped late last week as uncertainty over the fiscal cliff dampened risk and the market started pricing in the looming interest rate cut. The AUD recovered all lost ground after the rate decision.

• Little progress appears to have been made towards a fiscal cliff solution. On Tuesday, President Obama firmly reiterated that a deal must include take hikes for the wealthy. The Republicans continue to insist on increased tax revenue coming from tax reform rather than outright increases.

• The U.S. Institute for Supply Management released its Manufacturing Purchasing Managers’ Index (PMI) for November on Monday. The figure is a nationwide measure of manufacturing business conditions and indicates expansion when over 50. The figure was 49.5, the lowest reading since 2009. Respondents of the survey indicated uncertainty over fiscal cliff negotiations are hampering business. The reading is an illustration of the dangerous line being walked by ideological politicians given current fragile economic conditions.

• On Friday, U.S. Non-farm employment change will be released, a measure of jobs added during November. Expectations are for 91,000 new jobs, although, a market reaction may be muted as the fiscal cliff steals attention.

AUDEUR

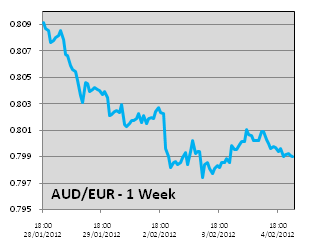

• The EUR made steady gains over the week; AUDEUR fell from a high of 0.8090 to 0.7990 at time of writing.

• The EUR made steady gains over the week; AUDEUR fell from a high of 0.8090 to 0.7990 at time of writing.

• The market warmed to Greece’s government debt buyback program to which it has pledged EUR 10 billion, the first steps to reducing its unsustainable debt levels.

• The European Stability Mechanism approved the first tranche of Spain’s bank recapitalisation program, adding further to Euro confidence.

• The European Central Bank will decide the benchmark interest rate on Thursday night; expectations are for rates to remain on hold at 0.75%.

By Chris Chandler