The Fed Fires Up The Printing Press…Again

Brief Summary:

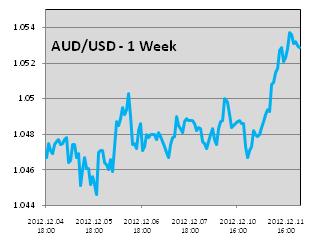

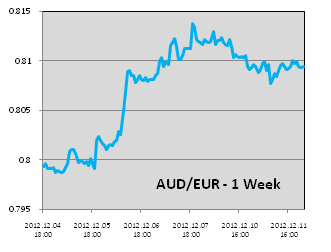

• The AUD rallies to the strongest levels seen against the USD for several months. AUDUSD climbed on the back of USD weakness to a high of 1.0541. AUDEUR made gains last Thursday as the European Central Bank lowered growth forecasts and opened the door to possible rate cuts. AUDEUR reached a high of 0.8139 to be 0.8097 at time of writing. AUDGBP was fairly stable trading between 0.6500 and 0.6550 to be 0.6534 at time of writing.

• Following the Reserve Bank of Australia’s decision to cut the cash rate last Tuesday, better-than-expected Australian Employment Data for November was released last Thursday. 13,900 new jobs were created although the AUD gained only marginally on the data. The details reveal all new jobs were part-time, and full-time jobs actually decreased by 4,200.

• Following the Reserve Bank of Australia’s decision to cut the cash rate last Tuesday, better-than-expected Australian Employment Data for November was released last Thursday. 13,900 new jobs were created although the AUD gained only marginally on the data. The details reveal all new jobs were part-time, and full-time jobs actually decreased by 4,200.

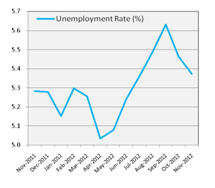

• The unemployment rate decreased from 5.4% to 5.2% after peaking just over 5.6% in September. Despite the headline figures, the data reveal employment conditions are softening slightly which is due to keep inflation contained as predicted by the RBA.

• The Australian Trade Balance, the value of exports less imports, was released on Friday. The figure was $-2.09 billion, slightly better than the $-2.15 billion expected. The figure is not helped by the stubbornly high AUD, which lowers the value of exports and encourages imports.

• The minutes of the RBA’s latest monetary policy decision will be released on Tuesday. The minutes may reveal more on the RBA’s view of the domestic economy and provide hints at policy considerations for the new year.

• Chinese data for November was released over the weekend that lent the AUD support on Monday. Industrial Production grew 10.1% in November from 9.8% expected and Retail Sales grew 14.9% from 14.6% expected. The data illustrate Chinese growth is stabilising; both figures were the strongest readings since April this year.

• On Friday the Chinese HSBC Flash Manufacturing Purchasing Managers’ Index will be released. This important gauge of manufacturing activity in China made a solid improvement last month; markets will be looking to see this trend continue.

•Please see below for specific currency commentary.

AUDUSD

• AUDUSD rallied on the back of speculation the Federal Open Market Committee (FOMC) would expand its bond buying program. The AUD was well supported at around 1.480 earlier in the week after good Chinese and Australian data. AUDUSD touched a high of 1.0541 on Tuesday night.

• AUDUSD rallied on the back of speculation the Federal Open Market Committee (FOMC) would expand its bond buying program. The AUD was well supported at around 1.480 earlier in the week after good Chinese and Australian data. AUDUSD touched a high of 1.0541 on Tuesday night.

• The FOMC is predicted to expand its bond buying program otherwise known as quantitative easing. The current program, called Operation Twist, is due to end soon. The twist involves the Fed purchasing longer term debt and selling short term debt in order to lower long term borrowing costs. The twist strategy makes no net difference to the Fed’s balance sheet as they are both buying and selling assets. The expected replacement strategy involves outright purchases and therefore expands the balance sheet. In short, the Fed will be injecting more money into the markets causing the USD to weaken across the board and boosting risk sentiment. The FOMC will hold a press conference tonight when the announcement is expected to be made.

• The Fiscal Cliff negotiations continue, although it seems unlikely a deal will be made before automatic increases and spending cuts begin on the 1st of January. Warren Buffett, a long supporter of higher taxes for the wealthy, has voiced his support for increases in estate taxes to be included in fiscal cliff reforms. Despite both party’s refusal to fold, commentators predict that the eventual compromise will see taxes increase by a figure in the middle of the current stand-off.

• A poll by POLITICO has found that 60 percent of respondents support raising taxes on the wealthy, data that will give Obama firepower in his firm stance on the issue.

• On Friday, U.S. employment data was released that surprised to the upside. U.S. Non-Farms Payrolls, the number of new jobs added for November excluding farming, was 146,000, and the unemployment rate declined to 7.7%. The data suggest the moderate recovery is still on track, although, the labour force continued to shrink. Worryingly, a large proportion of the unemployed, 40.1%, are classified as long-term unemployed who have been unemployed for 27 weeks or more.

• U.S. Retail Sales data for November will be released on Friday; the market is expecting 0.4% growth for the month.

AUDEUR

• AUDEUR made gains last Thursday as the European Central Bank (ECB) cut Eurozone growth forecasts and President Mario Draghi opened the door to a possible benchmark interest rate cut during the first quarter of 2013. After touching a high of 0.8139, the EUR regained support on the back of improved sentiment.

• AUDEUR made gains last Thursday as the European Central Bank (ECB) cut Eurozone growth forecasts and President Mario Draghi opened the door to a possible benchmark interest rate cut during the first quarter of 2013. After touching a high of 0.8139, the EUR regained support on the back of improved sentiment.

• The ZEW Indicator of Economic Sentiment, a survey that measures investor confidence in Germany, has increased by 22.6 points this month to 6.9. The indicator has read negative since May 2012 as a result of the Euro crisis, and reached a crisis low of -55.0 in December 2011. The market reaction was most pronounced in EURUSD climbing from a low of 1.2877 to 1.3005 at time of writing.

• Purchasing Managers’ Indices (PMI) are released for the Eurozone on Friday. The surveys, conducted by Markit Economics, will measure business conditions in the France, Germany and the Eurozone. The figures have been deeply negative for most of the crisis. Markets will watch the German Flash Manufacturing PMI closely especially given the solid improvement in the ZEW sentiment indicator discussed above.

By Chris Chandler