Brief Summary:

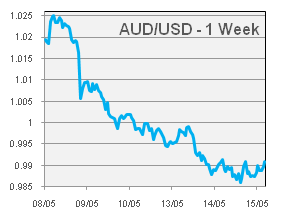

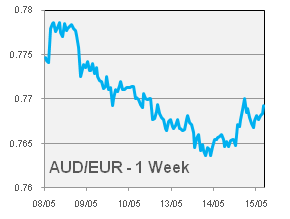

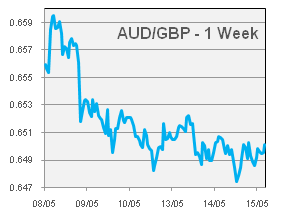

- This week has been characterised by a broad USD rally stemming from speculation on the end of quantitative easing in the U.S. The AUD has been a major victim, catalysed by last week’s rate cut and the Federal Budget release, though all commodity currencies have weakened. The AUD and NZD have fallen about 3.5%, whilst the EUR and GBP; about 2.4%.

- European GDP figures were released last night that showed economic contraction throughout the region. Germany managed to post 0.1% quarterly growth, while the region contracted by 0.2%.

When it rains it pours

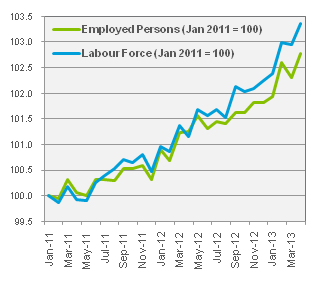

- Since Tuesday’s RBA rate cut, the tide of sentiment has turned against the AUD sending it to 12 month lows against all major currencies. While the rate cut didn’t actually trigger the AUD sell off, it acted as a catalyst in a broad USD rally. The sell off actually began after a relatively strong employment number mentioned below.

- After finding support at about 1.0180, strong employment numbers perked AUDUSD back up to 1.0250. Speculation of an end to quantiative easing in the U.S. was the main driver in the decline. Rumours circulated of an upcoming Jon Hilsenrath article said to detail the Fed’s exit from the strategy. In the end, the article, released on the weekend, didn’t deliver much new information, but the wheels were already in motion.

- AUD sellers got into action during U.S. trading on Thursday night, breaking the 1.0180 handle. With this key support broken, the next layer of support was found at 1.0050 where it traded above for the Asian session. Late in the day as Europe and the U.S. reopened the onslaught resumed, breaking the key psychological barrier of parity.

- Asian trading on Monday offered a brief respite, though once again as the U.S. session opened the sell off resumed. The budget release on Tuesday night delivered few surprises to the local market, though provided further fuel to international sellers, setting course toward 0.9800. With all key support layers of the past 12 months broken and no major Australian data releases until late May, the AUD will struggle to reverse sentiment in the short term.

|

|

Please see below for specific currency commentary.

USD

- No currency was spared by the USD rally; the AUD and NZD have lost about 3.5% in a week, while the EUR has lost 2.3% and the GBP 2.4%.

- U.S. Retail Sales were released for April on Monday night. The overall figure posted 0.1% monthly growth though it was primarily buoyed by automobile sales; as expected by the market. The figure did little to stem USD strength even though the figure confirms that quantitative easing should remain in place for some time to come.

- PIMCO, an investment firm, have warned in their most recent economic outlook, “Do not lose sight of the extent to which asset prices have been disconnected from fundamentals and, thus, require major eventual validation by fundamentals.” Mainly in reference to U.S. equities now trading at record prices, a market correction may be just around the corner.

EUR

|

|

- The wider Euro area contracted by 0.2% in the first quarter. Despite this, AUDEUR remained at three month lows due to the broader sentiment shift against the AUD.

- Euro area inflation data will be confirmed tonight for April. After declining to 1.2% in the preliminary figure, further detail will be released that may open the door to further European Central Bank interest rate cuts and monetary easing.

GBP

|

|

By Chris Chandler