Brief Summary:

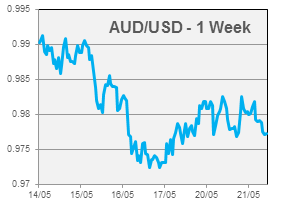

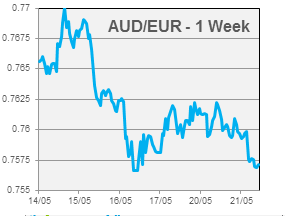

- The AUD started the week slightly higher than Friday’s though remained near twelve month lows against the USD and eighteen month lows against the EUR. The lack of any new Australian economic data has meant the currency has failed to grasp onto any meaningful support.

- Ben Bernanke, Chairman of the U.S. Federal Reserve, will testify before the Joint Economic Committee in Washington DC tonight. Speculation that the quantitative easing program will be scaled back soon has been priced into currency markets in recent weeks. He will give valuable insight into future monetary policy that will be closely watched by markets.

- Inflation declined in April in the U.K. for the first time in six months. The year-on-year figure fell to 2.5% after being stuck at 2.8% despite stagnant economic growth. The data may open the door to a monetary response from the Bank of England.

Inflation the key to the cut

Yesterday, the Reserve Bank of Australia released the minutes from its 7th of May interest rate cut. Despite the cut, the minutes read quite positively forecasting a return to trend growth in 2014. Their view on domestic conditions was positive stating, “A range of indicators pointed to a pick-up in spending by the household sector, conditions in the housing market remained generally positive and measures of consumer confidence had been above average”.

Similarly, their comments on long term mining investment included, “a larger share of ongoing mining investment related to LNG projects, which were based on long-term supply contracts. This characteristic implied less uncertainty about mining investment arising from volatility in commodity prices over the next couple of years.” A noteworthy change from simply concerns over the peak of mining investment. The comments highlight the board’s positive long-term outlook for the Australian economy.

Similarly, their comments on long term mining investment included, “a larger share of ongoing mining investment related to LNG projects, which were based on long-term supply contracts. This characteristic implied less uncertainty about mining investment arising from volatility in commodity prices over the next couple of years.” A noteworthy change from simply concerns over the peak of mining investment. The comments highlight the board’s positive long-term outlook for the Australian economy.

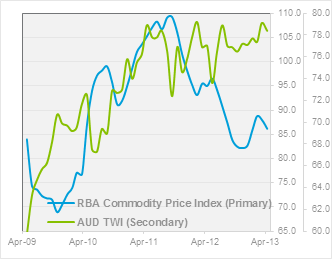

The comment also suggests the current disconnect of the AUD from commodity prices may continue. Despite the last twelve months of commodity price decline, the AUD has remained supported on a trade weighted basis; this can be seen in the figure to the right.

The decision to cut was largely justified by the lower than expected inflation rate. The word “inflation” appeared twenty-one times in this month’s minutes compared to five times in April. The “scope to ease” given inflation was mentioned in every monetary policy statement this year. The RBA stated they have used some of their scope, we should expect further cuts if inflation allows for it.

Please see below for specific currency commentary.

USD

AUDUSD headed towards a twelve month low this week, touching 0.9711 late on Friday. The cross touched 0.9582 at around the same time last year as the Euro crisis peaked. With no new Australian economic data released, the AUD has struggled to regain any firm support at the whim of sellers.

AUDUSD headed towards a twelve month low this week, touching 0.9711 late on Friday. The cross touched 0.9582 at around the same time last year as the Euro crisis peaked. With no new Australian economic data released, the AUD has struggled to regain any firm support at the whim of sellers.

Monday is a public holiday in the U.S. as Memorial Day is observed; trading volumes will be light on Monday.

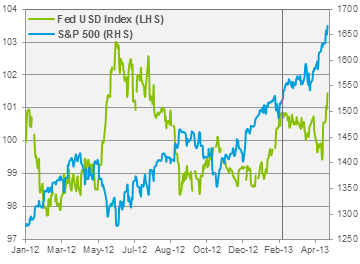

Ben Bernanke, Chairman of the U.S. Federal Reserve, will testify tonight before the Joint Economic Committee. Speculation has been abounds on the potential wind up of quantitative easing occurring later in the year. The speculation has fuelled a USD rally that has been gaining momentum since the beginning of the year. The rally occurs as the market prices tighter U.S. monetary policy, unwinding higher yielding currency carry trades.

Ben Bernanke, Chairman of the U.S. Federal Reserve, will testify tonight before the Joint Economic Committee. Speculation has been abounds on the potential wind up of quantitative easing occurring later in the year. The speculation has fuelled a USD rally that has been gaining momentum since the beginning of the year. The rally occurs as the market prices tighter U.S. monetary policy, unwinding higher yielding currency carry trades.

The line on the chart to the right indicates the last time Bernanke testified to the Senate on the 26 February. The USD rallied ahead of the testimony as speculation entered the market that quantitative easing would need to be wound up. The rally then subsided after Bernanke’s staunch defence of the program.

The most recent USD rally has occurred in the same fashion. The Unemployment Rate is at 7.5%, a fair way above the target of 6.5% and inflation is only 0.1% month-on-month from the 2.0% yearly target. Our view is that the USD rally has moved too far, especially against commodity currencies like the AUD and NZD. We expect Bernanke to deliver a similar testimony to February, defending the quantitative easing program as it stands until economic conditions improve further.

Tomorrow, the HSBC Flash Manufacturing PMI, a measure of manufacturing activity in China, will be released. The figure is expected to be 50.5, indicating expansion when over 50.0. a better than expected figure will boost risk sentiment towards the AUD as China is a major trading partner.

EUR

AUDEUR plunged to its lowest levels since late 2011 trading at a low of 0.7562 last Friday.

AUDEUR plunged to its lowest levels since late 2011 trading at a low of 0.7562 last Friday.

Purchasing Managers’ Indices (PMI) will be released for major Euro area countries tonight. Measures of German, French and Euro manufacturing and service sectors are all expected to indicate contraction. Similar to last week’s GDP figures, German services are expected to be the only spark in an otherwise dire predicament.

The Euro area Consumer Price Index will be released next Friday. This figure declined last month allowing the European Central Bank to lower the benchmark interest rate.

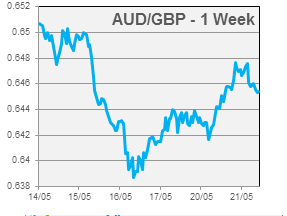

GBP

Last night, the U.K. release inflation figures for April. The figures showed a slight pull back in the stubbornly high inflation levels of the last six months. The Consumer Price index (CPI), the main measure of inflation, declined to 2.8% year-on-year and the Producer Price Index (PPI), a forward indicator, declined to -2.3% month-on-month; suggesting a lower future CPI. The high level of consumer inflation had somewhat tied the hands of the Bank of England in easing monetary policy further. The decline, though remaining above the 2.0% target, may allow for future cuts to support the fragile recovery.

Last night, the U.K. release inflation figures for April. The figures showed a slight pull back in the stubbornly high inflation levels of the last six months. The Consumer Price index (CPI), the main measure of inflation, declined to 2.8% year-on-year and the Producer Price Index (PPI), a forward indicator, declined to -2.3% month-on-month; suggesting a lower future CPI. The high level of consumer inflation had somewhat tied the hands of the Bank of England in easing monetary policy further. The decline, though remaining above the 2.0% target, may allow for future cuts to support the fragile recovery.

The Bank of England will release the minutes from its May interest rate decision tonight. Additionally, U.K. retail sales data will be released for April.

By Chris Chandler