Brief Summary:

- China released its Trade Balance for April today, posting a recovery to an $18.2 billion surplus. Last month’s figure was a $900 million deficit, though February, March and April tend post lower than average numbers due to seasonal factors. Importantly for Australia, imports grew by 16.8%. This trend was also evident in Australian trade data, released on Tuesday, which showed commodity export volumes recovering sharply as part of the $310 million trade surplus. The Australian figure was the strongest in thirteen months.

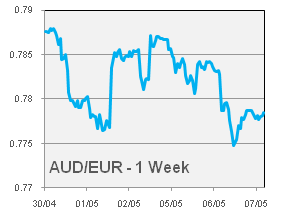

- The European Central Bank cut their benchmark interest rate to 0.5% from 0.75%.

- U.S. employment growth returned to normal this month with Non-Farm Employment Change, a monthly measure of job growth, recovering to 165,000.

- The Pound is buoyed by better than expected U.K. construction, manufacturing and services industry data.

Australian interest rates cut to a record low

|

|

- Last week, our view was that the board would wait to see more data unfold before acting. Their move can be seen as a both pre-emption of future events, and a response to last week’s lower than expected inflation data and continued softness of the labour market. Simply, there was no good reason not to cut, given recent developments.

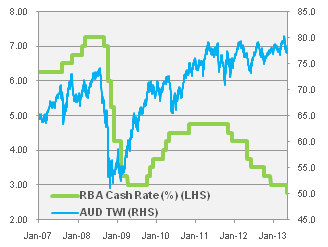

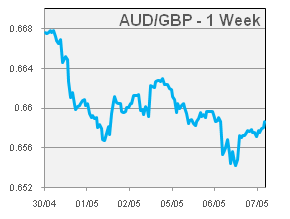

- The first key factor, the stubbornly high exchange rate, was targeted in the statement more firmly that previously, “The exchange rate, on the other hand, has been little changed at a historically high level over the past 18 months, which is unusual given the decline in export prices and interest rates during that time”. Their frustration evident in the chart above, which shows the RBA Trade Weight Index for the AUD and the cash rate for the last five years. The interest rate easing cycle has had virtually no impact on the overall value of the AUD.

- The second key factor, the waning growth of mining investment, will be revealed on the 30th of May. The quarterly Private Capital Expenditure figure will be released by the ABS and give an indication of the trajectory of mining investment. The previous figure showed that the predicted slow-down was indeed occurring, although at no worse rate than expected.

- Covering the final factor, the RBA move can also be seen as a pre-emptive response to the inevitable fiscal tightening that will occur in the near future. The $17 billion hole in the budget has been headline news this week, and the true extent of the deficit will be revealed on the 14th of May when the 2013-14 Budget will be released. It is a certainty that taxes will need to be raised or spending cut by whoever is elected in September. Fiscal tightening will soften growth and the RBA has stated it would ease monetary policy to support growth. The high AUD has also been the go-to excuse for the budget deficit, the RBA’s response encompasses both problems recently publicised in the political sphere.

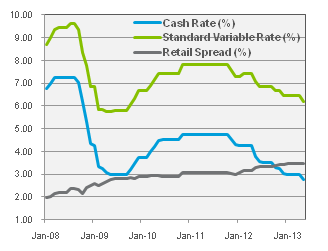

- The spread earned by lenders has risen by 75% in the past five years. So far, all the big banks have passed on the full 25 basis point cut; and rightfully so. Despite this, they maintain their spread at about 3.45%; the highest levels since the early 1990s.

- Australian employment data will be released on tomorrow at 11:30am. Expectations are for 11,500 new jobs in April, with the Unemployment Rate steady at 5.6%.

Please see below for specific currency commentary.

USD

|

|

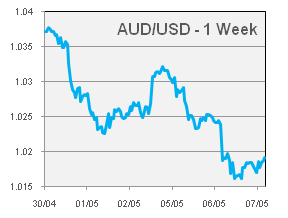

- On Friday, U.S. employment data was released for April. Non-Farm Employment Change, a national measure of jobs growth, showed 165,000 jobs were added in the month. The number recovering strongly from the 88,000 in March and better than the 146,000 expected. The Unemployment Rate also declined to 7.5%, and for the first time in months, it wasn’t due to declines in the Participation Rate; the number of people in the work force. The data boosted risk sentiment, the AUD jumped above 1.0300 heading into the weekend.

- Additionally from the U.S., PMIs were released for Manufacturing and Non-Manufacturing sectors. The national surveys of business conditions were both slightly worse than expected at 50.7 and 53.1, respectively; indicating industry expansion when over 50.0. The Non-Manufacturing figure, however, failed to dampen the mood set by strong jobs growth.

EUR

|

|

- The ECB fell short of indicating a FOMC or Bank of Japan style monetary easing program is ahead. The biggest problem faced by the Eurozone is that traditional transmission mechanisms for interest rates no longer work. Despite persistent cutting of benchmark rates, interest rates in countries like Spain and Italy remain high due to their sovereign risk. This is explained thoroughly in an article by The Economist this week.

GBP

|

|

- The Bank of England’s Monetary Policy Committee will meet tomorrow for their monetary policy decision. The benchmark rate is currently at 0.5%, though the committee’s hands have been tied by higher than expected inflation recently.

By Chris Chandler