Brief Summary:

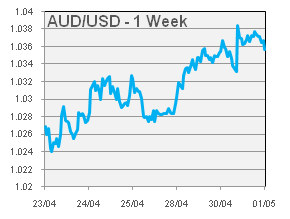

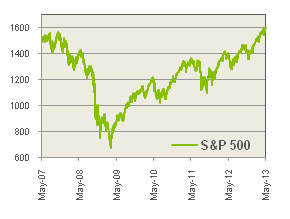

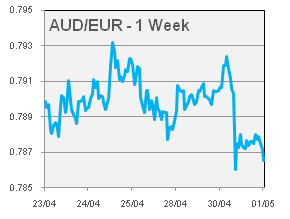

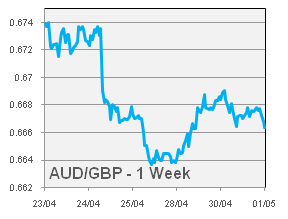

- Risk sentiment recovered this week after the Boston bombings, soft Chinese GDP and the Gold price crash reverberated through markets two weeks ago. The AUD made gains against the USD, though lost ground against the EUR and GBP. The S&P 500 stock index closed at a record high of 1,597.57.

- The U.K., where World First was founded, managed to escape the claws of a potential triple dip recession; posting 0.3% growth in the first quarter of 2013.

- Inflation figures in the Eurozone showed an accelerated decline to 1.2% year on year. The figure provides the European Central Bank scope to reduce its benchmark interest rate to 0.5% on Thursday; an outcome now largely expected by markets.

The RBA in May

- Last Wednesday, the Australian Bureau of Statistics (ABS) released the Consumer Price Index (CPI) for the first quarter of 2013. The broadest measure of consumer inflation read 0.4% for the quarter, placing the yearly figure at 2.5%. The target band of the Reserve Bank of Australia (RBA) is 2-3% yearly. The AUD fell on release as the figure provides scope for further rate cuts. The breakdown of release also reveals that underlying inflation is lower than the headline suggests. Major contributors were largely government or seasonally driven. Alcohol and tobacco prices increased due to taxes, healthcare costs increased due to changes in Medicare and the Pharmaceuticals Benefit Scheme and education increases following the commencement of the new school year. The Producer Price Index (PPI), a measure of input price inflation, will be released on Friday; expectations are for 0.2% quarter on quarter.

- Retail Sales data for March will be release on Monday. The February figure posted outsized growth of 1.3%; however, following the pull back in employment, we are likely to see a softer figure this month. Additionally from Australia, Building Approvals, a measure of construction activity, will be released tomorrow; and the Trade Balance, a measure of imports and exports, will be released on Tuesday.

- Importantly on Tuesday, the RBA will meet for its May monetary policy meeting. Market sentiment towards the AUD has taken a dive in recent weeks following the weaker than expected Chinese GDP growth. In our view, the figure was not weak enough to indicate a significant change of trajectory. The release was accompanied by Chinese official comments, sensibly stating, their pursuit of structural improvements and more sustainable growth over outright pace. Additionally, the Chinese pull back is in line with the global pull back following a fairly robust start to the year. Domestic indicators also followed this global pattern, and likewise, we do not view the outlook as significantly different from that in March or April. We therefore expect the RBA to hold rates and maintain its easing bias.

Please see below for specific currency commentary.

USD

- Non-Farm Employment Change, on Friday, will be the next major U.S. data release. The figure measures monthly jobs growth excluding agriculture. After a lacklustre April figure of 88,000, market expectations are for a recovery to 150,000; the average for the past twelve months is 158,000. The Unemployment Rate is expected to be steady at 7.6%; the Fed’s target for quantitative easing is 6.5%. The biggest problem for the U.S. remains the structural nature of unemployment. The Participation Rate is in decline, and long-term unemployed, jobless for at least 27 weeks, account for about 40% of the unemployed.

- Speculation that the pace of quantitative easing may need to be slowed increased earlier this year, broadly strengthening the USD at times. The latest GDP figure read neither too strongly, meaning quantitative easing will not be slowed, or too weakly, which would have dampened risk sentiment. Similarly, last month’s employment figure was not outside the monthly undulations of job growth. We expect a return to average jobs growth will give risk sentiment a much needed boost after the Boston bombing, soft Chinese GDP and volatile commodity price experience of the past couple of weeks.

- Tonight, the Institute of Supply Management will release their PMI figures for U.S. industries. The nationwide surveys of manufacturing and non-manufacturing sectors indicate expansion when over 50.0. Manufacturing printed 51.3 last month, while Non-Manufacturing; 54.4%. Expectations this month are for 51.0 and 54.1, respectively. The lower expectations may reflect expected disruptions in the wake of the Boston bombings.

EUR

|

|

- Eurostat released inflation data for March. The Consumer Price Index (CPI), the main measure of inflation across the union, posted an accelerated decline to 1.2% from 1.7% annualised in March. The figure provides necessary scope for the ECB to cut its benchmark interest rate 25 basis points to 0.5%; a move that is now widely expected by the market.

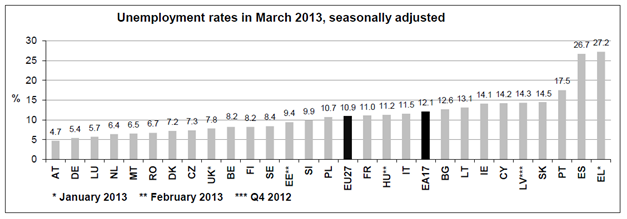

- Eurostat also released employment data for March, showing the Unemployment Rate was steady at 12.1%. The chart below, from the release, provides a good illustration of the impotency of monetary policy in the Euro area. The full wavelength of employment conditions must be targeted with a single interest rate. At one extremity Greece (EL) and Spain (ES) with unemployment over 25%, and at the other end; Austria (AT) and Germany (DE) near full employment. A similar illustration exists for the CPI; deflationary Greece is at the lowest end of the scale, while Spain has one of the highest inflation rates in the union.

- With a benchmark rate cut widely expected and priced into the market, there is upside risk for the EUR if they do not deliver. On the other hand, the risk of an extensive EUR sell off is low unless the ECB can deliver an aggressive easing policy like that of the U.S. Fed and Bank of Japan. The market, as usual, will look to the ECB press conference for hints on any future use of such policy.

GBP

|

|

- PMI figures will be released for the U.K. this week. The figures will gauge manufacturing, construction and service industry activity. Services is the only sector currently in expansion; a figure of 52.5 expected. PMI figures are more timely indicators that GDP, worse than expected figures may quickly dampen any confidence from Thursday.

By Chris Chandler